Is Land a Current Asset? A Guide for Owners & Bookkeepers

Quick Answer In virtually all standard bookkeeping and accounting frameworks, land is classified as a non-current asset, specifically as a fixed asset or property, plant,

Key Takeaways

This question is a common point of confusion—even among seasoned field service business owners and accountants. Here’s the short answer: no, it’s not. But the real value lies in understanding what it is and how it impacts the accuracy of your financial statements. Knowing this helps you present a more honest and clear view of your company’s financial standing.

This guide breaks it down in plain English, peppered with real-world examples, a few accounting war stories, and some no-fluff wisdom you can actually use. Ready? Let’s get into it!

Accumulated depreciation represents the total wear and tear that your long-term assets have experienced since you bought them.

Think of it like mileage on a truck. You didn’t lose the truck—it’s just not worth what it was on day one.

Official Definition:

Accumulated depreciation is a contra asset account that reduces the recorded gross amount of fixed assets on the balance sheet.

In short, it keeps you honest about how much your buildings, equipment, and vehicles are really worth after time and usage take their toll.

A contra asset account acts like a financial subtractor—it sits among your assets but actually works to reduce their book value, offering a more accurate picture of what your assets are truly worth.

So, instead of boosting what you own, it reflects the truth: assets lose value. Accumulated depreciation sits right under your fixed assets, making sure you don’t think that fleet of HVAC vans you bought five years ago is still worth full sticker price.

Simple Math:

If you bought equipment for $50,000 and it’s lost $10,000 in value so far:

| Asset | Debit | Credit |

| Equipment (Original Cost) | $50,000 | |

| Accumulated Depreciation | $10,000 | |

| Net Book Value (on Balance Sheet) | $40,000 |

Boom—accurate financials.

For a deeper dive into how credits and debits impact financial reports, check out Debits and Credits: How They Affect Financial Reports.

Short answer: No.

Long answer: Also no, but let’s dig a little deeper.

Current assets are things you expect to turn into cash, sell, or consume within 12 months. Examples:

Accumulated depreciation doesn’t fit the bill because:

Accumulated depreciation belongs on the long-term side of your balance sheet, paired with the assets it depreciates—like buildings, vehicles, and heavy equipment.

Your assets aren’t worth what you paid for them years ago. Recording depreciation makes your balance sheet honest and transparent.

Thinking of selling some service trucks or warehouse equipment? Your net book value gives you a starting point for pricing and negotiation.

Banks and investors dig into your asset valuations. Inflated numbers from ignoring depreciation could turn lenders off or delay funding.

Accurate depreciation affects ratios like Return on Assets (ROA) or Debt-to-Asset Ratio— metrics that lenders and investors rely on to evaluate your business’s financial performance.

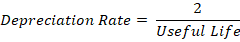

There are multiple methods, depending on how you want to slice it. The most popular are:

Example:

Every year, you add $7,000 to accumulated depreciation.

Front-loads depreciation (assets lose value faster in early years).

Then apply that percentage to the assets’ book value at the beginning of each year.

Good for tech-heavy businesses where equipment becomes outdated quickly.

Tie depreciation to usage (e.g., miles driven, hours used).

Useful for field service companies with heavy vehicle fleets or specialized machinery.

Still not sure how to calculate accumulated depreciation? Please read this in-depth tutorial: How to Calculate Accumulated Depreciation

Balance Sheet:

Income Statement:

Accumulated depreciation is the total of all prior period depreciation expenses stacked together.

Skipping monthly or quarterly entries throws your balance sheet way off. Even a six-month delay can make your reports useless for decision-making.

Accumulated depreciation doesn’t “save up” cash for you. It’s an accounting adjustment—not a fund you can tap into later.

Don’t do it. Accumulated depreciation, again, is NOT a current asset. Mislabeling it will frustrate your CPA and signal to lenders that you may not fully understand your financials.

Don’t forget about salvage value or different useful lives for different asset types. Not all service trucks or equipment age equally.

Let’s say you bought:

Straight-line depreciation:

Each year, you add $14,000 to accumulated depreciation. After 3 years:

So, your accumulated depreciation is $42,000, and your vans now show a Net Book Value of:

Still rolling—just at a lower accounting value.

Still feeling unclear about accumulated depreciation? Start by putting a simple system in place to track each fixed asset—its cost, useful life, and depreciation. Even a simple spreadsheet can work, as long as you update it monthly. But for a more streamlined, professional solution, consider using Aptora’s Total Office Manager software. It’s built to help service businesses manage assets, accounting, and more—all in one place. Nail this process, and you’ll avoid awkward bank meetings, make sharper asset decisions, and show serious financial credibility. Don’t let sloppy accounting drag down a good business—own your numbers.

Because it reduces asset value rather than adding to it. It’s a contra asset, meaning it sits on the asset side but works against asset totals.

No. Current assets are things that turn into cash within a year. Accumulated depreciation is tied to long-term assets and reflects years of value loss—not something liquid or sellable.

Depreciation expenses can lower taxable income each year. Accumulated depreciation itself doesn’t directly affect taxes—it’s a cumulative tracking tool.

When you sell an asset, both the asset’s original cost and its accumulated depreciation come off your balance sheet. You record any difference as a gain or loss on the sale.

If an asset is fully depreciated but still in use, yes, technically its book value drops to zero. But as long as you properly tracked it, there’s no penalty—just be prepared to replace assets when operationally necessary.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.