Is Land a Current Asset? A Guide for Owners & Bookkeepers

Quick Answer In virtually all standard bookkeeping and accounting frameworks, land is classified as a non-current asset, specifically as a fixed asset or property, plant,

By James R. Leichter (aka: Mr. HVAC)

Key Takeaways

I get a lot of questions from my consulting clients—things like: What is deferred revenue? How do you make a deferred revenue journal entry? Is it an asset? Is it a liability? And many more.

Because of this, I decided to write an article on the subject of deferred revenue to hopefully answer all of these questions in one place. I have also included an example of how to make an adjusting journal entry that can be used in QuickBooks, Total Office Manager, and other accounting ERP (Enterprise Resource Planning) software.

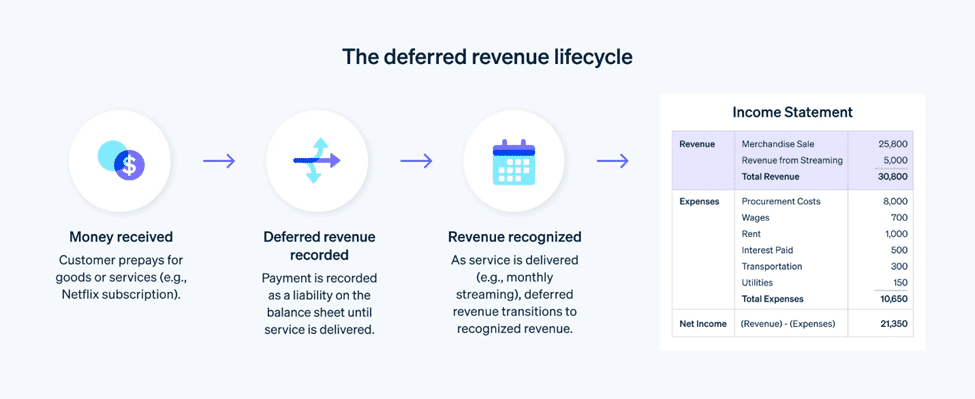

Deferred revenue, also known as unearned revenue, is an important accounting concept, especially for HVAC and plumbing companies that often receive payments in advance for services. But what exactly is deferred revenue? In simple terms, deferred revenue represents money received by a company for goods or services that have yet to be delivered or performed.

Think of deferred revenue as a promise—a promise to your customers that you will provide them with the services they’ve paid for. It’s like getting a subscription to your favorite magazine; you pay upfront, but the magazines arrive over time. Similarly, when your HVAC or plumbing company receives payment for a service contract upfront, that payment becomes deferred revenue until the service is actually provided.

Want to understand how deferred revenue impacts your revenue recognition? Check out Cash vs. Accrual Accounting: The Difference Could Kill Your Business.

Yes, deferred revenue is a liability. Why? Because it represents an obligation to provide goods or services in the future. Until you fulfill this obligation, you owe your customers the value they paid for in advance.

For a more in-depth examination of why deferred revenue is a liability, check out this great article by Investopedia: What Deferred Revenue Is in Accounting, and Why It’s a Liability.

No, deferred revenue is not an asset. An asset represents something you own that has value, such as cash or equipment (e.g., accounts receivable or inventory). Deferred revenue, on the other hand, is an obligation—a promise to perform services or deliver goods in the future. Therefore, it is recorded as a liability on your balance sheet.

Deferred revenue appears on the balance sheet under the liabilities section. It’s important to note that as you provide the services or deliver the goods, deferred revenue is gradually recognized as actual revenue. This transition moves the amount from the liabilities section to the revenue section on the income statement.

Recording deferred revenue properly ensures your financial statements accurately reflect your business’s financial health. Let’s break it down with an example using debits and credits:

Imagine your HVAC contracting or plumbing company receives a $12,000 payment in advance for a one-year service contract. You need to record this payment as deferred revenue initially. In QuickBooks and Total Office Manager, select the account type of ‘Other Liability’ for your ‘Deferred Revenue’ account in your chart of accounts.

Here’s how the journal entry looks:

Account | Debit ($) | Credit ($) ----------------------------|-----------|------------ Cash | 12,000 | Deferred Revenue | | 12,000

Each month, as you provide the service, you recognize part of the deferred revenue as actual revenue. For instance, after the first month, you would recognize $1,000 as revenue (since $12,000 divided by 12 months equals $1,000 per month):

Account | Debit ($) | Credit ($) ----------------------------|-----------|------------ Deferred Revenue | 1,000 | Service Revenue | | 1,000

Repeat this process each month until the entire $12,000 is recognized as revenue.

In QuickBooks and Total Office Manager, select the account type of ‘Income’ for ‘Service Revenue’.

In QuickBooks and Total Office Manager® from Aptora, select the account type of ‘Other Liability’ for your ‘Deferred Revenue’ account in your chart of accounts.

In construction and field service industries, many jobs are billed in stages or with milestone payments. That means a single project might generate multiple deferred revenue entries over its life cycle.

For example, if a plumbing contractor is paid 30% upfront, 40% at midpoint, and 30% upon completion, each of those payments should be treated as deferred revenue until the corresponding work is completed. This segmented recognition allows for cleaner financials and more precise job costing.

Set up clear policies in your accounting system to allocate each payment appropriately. Use job costing reports to track how much work has been completed and match revenue recognition accordingly. This alignment supports accurate profitability analysis and stronger forecasting.

Deferred revenue is more than just an accounting formality—it reflects your company’s accountability. When your business collects payments upfront, especially for long-term service agreements, those funds aren’t truly yours until the work is done. Mismanaging deferred revenue can cause major issues, from inaccurate financials to compliance problems.

For contracting businesses, properly managing deferred revenue ensures you never get ahead of your actual earned income. This matters especially when you’re using those upfront payments to pay expenses before earning the revenue. It’s easy to think you have more cash than you really do, which is why treating deferred revenue as a liability is so important.

Managing deferred revenue appropriately helps ensure that your financial statements are accurate and reflect the true financial health of your business. By properly recording and recognizing deferred revenue, you can avoid overstating your income and ensure that you meet your financial obligations to your customers.

Deferred revenue might sound like a complicated accounting term, but with a clear understanding and the right tools, it’s completely manageable. It’s a liability because it represents services or goods your business still owes to your customers, and treating it that way keeps your financials honest.

From simple monthly service contracts to complex, milestone-driven projects, understanding how to record, recognize, and report deferred revenue helps you avoid overstating income and maintain financial stability.

So, whether you’re using QuickBooks, Total Office Manager by Aptora, or another ERP system, follow these best practices and stay ahead of your accounting obligations. Your future self—and your financial statements—will thank you.

Now, you’re ready to tackle deferred revenue with confidence! Happy accounting!

A: Deferred revenue is considered a liability because it represents a future obligation. When customers pay you in advance, you owe them the service or product they paid for. Until you fulfill this obligation, the payment is a liability on your balance sheet.

A: Deferred revenue is a liability account. It’s listed under current liabilities if the service or product is expected to be delivered within a year. If the delivery is expected to take longer than a year, it can be classified as a long-term liability.

In QuickBooks and Total Office Manager, select the account type of ‘Other Liability’.

Q: Deferred revenues are simply amounts received by a business in advance of delivering goods or services. These amounts are recorded as liabilities until the corresponding goods or services are provided, at which point they are recognized as revenue.

A: In accounting, deferred revenue is defined as revenue that a company has received but has not yet earned. This revenue is recorded as a liability on the balance sheet because it represents an obligation to deliver goods or services in the future.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.