Is Land a Current Asset? A Guide for Owners & Bookkeepers

Quick Answer In virtually all standard bookkeeping and accounting frameworks, land is classified as a non-current asset, specifically as a fixed asset or property, plant,

If you’ve ever looked at a balance sheet and wondered why there’s a negative number under “Assets”, or why some accounts seem to contradict themselves, you’re probably staring at what’s known as a contra account.

As an owner or manager of a field service business, knowing how contra accounts work gives you sharper insight into the real financial health of your company. So, if you are indeed a business owner, get ready to take some notes because understanding contra accounts is NOT just for accountants.

In this article, I’ll explain exactly what a contra account is, which contra accounts you’ll encounter most often, why they’re essential to your accounting, and how to use them.

Key Takeaways

So, let’s uncover the mystery. A contra account is simply a way accountants keep track of reductions without messing up the main numbers.

So, instead of burying adjustments directly inside the account itself, we park them in a separate account that acts like a mirror image. That way, your reports stay clean, and you can see both the original total and the true net amount at the same time.

For example:

Think of it as sort of a “mirror image” of a regular account. Where assets normally have a debit balance, their contra or opposite (like accumulated depreciation) have a credit balance. Where revenues normally increase equity, contra revenues (like sales discounts) decrease it.

In that, contra accounts exist to show gross and net values side by side, which provides you a clearer view of what’s actually going on with your financials.

Now that you know what a contra account is and how it works in practice, the next question is, why bother with them at all? After all, wouldn’t it be simpler just to adjust the main account directly? Turns out, there are some very good reasons for keeping them separate:

I often remind field service business owners that “what gets measured gets managed” and, in my time in accounting, I’ve seen how messy books can become when contra accounts aren’t used. Business owners lose visibility into why numbers look the way they do, and this can create major blind spots in financial planning. This is why we use contra accounts.

Now that we’ve covered why contra accounts matter, let’s get a little more practical. Contra accounts don’t all look the same and, depending on what they’re tied to, they can show up in different places on your financials. Here are the main types of contra accounts you’ll likely run into:

Concepts are always easier to grasp with a real-world scenario. So, let’s step out of theory and into the trades for a moment. Here’s how a contra account might show up in your books.

Let’s say your plumbing business invoices $100,000 in sales for the month. Out of that:

Example journal entry:

Account | Debit ($) | Credit ($)

----------------------------|-----------|------------

Accounts Receivable | $100,000 |

Sales Revenue | | $100,000

Instead of reducing the Sales account directly, you record:

Example journal entries:

Account | Debit ($) | Credit ($)

--------------------------------|-----------|------------

Sales Returns and Allowances | $5,000 |

Accounts Receivable | | $5,000

Account | Debit ($) | Credit ($)

--------------------------------|-----------|------------

Sales Discounts | $2,000 |

Accounts Receivable | | $2,000

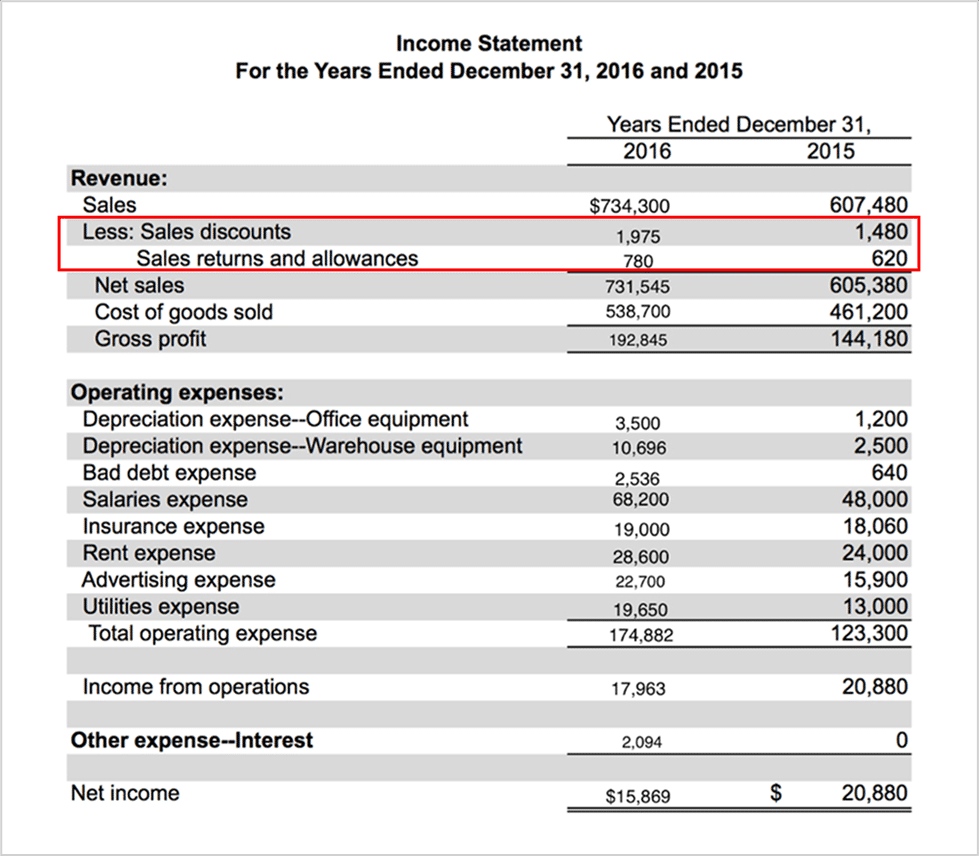

So now, on your income statement, gross sales remain at $100,000. But you subtract $7,000 in contra accounts to arrive at a net sales of $93,000.

