Is Land a Current Asset? A Guide for Owners & Bookkeepers

Quick Answer In virtually all standard bookkeeping and accounting frameworks, land is classified as a non-current asset, specifically as a fixed asset or property, plant,

Key Takeaways

I know, figuring out how to calculate manufacturing overhead isn’t the most glamorous part of running a field service or production-based business. But, if you want to stop wondering where your profits went and start quoting prices that actually make you money, understanding overhead is non-negotiable.

Whether you’re running a small fabrication shop, HVAC service business with an in-house warehouse, or a production-focused operation, this guide will walk you through everything you need to know: what manufacturing overhead is, how to calculate it, how to apply it, and what to avoid along the way.

Manufacturing overhead, also called factory overhead or production overhead, includes all the indirect costs that go into making a product. These aren’t the direct labor or direct materials used on the item itself. Instead, they’re the support costs that keep production humming.

If you can’t tie the cost directly to one product being built, there’s a good chance it belongs in the overhead category.

Ignoring manufacturing overhead—or underestimating it—leads to underpriced products, mystery expenses, and shaky profit margins. Worse, it clouds your view of how efficient your operations actually are.

Here’s why calculating it correctly matters:

Start by gathering a list of every cost that supports production but doesn’t touch the product directly. This includes:

That’s your monthly manufacturing overhead.

A cost driver is the activity that causes overhead. This is what you’ll use to allocate your overhead to each unit or project.

Common cost drivers include:

Choose whichever is most logical for your operation. If your shop runs highly automated equipment, machine hours might be best. For labor-intensive services, labor hours may be the smarter route.

💡 Tip: For a quick read on how well your team is turning hours into revenue, check your labor efficiency ratio.

This step helps you figure out how much overhead to assign per unit, hour, or batch.

Overhead Rate Formula:

Example:

Let’s say your cost driver is direct labor hours, and your team logged 400 hours this month.

That means for every labor hour spent on a project, you should apply $25.50 in overhead to accurately reflect total costs.

Let’s say a recent job used 10 hours of labor:

If the job also used $800 in materials and $300 in direct labor, your total job cost becomes:

That’s the true cost of doing business.

Want to gauge the overall financial health of your business? Learn how to calculate your profitability ratio.

For businesses with varied production activities, ABC assigns costs more precisely. You track each activity (e.g., machine setup, quality testing), and apply overhead based on how much of each activity a product consumes.

Calculated in advance based on estimated costs and driver volumes.

This helps with pricing jobs before you know actual totals but requires adjustments later.

If your business is machine-heavy but you base overhead on labor hours, your cost allocations will be off.

Equipment doesn’t fix itself. Forgetting to include maintenance expenses underestimates your real costs.

Applying overhead to some jobs but not others skews job costing and can lead to inaccurate profit margins.

Your office manager’s salary isn’t production overhead. It goes under general and administrative (G&A), not manufacturing.

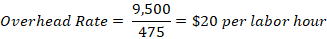

Total Overhead: $9,500

If your team logs 475 labor hours per month:

A mini-split installation that takes 5 hours? Add $100 in overhead to the job’s cost.

Once you’ve calculated your overhead rate, here’s how to put it to work:

Don’t let your business run blind to its real costs. Start by gathering your indirect expenses this month, pick a smart cost driver, and apply your overhead to every job moving forward. You’ll be amazed how much clearer your margins become—and how much easier pricing decisions get. Want to make it even smoother? Use accounting software, like Aptora’s Total Office Manager, or cost-tracking tools that let you automate overhead calculations and keep your profit margins in check.

Nope. Manufacturing overhead relates only to production. Operating expenses include office rent, marketing, and admin salaries, which don’t get tied to production.

Actual overhead is what you truly spent. Applied overhead is what you estimated and allocated based on your cost driver. You may need to reconcile the two at the end of the period.

Not usually. Inbound shipping (getting materials to your plant) might count. Outbound shipping (sending products to customers) is a selling expense.

At least quarterly. If your business has seasonal swings or rapid growth, monthly might make more sense.

You can, but you shouldn’t. Even small businesses benefit from tracking overhead—it sharpens pricing, budgeting, and profit analysis.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.