Is Land a Current Asset? A Guide for Owners & Bookkeepers

Quick Answer In virtually all standard bookkeeping and accounting frameworks, land is classified as a non-current asset, specifically as a fixed asset or property, plant,

At its core, unearned revenue (also known as deferred revenue) is simple: it’s money you have received from a customer for a service you have not yet performed or a product you have not yet delivered. Think of it as a prepayment.

In this article, we’ll tackle what unearned revenue is and show you how understanding it can transform this confusing accounting term into a powerful driver of stability and growth.

Key Takeaways

I’ll never forget the panicked call from a plumbing company owner we’ll call Mark. He’d just landed his biggest job ever: a $15,000 repipe for a large commercial client. The check had cleared, the money was in the bank, and he was ready to go on a spending spree for some new equipment. His bookkeeper, however, had just shown him his monthly profit and loss statement, and it was a bloodbath. According to his books, he was deep in the red.

“How can I be losing money when I have fifteen grand just sitting there?” he demanded, his voice a mix of confusion and frustration.

I took a deep breath. “Mark,” I said, “that $15,000 isn’t yours yet. It’s unearned revenue. Your bookkeeper is right. On paper, you’re broke because you haven’t done a single minute of work for that money.”

This is the moment of reckoning for so many talented, hard-working tradespeople. Granted, you’re a master of your craft and not a certified public accountant, but that disconnect between the cash in your hand and the reality on your financial statements can sink your business faster than a faulty water heater.

In the HVAC, plumbing, and electrical trades, this is incredibly common. Here are some common examples of when unearned income might show up:

That money feels real. It’s in your bank account. You can see it. But from an accounting perspective, and this is the crucial part, it isn’t yours. Not yet. You are essentially holding that money in trust until you fulfill your obligation to the customer. So, until you pick up your tools and do the work, that cash is a promise, not profit.

This is the question that causes the most confusion: is unearned revenue a liability? The textbook answer is a resounding yes. And once you understand why, the entire financial picture becomes much clearer.

A liability is simply something you owe. So, this could be a loan from the bank, a bill from your supplier, or wages you need to pay your technicians. Unearned revenue fits perfectly into this category, seeing that you owe a customer a service they paid for.

If you were to shut down your business tomorrow, you would legally be required to refund any unearned revenue to your clients. While unlikely, it is still a possibility, and that possibility is what makes unearned revenue a liability.

Now, knowing this, let’s take a closer look at what happened when Mark deposited that $15,000 check.

When that $15,000 check hit Mark’s account:

Understanding that Assets = Liabilities + Equity, when Mark received that $15,000, you can see that the equation remained in perfect balance. His Equity (the actual value of the business) didn’t change one bit. No revenue was recorded. No profit was made. This is why his Profit & Loss statement looked so terrible, because P&L only minds earned revenue.

From an accounting perspective, recognizing unearned revenue as a liability ensures your books accurately reflect your obligations.

This practice is a cornerstone of the revenue recognition principle, a key tenet of Generally Accepted Accounting Principles (GAAP). This principle dictates that companies must recognize revenue in the accounting period in which they earn it, not necessarily when they receive payment. This provides a more accurate matching of revenues with the expenses incurred to generate them.

Now, let’s translate this into practical journal entries. We’ll follow a hypothetical contractor, “Stellar Kitchen Remodels,” through a common scenario.

Scenario: Stellar Kitchen Remodels signs a contract to renovate a kitchen for a total price of $20,000. The client agrees to pay $8,000 upfront to allow Stellar to purchase materials.

The $8,000 check is received as an advance payment for services that have not yet been performed. Because the work hasn’t been completed, the payment cannot yet be recorded as revenue. Instead, it must be recognized as a liability to reflect Stellar’s obligation to deliver $8,000 worth of work.

Journal Entry:

Account | Debit ($) | Credit ($)

----------------------------|-----------|------------

Cash | 8,000 |

Unearned Revenue | | 8,000

Your balance sheet now accurately shows an increase in cash and an equal increase in liabilities.

This is the process of moving money from your liability account to your revenue account. With this, you need a systematic way to determine when revenue is earned. This “when” is typically tied to project milestones, completion percentages, or the passage of time.

So, let’s say Stellar completes the demolition and framing, which represents 25% of the total project. They have now earned 25% of the initial deposit.

Calculation: $8,000 initial deposit x 25% = $2,000 earned revenue.

Journal Entry:

Account | Debit ($) | Credit ($)

----------------------------|-----------|------------

Unearned Revenue | 2,000 |

Construction Revenue | | 2,000

By making this entry, you’ve officially recognized $2,000 in income, and the remaining $6,000 stays in the Unearned Revenue liability account until you complete more work.

