The Retail Accounting Playbook: Bookkeeping, Inventory, COGS, and More

Over my many years in the field service industry, I’ve learned that the way you look at your numbers can really make or break you

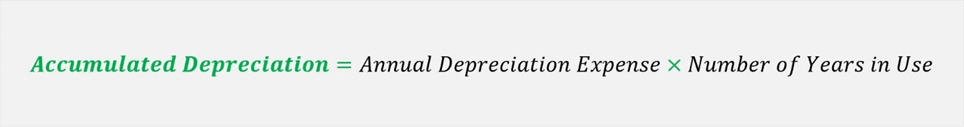

To calculate accumulated depreciation, you simply total up all the depreciation expense recorded on an asset from the day you put it into service. Essentially, it’s a running tally of how much value the asset has lost over time. The simplest and most common formula to calculate accumulated depreciation will look something like this:

In the field service world, whether it’s an expense as little as a rooftop unit or as big as a $20,000 press brake, this number matters. I’ve seen too many business owners ignore it, and then wonder why their balance sheet looks off or their taxes are out of whack. For business owners, especially in service industries with heavy equipment usage, knowing this number is critical for accurate financial reporting, smart tax planning, and long-term budgeting.

In this guide, I’ll walk you through how accumulated depreciation works, break down the other common methods for calculating it, and show you how to track it properly so your financials stay sharp and audit-ready.

Key Takeaways

As a seasoned HVAC industry consultant, I’ve often encountered HVAC, plumbing, and even electrical business owners who find financial concepts like accumulated depreciation challenging. So, if you too are wondering exactly how to calculate accumulated depreciation and what it means for your business, you’re in good company.

Accumulated depreciation refers to the total depreciation recorded for a tangible asset since it was first placed into use. This concept reflects how much of an asset’s cost has been allocated to depreciation expense over its useful life.

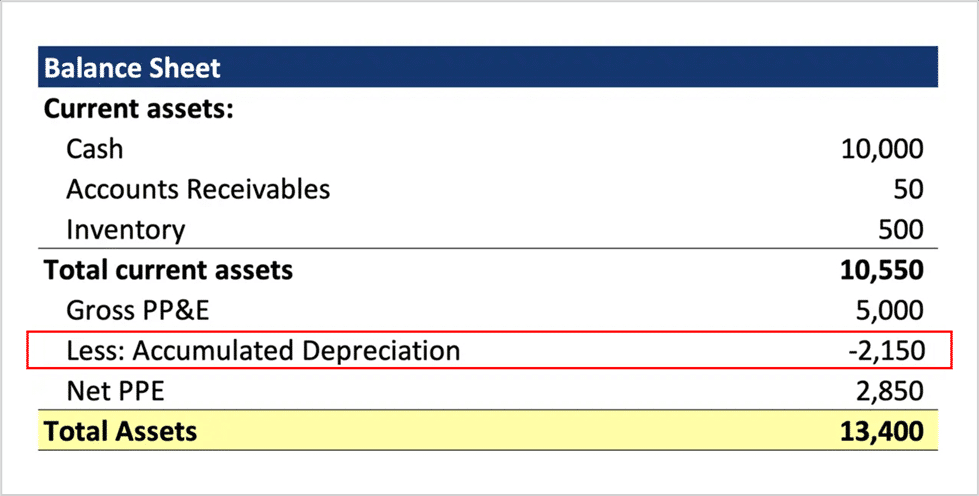

Simply put, if you buy an HVAC service vehicle, its value diminishes over time. This number is typically reported on the balance sheet as a contra asset account, meaning it reduces the gross value of your assets. For example:

⚠️ A lot of people think accumulated depreciation is a current asset – it is not. Knowing where it belongs (and where it doesn’t) on your balance sheet helps you avoid mistakes that can throw off your financials. If you’re unsure how it works, please read: Is Accumulated Depreciation a Current Asset?.

This gives a realistic picture of what your assets are worth after accounting for usage, wear and tear, and the passage of time. Tracking this reduction accurately helps you better gauge your company’s true worth and make smarter investment decisions.

It helps determine the net book value of your fixed assets. This is important for financial reporting, asset tracking, and even selling equipment.

Depreciation expenses lower your taxable income. Accurate depreciation calculations mean you’re not paying more tax than you should – or less, which can bring trouble.

