The Retail Accounting Playbook: Bookkeeping, Inventory, COGS, and More

Over my many years in the field service industry, I’ve learned that the way you look at your numbers can really make or break you

To calculate retained earnings, you simply subtract dividends paid from your total net income over a given period – this is your profit retained in the business after paying out to owners or shareholders. Now, how do you actually use this information to run a smarter, more profitable operation? Let’s examine.

I remember coaching a HVAC shop in Kansas City that was profitable on paper, yet was always writing checks from a nearly empty bank account. The culprit turned out to be retained earnings – the silent engine that funded their growth, cushioned their downturns, and decided their credibility to lenders.

Throughout my years, I’ve seen many contractors facing this same dilemma: working 60-hour weeks, growing their teams, serving customers faithfully, and yet still scratching their heads when it comes to truly understanding the numbers.

In this article, I’ll share with you some of my real-world experiences from my time in the HVAC and accounting industry, walk you through how to calculate retained earnings and why it matters, and leave you with some practical tips that you can use starting today!

Key Takeaways

Let’s start with a basic retained earnings definition: Retained earnings (or retained profit) represent the cumulative net income your business has earned after paying out dividends to shareholders or owner draws. In other words, it’s the profit you keep in the business – for reinvestment, paying down debt, or building rainy day reserves – rather than distribute.

Think of it like your company’s piggy bank. Each year, after you tally up revenue and subtract expenses (and taxes), you get net income. If you don’t distribute all that profit as dividends, what remains gets rolled into retained earnings.

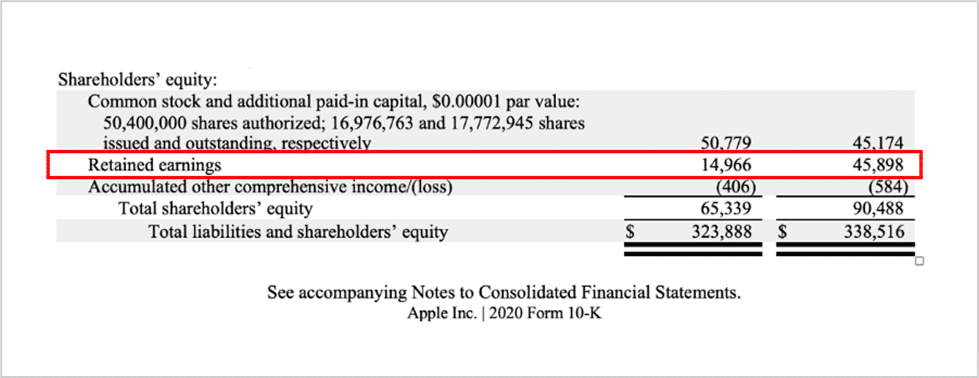

You should be able to find this number in the equity section of your balance sheet. It’s a clear indicator of your company’s ability to reinvest, pay down debt, or weather a slow season.

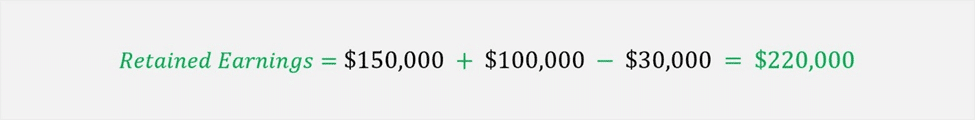

The great news is you don’t need to be a CPA to calculate retained earnings. Here’s the simple retained earnings equation:

Now, let’s break that down:

Putting this into play, let’s say your HVAC company had $150,000 in retained earnings at the beginning of the year. This same year, you earned $100,000 in net income and paid out $30,000 in dividends. So, in this example, your retained earnings would be:

The math is simple, but incredibly important.

Retained earnings give you flexibility and control. So, you’re not having to wait on a loan or investor approval to make moves.

I once worked with an electrical company that had strong sales but never seemed to really flourish beyond their average. After digging into their books, we discovered that they were distributing nearly all of their profits to shareholders every year. So, for that reason, their retained earnings were close to zero.

Once they adjusted their dividend policy and reinvested earnings, they were able to build out a second crew, double their revenue in two years, and finally had the cash to weather the regular rough winter season.

💡 Pro Tip: Use your retained earnings to prepare for equipment replacement cycles.

If you have vehicles or rely heavily on tools, you should set aside a portion of your company’s retained earnings annually for this specific purpose in order to avoid sudden budget pressure when it’s time for replacements.

Understanding your financials at a glance is super important and I can’t stress this enough. So, if you’re not using a dedicated software that enables you to quickly view and understand your financials, you must start!

If you’re using accounting software like QuickBooks or Aptora’s built-in general ledger, you’ll find retained earnings listed in the equity section of your balance sheet. Here’s an example of what you might see:

This snapshot tells investors, lenders, and partners how much profit you’ve kept over time.

By the way, if you’re not reviewing your balance sheet at least quarterly, now’s the time to start. It’s not just a report for your CPA, it’s a vital tool for good decision-making.

Check out our Accounting Guide for Contractors if you need a refresher on those accounting basics!