As you can see, this separation shows you exactly where the leaks are (i.e., in returns and discounts) rather than just a lower sales number. This is very helpful!

Taking it a step further, let’s examine where contra accounts will appear and how they might look on your financial statements:

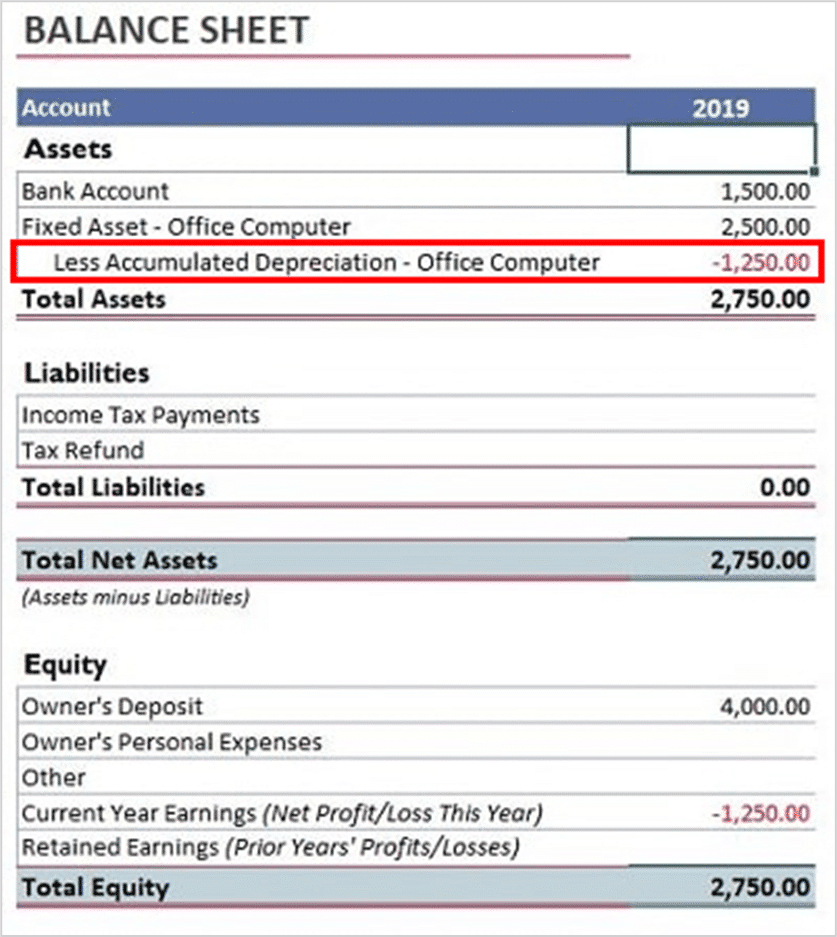

Contra asset accounts sit just below their related assets, reducing their value to reflect things like wear and tear or potential losses:

This layout lets you see both the original value and the reductions side by side, giving a clearer picture of what your assets are actually worth.

Contra revenue accounts work similarly, subtracting from gross sales to show what you truly earned after returns or discounts:

By keeping the original numbers visible, your statements remain clear, helping you identify trends, spot problem areas, and make better informed business decisions.

Even when sales look strong, that number doesn’t necessarily tell the full story. Sometimes, hidden reductions are quietly eating into your profits.

Years ago, a mid-sized electrical contracting client of ours was struggling with profitability despite seeing strong sales numbers. Their income statement showed $2.5 million in sales, but their net sales were only $2.1 million.

Where did the $400,000 go? After some investigation, we found that it was sitting in Sales Returns and Allowances. Digging even deeper, we discovered that faulty materials and incorrect installations were driving customer returns.

By tracking this through contra accounts, we pinpointed the operational issue. The business then invested in training and vendor quality control, which resulted in them being able to reduce returns by sixty percent the following year. That one insight turned losses into solid profit margins.

💡 Pro Tip: Use Historical Contra Account Data to Forecast Risk

Analyze trends in returns, allowances, or bad debt over multiple years to anticipate cash flow challenges and plan for seasonal or operational risks before they impact your business.

Understanding contra accounts is one thing, putting them to work for your business is another. Here’s how you can start applying contra accounting in your own business today:

📥 Download our FREE “Contra Accounts: Financial Health Checklist” and keep track of hidden issues, stay compliant, get the clearest picture of your company’s financial health, and ensure you’re getting the most out of your contra accounting!

💡 Pro Tip: Leverage Visual Reports

Use charts or dashboards to track trends in your contra accounts over time. Seeing spikes in returns or discounts visually can help you pinpoint problem areas faster than numbers alone.

Contra accounts are the unsung heroes of accurate accounting. They don’t get the spotlight, but they hold the whole show together. They make your numbers more trustworthy, your reports more clear, and keep your books audit ready.

Whether you’re adjusting for depreciation, writing off receivables, or just trying to make your income statement less of a mystery novel, contra accounts are your go-to tool.

Get them right and your books won’t just be balanced, they’ll be bulletproof.

Not always. Sometimes it simply reflects depreciation or expected losses.

Because you’d lose detail. Transparency matters for management, tax reporting, auditing, and investors.

No. Even a small HVAC shop with a couple of vans benefits from accurate depreciation tracking and return monitoring.

Yes. Certain contra accounts, like accumulated depreciation, directly impact taxable income. By accurately tracking these reductions, you ensure you’re not overpaying—or underreporting—your taxes.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.