Understanding how assets lose value helps you plan for replacements or upgrades. No one wants to find out their essential machinery is worthless mid-project.

External auditors and internal stakeholders rely on accumulated depreciation to ensure that your books reflect reality. Misreporting this can lead to some very uncomfortable conversations come audit time.

Knowing your accumulated depreciation helps you determine when to invest in assets. For instance, an HVAC company I consulted for delayed updating their fleet, thinking the vehicles were still providing great value. After reviewing their accumulated depreciation, it became clear it was costing them more to maintain the old fleet than investing in new, more efficient vehicles.

💡 Pro Tip: Track Improvements Separately from the Original Asset

When you upgrade or improve an existing asset (like installing a new lift gate on a service truck) treat that improvement as a separate asset with its own depreciation schedule. This keeps your records clean and aligns with best practices outlined in Aptora’s depreciation methods guide.

Earlier in this article, I talked about the most basic way to calculate accumulated depreciation. That method is called the “Straight-Line Method.”

The straight-line method is one of three ways to calculate your accumulated depreciation with the other two being the “Declining Balance Method” and the “Units of Production Method.”

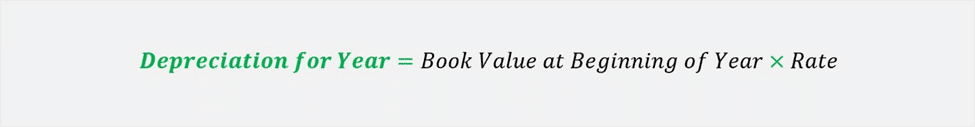

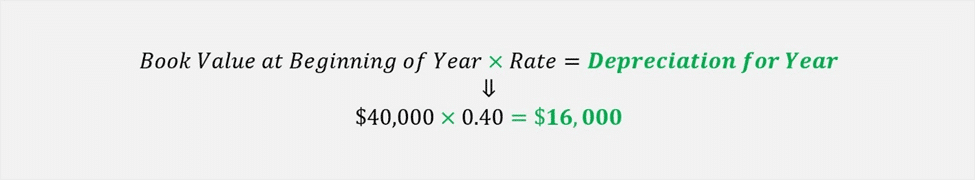

The declining balance method formula looks like this:

Note: This method is often used in its double-declining form (2× straight-line rate).

This declining balance method is an accelerated method that accounts for higher depreciation in earlier years. It’s useful for assets that quickly lose value, like certain high-tech diagnostic tools or specialized HVAC equipment.

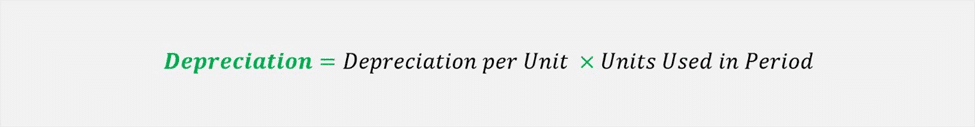

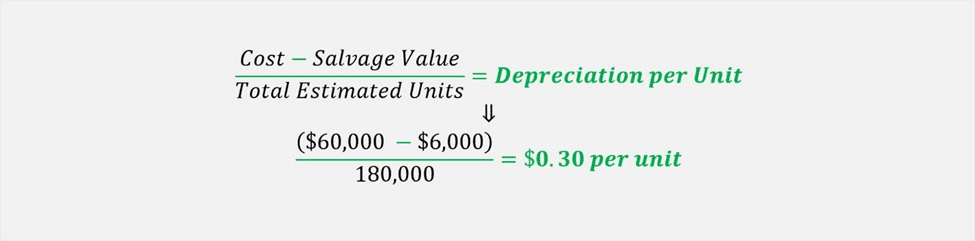

And, the units of production method formula looks like this:

This units of production method works best for machinery and equipment where usage can vary.

Now, let’s put each of these methods into play with some real-world scenarios to give you a better understanding of how to implement them.

