The Retail Accounting Playbook: Bookkeeping, Inventory, COGS, and More

Over my many years in the field service industry, I’ve learned that the way you look at your numbers can really make or break you

Yes, depreciation is an operating expense. While not directly reducing your bank account, it does impact your profits. Classifying depreciation as an operating expense allows you to match revenue generated by an asset with its related expense, providing a clear picture of your business’s true profitability.

Depreciation is one of those accounting concepts that seems straightforward but, if you’re unclear on the ins-and-outs, it can leave you scratching your head when it comes time to review your business’s financial statements.

As someone who has spent over 27 years advising field service businesses, I’ve seen firsthand how confusing accounting concepts can become as a business grows and ages. So, if you’re an accountant, a controller, or even a business owner, squinting at financial statements wondering, “Am I treating the depreciation of my assets properly? Is it an operating expense?” …This one’s for you.

Now, let’s unravel this confusion and explore what depreciation really means, how it impacts your business, and where it belongs on your balance sheet!

Key Takeaways

At its core, depreciation is the gradual reduction in value of a tangible fixed asset over time. It’s the systematic reduction in value of things like equipment, vehicles, and machinery you rely on daily and typically use for more than a year.

So, depreciation reflects:

So, rather than expensing the full cost of a new delivery truck or HVAC system on the day you buy it, depreciation spreads that cost over the asset’s useful life.

Here’s an example of what this means:

Let’s say you purchase a service van for $50,000. It has a useful life of 5 years and no salvage value. Using the straight-line method to calculate depreciation here, you’d expense $10,000 per year for 5 years.

So, in this example, even though you paid $50,000 upfront, your income statement reflects only $10,000 in depreciation expense each year. This gives you a more accurate picture of your profit over time.

For the sake of clarity, it’s also important to note that depreciation in and of itself is NOT an asset; it is an expense that gradually reduces the value of an asset over time. Your service van, your building, and your tools are assets and, as they age, depreciation captures their declining usefulness. As a result of this, depreciation appears as an expense on your income statement, and it directly affects your net income.

In financial accounting, operating expenses (OPEX) are the costs a business incurs through its normal operations. That includes rent, wages, utilities, and yes, depreciation.

So, what makes depreciation fit this category?

Depreciation hits your books every accounting period, as long as the asset is still in use.

Depreciation applies to assets you use to generate revenue. If your field service business relies on work trucks, then their depreciation is a cost of doing business.

