Is Land a Current Asset? A Guide for Owners & Bookkeepers

Quick Answer In virtually all standard bookkeeping and accounting frameworks, land is classified as a non-current asset, specifically as a fixed asset or property, plant,

The definitive answer is no: equipment is NOT a current asset. It’s classified as a non-current asset, specifically a fixed asset, on your balance sheet. But here’s the real question: why?

Let me be blunt. If you’re running an HVAC, plumbing, or electrical business and you don’t understand the why, you’re flying blind. I’ve seen the fallout from not understanding the reason for this distinction firsthand.

Understanding the difference between a current and a non-current asset isn’t just accounting jargon. It’s the bedrock of your financial clarity, smart tax planning, and ultimately, your company’s survival and growth.

As someone who has been in the trenches with field service businesses for nearly three decades, I can tell you that this single distinction has made or broken more companies than you might imagine.

So, let’s settle this once and for all. We’ll dive deep into what these terms mean, why they matter specifically to you, and how getting this right can transform your financial decision-making.

This isn’t about becoming an accountant. It’s about becoming a better business owner.

Key Takeaways

Before we can classify anything, we need a solid foundation. Think of your balance sheet as a snapshot of your company’s financial health at a specific moment.

It’s built on a simple equation: Assets = Liabilities + Equity.

Assets are everything your company owns that has value. That’s the simple part. The complexity and power of your business’s assets lies in how we categorize them.

Assets are split into two fundamental camps, and this split is everything.

These are the sprinters of your business. Current assets are things like cash and other resources you reasonably expect to convert into cash or use up within one year or one operating cycle. They are “liquid”, meaning they can be quickly accessed to pay for day-to-day expenses.

Common examples of current assets include:

Think of these as your business’s ready-to-use fuel.

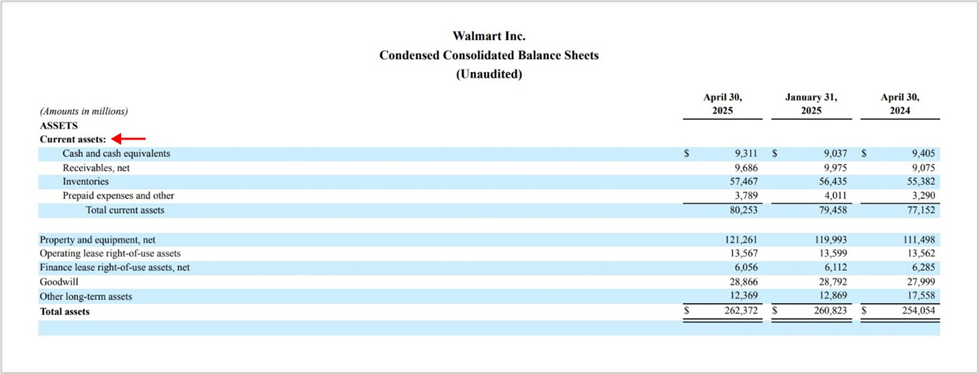

Here’s how current assets appear on a balance sheet:

These are the marathon runners. Non-current assets are long-term investments that you expect to hold for more than one year. They are not easily converted into cash and are essential for the long-term operations of your company.

Common examples of non-current assets include:

Think of these as the engine of your business, not the fuel.

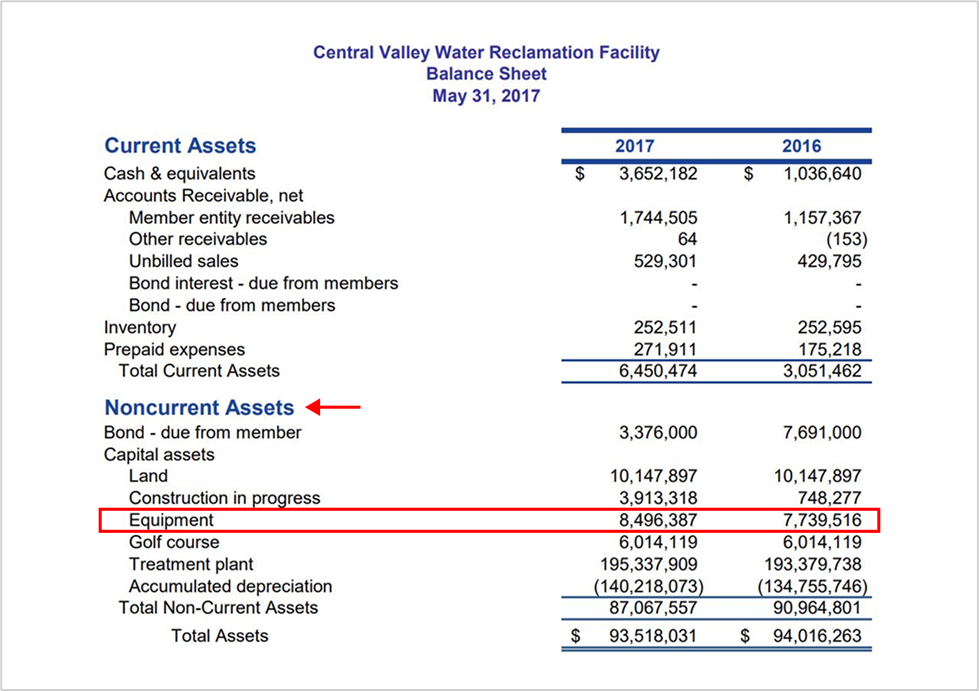

Here’s how non-current assets and equipment appear on a balance sheet:

Understanding the difference between these two asset types matters because mistaking your fuel for your engine can cripple your business. You can’t draw from fixed assets to cover short-term expenses any more than you can pour part of your engine into the gas tank. This distinction is what separates liquidity (the ability to keep things running day to day) from long-term stability, which keeps your business on the road for the long haul.

Understand that this isn’t just an academic exercise. Categorizing your assets right (or wrong) has profound, real-world consequences for your field service business. Let me show you what I mean with an example from my own experience.

Early in my career, I worked with a brilliant HVAC technician who had started his own company. He was a wizard with a boiler but less so with a balance sheet.

The tech had just landed a huge commercial contract and used his profits to buy two brand-new, fully loaded service trucks! He saw the trucks as a “necessary expense” to handle the new work. On his books, he correctly listed them as fixed assets, but he didn’t truly understand what that meant.

A few months later, the big-fish client was slow to pay their first massive invoice. My client looked at his balance sheet, saw a high total asset value from the new trucks, and assumed he was flush. But when payroll came due, he couldn’t make it.

What he didn’t realize was that a large portion of the asset value he saw was tied up in those new trucks (illiquid, fixed assets), and that he was mistakenly equating his company’s overall value with its liquidity.

He ended up having to scramble to arrange a short-term line of credit to cover the gap, and that was the day he truly learned the difference between a current asset and a non-current (fixed) asset.

The distinction between asset types can impact three critical areas:

For the amateur accountant or contractor, understanding the theory is one thing; knowing the practice is another. Here’s a step-by-step breakdown of how to record equipment on your books.

When you first purchase a significant piece of equipment, you don’t record the entire cost as an expense on your income statement in that single month. Instead, you “capitalize” it, meaning you record it as a fixed asset on your balance sheet. Here’s an example journal entry to demonstrate what I mean.

(To record the purchase of a new compact excavator for cash.)

Account | Debit ($) | Credit ($)

----------------------------|-----------|------------

Equipment (Fixed Asset) | $10,000 |

Cash (or Accounts Payable) | | $10,000

The journal entry above shows an exchange: you decreased your cash (a current asset) and increased your equipment (a fixed asset). So, your total assets remain the same; it’s just a change in composition.

💡 Pro Tip: Have a clear “capitalization policy”. For instance, your business might decide that any single item costing over $2,500 is a fixed asset, while anything less is expensed immediately. This simplifies bookkeeping and ensures consistency.

Don’t have a clear capitalization policy for equipment purchases and depreciation?📥 Download our FREE “Equipment Purchase & Depreciation Policy Template” and bring order to your books. This ready-to-use template helps you set consistent rules for handling your assets, so your financial statements stay accurate and audit-ready!

This is one of the biggest ongoing lessons in managing your assets. Equipment doesn’t last forever, and accounting recognizes that through depreciation. It’s simply the way we spread out the cost of that equipment over the years it’s used. In plain English: you match the expense of the asset with the income it helps you earn, that’s the matching principle at work.

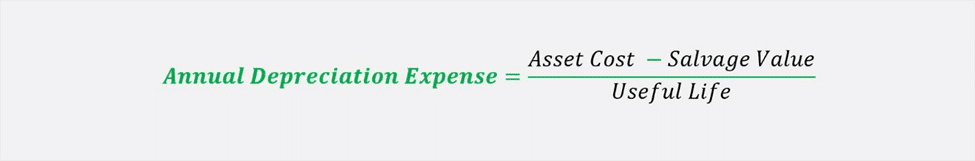

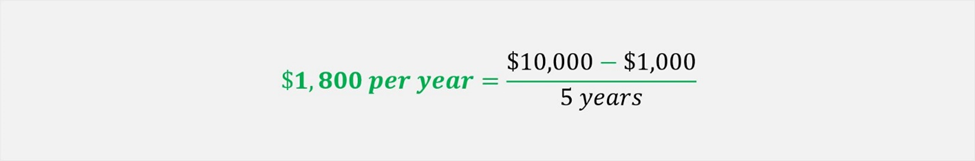

Now, let’s put some numbers to it. Again, say you bought that excavator mentioned in our previous example for $10,000 as shown in the sample journal entry. You plan to run it for 5 years (its useful life), and at the end of that ride, maybe you can sell it for $1,000 (its salvage value). Using the straight-line method, the simplest and most common approach, your annual depreciation expense works out like this:

So, every month, you would record:

(To record one month of depreciation on the compact excavator.)