This process continues throughout the project until the entire $20,000 has been earned and the Unearned Revenue account balance for this project is zero.

You might be wondering if all this accounting work is really worth the effort. The truth is, tracking unearned revenue isn’t just about keeping your books tidy, it’s about protecting your business from false confidence and financial blind spots. When you get this right, the payoff goes far beyond compliance. You gain clarity, control, and a real understanding of your company’s financial health.

Here’s what that looks like in practice:

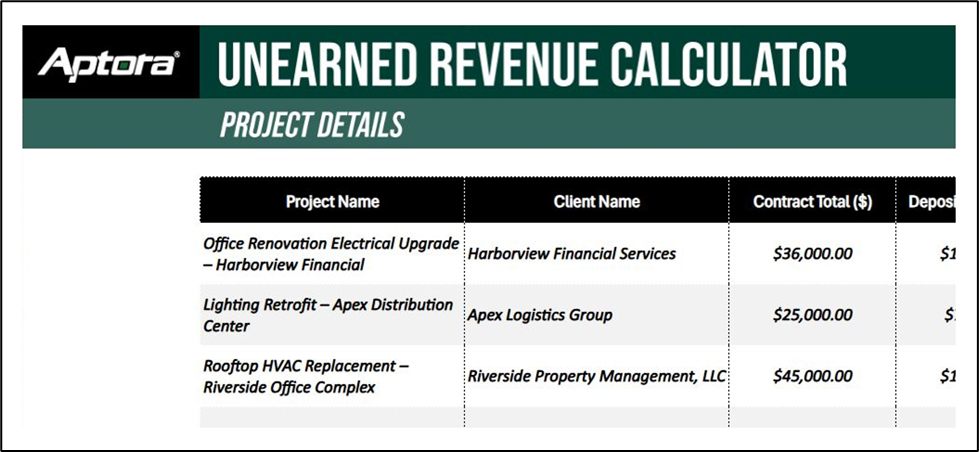

📥 Looking to get started tracking your unearned revenue right away? Grab our all-in-one, easy-to-use Unearned Revenue Tracking Calculator to get a clear and accurate picture of your deposits, liabilities, and earned revenue today!

The goal in managing unearned revenue properly isn’t just to stay compliant; it’s to turn this accounting principle into a tool that strengthens your cash flow, builds trust with your customers, and keeps your business financially grounded.

Here’s how to do it right:

I see it all the time: otherwise savvy contractors cross their wires with revenue recognition, and it silently strangles their profitability. After watching too many talented people make the same costly errors, here are the three biggest mistakes and financial blind spots I see you should avoid.

💡 Pro Tip: Use a sub-account or project code for your unearned revenue liability account. Instead of one giant “Unearned Revenue” bucket, have “Unearned Revenue – Project A,” “Unearned Revenue – Project B,” etc. This makes tracking and recognizing revenue for each job infinitely easier.

Unearned revenue is a paradox. It is a liability on your balance sheet, but when managed with discipline and foresight, it can become a launchpad for your business’s stability and growth. But, most importantly, it is the financial embodiment of the promise you make to every customer: “I will take care of you.”

Understanding that the cash in your bank isn’t always yours to keep is a sign of maturity as a business leader. It moves you from being a talented technician who owns a business to a savvy CEO who runs one.

So, start mastering the management of your unearned revenue with Aptora’s job costing and accounting tools. With Aptora, you can automate revenue recognition, clean up your books, make smarter financial decisions, and become a more capable steward of your company’s success. See how Aptora can transform your bookkeeping today!

They are opposites. Accounts receivable is when you have done the work (earned the revenue) but haven’t yet been paid. In accounting, accounts receivable is classified as an asset. Unearned revenue is when you have been paid but haven’t yet done the work. It’s classified as a liability.

This can be complex and depends on your accounting method. Most small businesses use the cash basis for taxes, meaning they report revenue when received, even if it’s unearned. However, there are exceptions (e.g., for advanced payments for services). It is crucial to consult with a tax professional to ensure you are handling this correctly for your specific situation.

If a project is cancelled, you must refund any unearned prepayment to the client. The journal entry would involve debiting (reducing) the unearned revenue liability account and crediting (reducing) your cash account. If you have already recognized some revenue for work done, you would only refund the remaining unearned portion.

It’s smart to review your unearned revenue at least monthly or every time you close your books. This ensures you’re recognizing revenue in the correct periods and that your liability balance reflects only what’s truly unearned. Regular reviews also make it easier to catch errors early, stay compliant, and maintain a clear picture of your financial position.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.