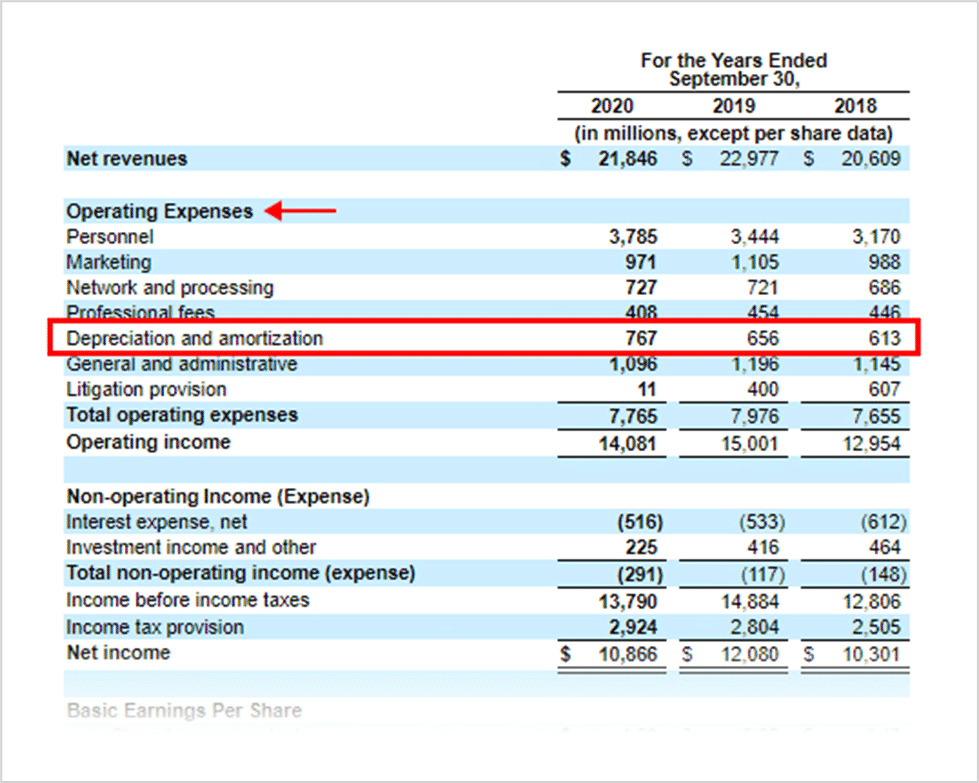

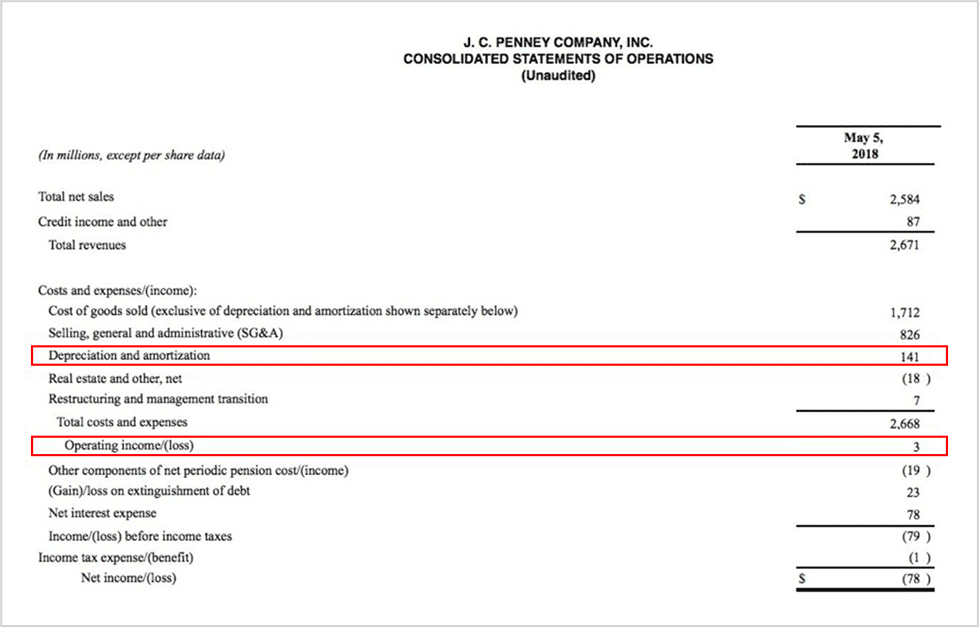

Depreciation shows up under “Operating Expenses” or sometimes as a separate line below gross profit. Here’s an example of what that might look like:

💡 Pro Tip: Track Depreciation by Department or Job Function

If you’ve got assets pulling double duty across departments, like trucks used for both installs and service calls, it’s a good idea to split up the depreciation accordingly. Doing this gives you cleaner, more accurate profit-and-loss numbers for each department, which is key when you’re trying to control costs and see how each area of the business is really performing.

Great question.

Even though depreciation doesn’t involve money leaving your account during the period, it still reflects a real economic cost.

Think of it this way:

By spreading out the cost of an asset over its useful life, depreciation matches expenses with income, following the matching principle of accrual accounting.

This paints a truer picture of your profitability.

Let’s visually compare depreciation to more traditional OPEX items to further demonstrate why it qualifies as an operating expense.

| Expense Type | Cash Impact? | Recurring? | Tied to Operations? |

| Wages | ✔️ | ✔️ | ✔️ |

| Rent | ✔️ | ✔️ | ✔️ |

| Depreciation | ❌ | ✔️ | ✔️ |

| Advertising | ✔️ | ✔️ | ✔️ |

As you can see, depreciation checks all the same boxes as your more traditional operating expenses, minus the cash impact.

Technically, yes, depreciation can be considered NOT an operating expense. For example, if an asset isn’t used in day-to-day operations, its depreciation may be categorized elsewhere.

For example, depreciation of:

So, while depreciation is typically an operating expense, context matters!

By now, you know depreciation affects your bottom line. But where exactly does it live in your financials? Let’s walk through how it may show up across your key financial statements.