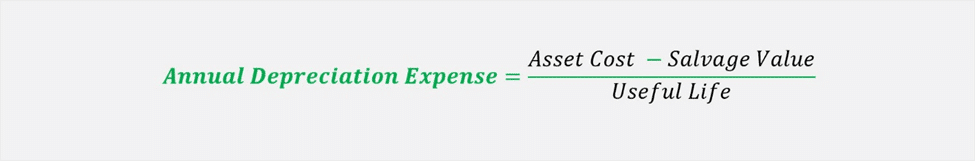

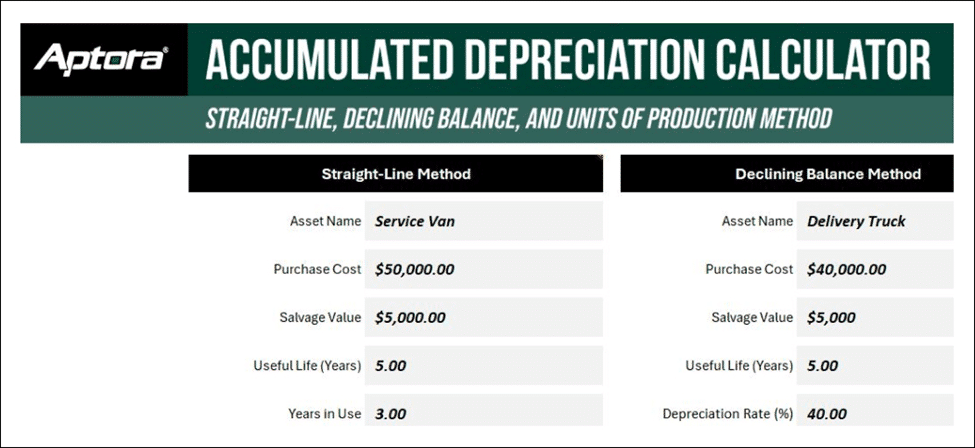

Imagine purchasing an HVAC service van for $50,000, with a useful lifespan of 5 years. To utilize the straight-line depreciation method, we’ll first need to find the annual depreciation expense by using this formula:

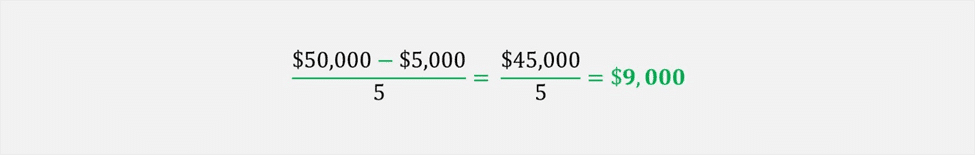

Assuming a salvage value of $5,000, the calculation becomes:

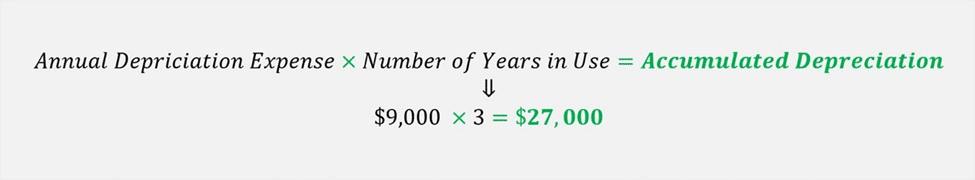

Thus, each year the van depreciates by $9,000. After three years, the accumulated depreciation is:

Let’s say you buy a delivery truck for $40,000 (book value) and choose the declining balance method with a 40% depreciation rate.

In the first year, you calculate depreciation as:

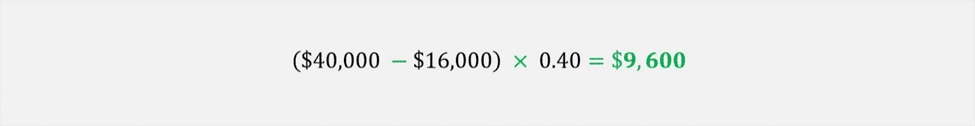

In the second year, you apply the same rate to the current reduced book value:

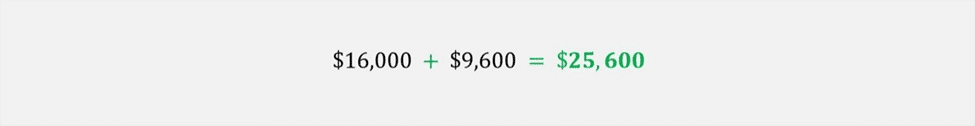

So, your accumulated depreciation after two years would be:

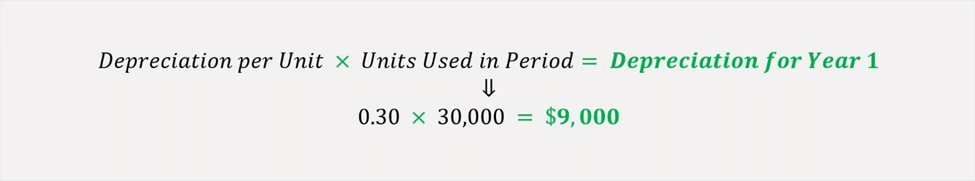

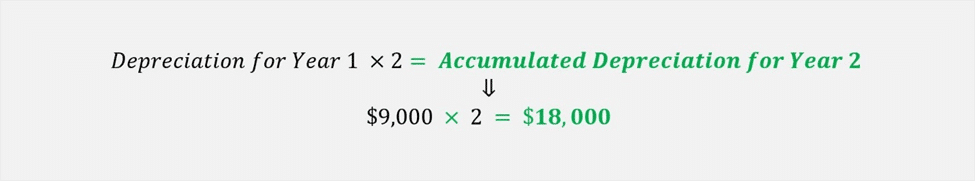

Now, let’s imagine you run a fabrication shop and invest in a $60,000 CNC machine expected to produce 180,000 parts over its lifetime, with a $6,000 salvage value and, in its first year, the machine is used to produce 30,000 parts. To implement the units of production method, we’ll first need to figure out your depreciation per unit with this formula:

Now, for the first year, you would calculate depreciation as:

If the machine is used to produce another 30,000 parts in the second year, the accumulated depreciation at the end of the second year would intuitively be:

So, when preparing to calculate accumulated depreciation for an asset, you’ll want to begin by determining the asset details (i.e., purchase cost, salvage value, useful life, start date of depreciation), and then select a depreciation method based on the nature of the asset, your company policy, or industry standard.

📥 Download Our FREE Accumulated Depreciation Calculator!

Take the guesswork out of tracking depreciation. This powerful, easy-to-use Excel tool includes three calculation methods so you can calculate depreciation accurately for any asset type.

⚡ Quick Tip: Use the same depreciation method across similar asset types whenever possible. Consistency not only speeds up and simplifies your accounting, but it also makes your financial reports easier to interpret for lenders, partners, and auditors.

One of the most common missteps I see is completely overlooking salvage value (the estimated amount you can recover when the asset reaches the end of its useful life). If you ignore this, your depreciation expense will be too high year after year. That means you’ll be understating profits, which can confuse your financial picture and possibly throw off everything from loan applications to partner buyouts. Always estimate a reasonable salvage value upfront, even if it’s small.

Overstating or understating the useful life of your assets is another misstep. I’ve seen business owners claim a 15-year life on a truck that barely made it past six. Use industry standards as your baseline, but also think practically – your vehicles and equipment take a beating out in the field. Underestimating life can overinflate expenses; overestimating it can make your books look better than they really are. Either way, it distorts the truth.

Depreciation is not a “set-it-and-forget-it” type deal. Your asset usage, repairs, or upgrades can affect how long something actually stays useful. I recommend reviewing your fixed asset list at least once a year. You should look for assets you’ve disposed of, stopped using, or had to replace sooner than expected. A stale depreciation schedule can lead to misleading reports and potential issues come tax time or when you’re seeking financing.

Always opt for simplicity and consistency. Use software tools designed specifically for field service businesses’ asset management, such as Aptora’s asset management software, to automate and simplify your depreciation tracking.

Knowing how to calculate accumulated depreciation helps you value your assets correctly, keep your balance sheet honest, and prepare for the future. Whether you’re depreciating forklifts, laptops, or HVAC units, consistent and accurate tracking protects your bottom line.

And it doesn’t have to be complicated, just choose the right method, set up a system, and stay on top of updates.

Generally, no – not without justification and proper documentation. It may require approval if you’re audited or reporting to stakeholders.

You stop depreciating and recognize a gain or loss on disposal depending on the asset’s book value vs. sale price.

No. Land doesn’t wear out, so it’s not depreciated. Buildings on land, however, are depreciated.

Depreciation expense is recorded each period. Accumulated depreciation is the total of all past depreciation expenses for an asset.

Only tangible, long-term fixed assets used in the business. Inventory, intangibles, and personal-use items don’t qualify.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.