Account | Debit ($) | Credit ($)

--------------------------------------|-----------|------------

Depreciation Expense | $150 |

Accumulated Depreciation | | $150

Notice that the credit goes to a “contra-asset” account called accumulated depreciation. This account sits on your balance sheet and reduces the total value of your equipment assets.

On the balance sheet, it would look like this:

Account | Amount ($)

-------------------------------------------------|------------

Equipment | $10,000

-------------------------------------------------|------------

Less: Accumulated Depreciation | ($1,800)

|

Net Book Value of Equipment | $8,200

📝 Note: This net book value (or carrying value) is what you see reported on the balance sheet. It is NOT the same as the market value.

Check out Accumulated Depreciation: Overview + Calculator for a more in-depth look at accumulated depreciation.

Like everything, equipment eventually wears out or gets sold. When this happens, you obviously need to remove it from your books. This involves calculating any gain or loss on the sale, which is the difference between the sale price and the asset’s net book value at the time of sale. To demonstrate this, let’s go back to our scenario.

Let’s say you sell that excavator you bought after 3 years for $5,000 cash.

Net Book Value: $10,000 − $5,400 = $4,600

(To record the sale of the excavator for a gain.)

Account | Debit ($) | Credit ($)

--------------------------------------|-----------|------------

Cash | $5,000 |

Accumulated Depreciation | $5,400 |

Equipment | | $10,000

Gain on Sale of Asset | | $400

You sold it for more than its net book value, so you recorded a gain. If you had sold it for less, you would have recorded a loss.

💡 Pro Tip: Always consult with an accountant regarding Section 179 Deduction and Bonus Depreciation. Under certain IRS rules, you can deduct the entire cost of qualifying equipment in the year you start using it. That can mean a big tax break upfront! Just remember, you’ll still spread that cost out over the asset’s useful life through depreciation on your books.

So, what happens if you record that $10,000 excavator as a current asset, or worse, dump the whole thing into expenses right away? The consequences can be significant.

Skewed Financial Ratios: On paper, your numbers might look great, and your working capital and current ratio shoot up, making your business look stronger than it really is. But that glow fades fast, and next year those same ratios fall off a cliff once the asset’s gone from the books.

Misleading Profitability: Expensing the full $10,000 in one shot takes a sledgehammer to your profits. It’s not a fair picture of how the equipment actually earns its keep over time. Depreciation spreads that cost evenly, keeping your income statement honest.

Inefficient Tax Reporting: Sure, writing it all off up front feels good in the short term. But that one-time deduction comes back to bite you later. You lose steady depreciation write-offs in future years, and your tax bill can climb because of it.

Poor Decision-Making: When your balance sheet isn’t accurate, you’re making decisions in the dark. Lenders get the wrong idea, investors hesitate, and even your own decisions about cash flow and company value can go sideways.

For a sole proprietor with one truck and a few tools, tracking things like your assets’ depreciation in a spreadsheet might seem manageable. But, as your business grows, the complexity explodes.

Can you imagine manually calculating and tracking depreciation for 100 different assets across multiple job sites? What about scheduling maintenance, handling disposals, and ensuring your books align with your tax returns?

This is where manual processes break down, spreadsheets become error-prone, time-consuming monsters, and a single data entry mistake can throw off your entire financial picture.

We understand you didn’t start your contracting business to become a full-time spreadsheet jockey. That’s exactly why we built Aptora 360 to take the guess and grunt work out of managing assets. Our tools automatically track depreciation, schedule maintenance, and keep your books in sync with your operations, so you can focus on running your business, not wrestling with spreadsheets.

So work smarter, not harder, starting today! Book a free demo now and discover how Aptora’s all-in-one software can drive unstoppable growth for your field service business!

The core difference is time and purpose. A current asset (like cash or inventory) is expected to be used or converted to cash within one year to support daily operations. A fixed asset (like equipment or a vehicle) is a long-term resource used to generate revenue over multiple years.

For a business, a laptop is almost always considered a fixed asset. It has a useful life of more than one year and is used to conduct business over the long term. However, if your company has a capitalization policy (e.g., items under $1,000 are expensed), a cheaper laptop might be recorded as a supply expense, but it still functions as a long-term tool.

Equipment is listed under “Property, Plant, and Equipment (PP&E)” in the non-current assets section of the balance sheet. It is presented at its net book value, which is its original cost minus all accumulated depreciation.

A good rule of thumb is to compare the cost of ongoing repairs to the equipment’s net book value and productivity. If repairs are becoming frequent or expensive, or the equipment no longer meets operational needs, it may be time to replace it. Proper tracking through depreciation schedules and maintenance logs can help you make these decisions proactively to avoid surprise costs and downtime.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.