You’ll typically see your depreciation pop up in three main places:

Depreciation will show up here as an operating expense, reducing your net income (even though no cash is actually leaving your account).

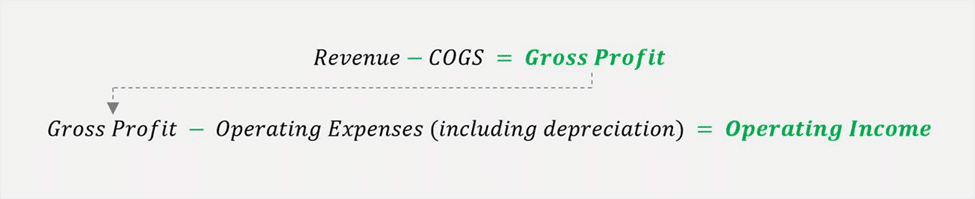

Here’s how it fits into reducing your net income:

And again, here’s how it may appear on your income statement:

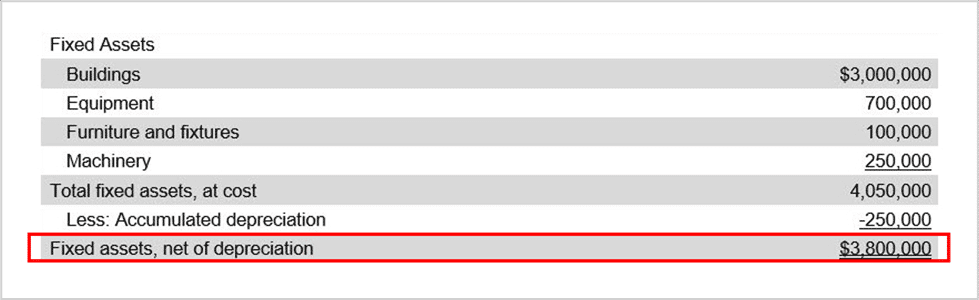

On the balance sheet, depreciating assets like vehicles and equipment are shown net of depreciation, which is just a fancy way of saying we subtract how much value they’ve lost over time.

For example:

So while the total of your fixed assets may have cost you a whopping $4,050,00, net of depreciation, your balance sheet now reflects it as being worth only $3,800,000.

Depreciation also shows up in the operating activities section of your cash flow statement, but here’s the twist: instead of being subtracted, it’s actually added back in.

The reason for this is, depreciation reduces your net income on paper, but it doesn’t cost you any actual cash. It’s what accountants call a non-cash expense, and the cash flow statement adjusts for that to reflect the real cash that moved in and out of your business.

So, while depreciation makes your profit look smaller, it doesn’t shrink your cash position, and your cash flow statement makes sure of that.

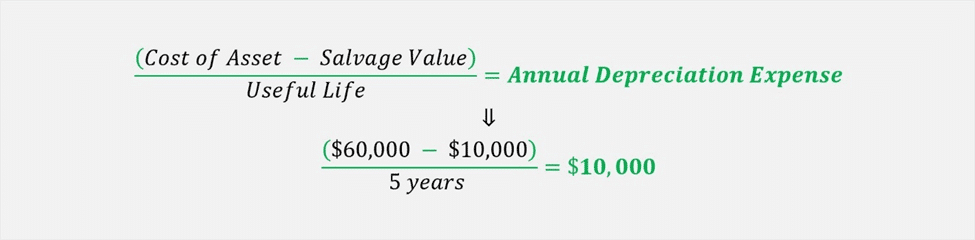

Here’s a real-world example to demonstrate how depreciation plays out in your daily financials.

Let’s say you run an HVAC business and pick up a new service van for $60,000. You expect it to last five years and figure you can sell it for $10,000 at the end. Pretty typical.

Again, using the standard straight-line depreciation expense method, here’s how the math works:

So, in Year 1, you’ve got:

Now, here’s the kicker: most service businesses don’t just have one van. You likely have a whole fleet, plus tools, laptops, or diagnostic equipment that’s all being depreciated. Multiply this one example across your entire asset list and you’ll see just how fast that “invisible” expense adds up.

If you’re not tracking this stuff properly, or worse, if your depreciation schedule doesn’t match how hard those assets are actually being used, it can throw off your financials and your planning in a big way.