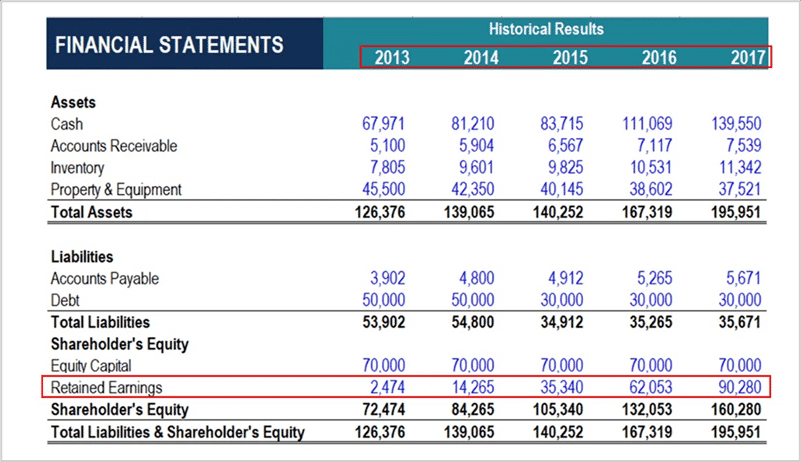

A retained earnings statement is a report that shows your financial story over time by tracking changes in your retained profit across a specific period (usually a year or quarter). It’s often part of your full financial statement package, but it can also be created separately.

Here’s an example of what that might look like:

This statement helps stakeholders understand how your retained earnings evolved: what came in, what went out, and what remains.

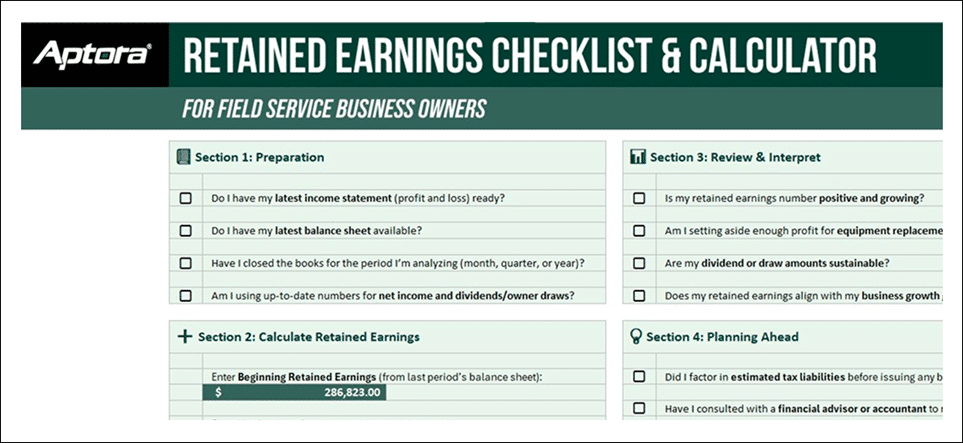

📥 Download our FREE Retained Earnings Checklist & Calculator below to make sure you have everything you need to start calculating and setting your retained earnings goals!

Here’s an eye-opening story about how one plumbing company I consulted with used retained profit to survive a crisis.

During the early months of the COVID-19 pandemic, I consulted with a mid-sized plumbing firm in St. Louis. During this state of emergency, their revenue dropped 40% almost overnight. But, they had a secret weapon – and it was, you guessed it, strong retained earnings.

Instead of taking on high-interest loans or laying off staff, they dipped into their retained profits to cover payroll and marketing shorts. Within six months, their business started bouncing back, and by the end of 2021, they had not only survived, they had grown.

After the scare, the owner of the company told me, “If we hadn’t built up those earnings year after year, we would’ve been toast.”

That’s the power of retained earnings. It’s not just a number – it’s a safety net.

Here’s another personal story of mine:

Many years ago, I had a close pal who started a small HVAC business. He worked hard, and within just a couple of years of getting it off the ground, business was booming. So naturally, he decided to celebrate by giving himself and his partners a generous bonus.

Then… Tax season hit.

He hadn’t planned for the fact that his business’s net income, on paper, wouldn’t match his cash flow. As a result of this major oversight, he had low retained earnings and ended up having to scramble to pay the IRS. Thankfully, he did manage to cover their tails, but he walked away from that situation a forever changed businessman.

That mistake taught me that one must always factor in future obligations and working capital when considering dividend payouts.

Now, as the president of Aptora and a shareholder at RA Tax and Accounting, I use that lesson taught to me to help other contractors avoid the same mistake.

💡 Pro Tip: Calculate your tax obligations before deciding on bonuses or draws.

When your profits look strong, it’s very tempting to reward yourself – but a quick tax estimate can help you avoid the classic “paper profit, empty account” trap. Don’t skip this step!

There are some pretty simple strategies that you can employ to improve your bottom line.

If you want to grow your retained earnings – and who doesn’t? – here are some practical tips:

Most importantly, I recommend talking to a financial advisor who understands the service trades. Not all accountants speak “HVAC.”

💡 Pro Tip: Forecast retained earnings as part of your annual planning.

Just like you’d forecast revenue or expenses, projecting retained earnings helps you identify how much profit you’ll keep and whether it aligns with your growth goals.

Retained earnings aren’t just a line item – they’re a reflection of your company’s health, strategy, and future.

When you understand how to calculate retained earnings, you unlock a clearer picture of where your business has been and where it can go.

Whether you’re planning to expand your crew, survive a slowdown, or just make smarter decisions, knowing your retained profit gives you power.

If you’re unsure where to begin, don’t worry – you’re not alone. At Aptora, we specialize in helping contractors take control of their financials and we build the tools to make it easier.

Ready to get serious about your numbers? Start by checking your balance sheet today!

Yes. If your business has more losses or distributions than cumulative profits, your retained earnings will show as a negative number, often labeled as an accumulated deficit.

No. Retained earnings are an accounting entry that reflects profits kept in the business, but they don’t always translate to available cash on hand.

Ideally, update your retained earnings monthly or quarterly, whenever you close your books or prepare internal financial statements.

Yes. For sole proprietors or partnerships, owner draws reduce equity, and in effect, reduce retained earnings since they’re a form of profit distribution.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.