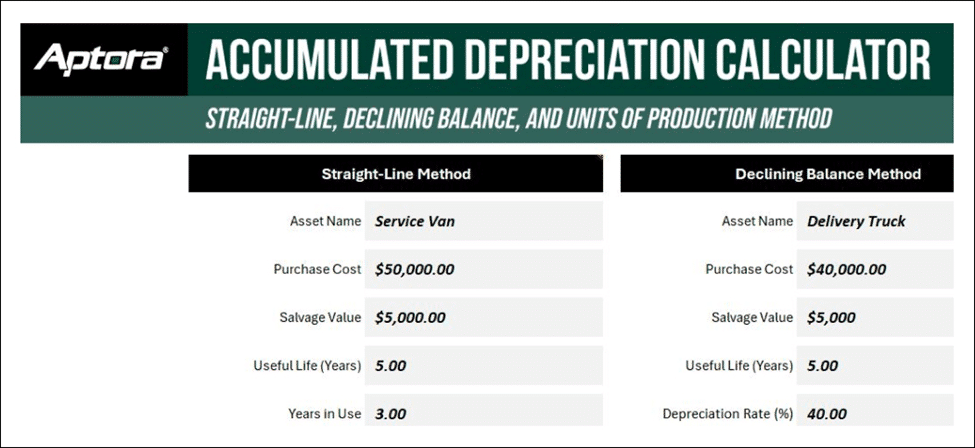

Not sure how to calculate your assets’ accumulated depreciation? Download our easy-to-use Accumulated Depreciation Calculator to get clear insight into your annual expenses. It includes three built-in methods, so you can calculate depreciation accurately, no matter the asset.

📥 Download Aptora’s FREE Accumulated Depreciation Calculator below!

💡 Pro Tip: Align Depreciation Your Schedules with Your Maintenance Plans

If a work truck is racking up miles faster than expected, chances are it’s wearing out faster, too. Tying your depreciation schedule to your maintenance plan keeps your books realistic and helps you budget smarter for repairs or replacements.

Reflecting on my decades helping HVAC businesses thrive, understanding depreciation stands out as crucial. I’ve seen early confusion around this, seemingly, minor accounting detail lead to significant misjudgments for many clients. Seeing that transformed my consulting approach and has enhanced my ability to provide impactful guidance and identify the common depreciation mistakes that business owners make.

Here’s what you’ll want to watch out for:

Avoiding these mistakes will help to ensure your financials tell the real story of your business. Keeping your numbers clean and accurate helps keep your financial decision-making grounded in reality which is SUPER important.

💡 Pro Tip: Review Your Asset List Annually

Go through your asset list at least once a year, clean out anything you’re no longer using, and make sure what’s depreciating is still pulling its weight. An annual asset review helps remove obsolete items and ensures your depreciation expense actually reflects the assets in use. Doing this will help keep your financials accurate and your tax deductions valid.

Now here’s the part most business owners love when it comes to depreciation: tax deductions.

The IRS lets you deduct depreciation as a business expense, which in turn reduces your taxable income. This means you’re paying less in taxes, and your cash flow takes less of a hit.

Here are a few common methods for calculating depreciation when it comes to tax purposes:

⚠️ These depreciation methods come with their own set of rules and limitations.

Always run your tax methods and ideas by your CPA or tax pro. They’ll help you with staying compliant and squeezing the most value out of your asset purchases.

So, there you have it: yes, depreciation is an operating expense, and a powerful one at that.

Understanding and handling financial concepts like depreciation properly is what sets stable, scalable businesses apart from those who are just “getting by.” It’s not merely an accounting technicality; it’s vital for maintaining accurate financial statements, strategic planning, and driving your business growth.

Feeling ready to take control of your business financials? Explore our powerful suite of products, built with robust accounting and field service management features, and see how Aptora’s software can simplify your accounting!

No. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization—so depreciation is excluded from that metric.

Sort of. For book purposes, yes. For tax purposes, you must follow IRS guidelines, which often require specific methods.

Absolutely. Many companies use fully depreciated assets for years. They stay on the books at salvage value.

Similar idea, different application. Depreciation is for tangible assets; amortization is for intangibles like patents or trademarks.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.