The Retail Accounting Playbook: Bookkeeping, Inventory, COGS, and More

Over my many years in the field service industry, I’ve learned that the way you look at your numbers can really make or break you

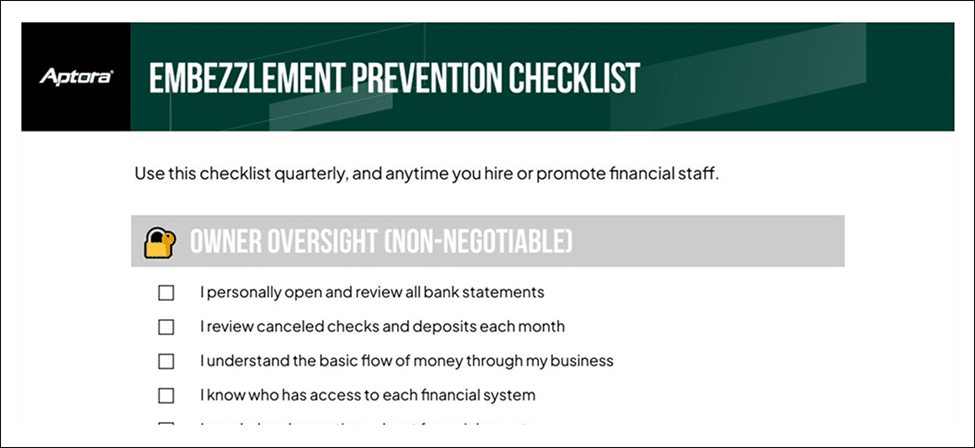

To protect your service business from embezzlement you MUST: stay involved in your business’s finances, separate accounting duties, and use accounting software with strong security and audit trails.

If you own or manage an HVAC, plumbing, electrical, or construction business and would rather be running calls than dealing with accounting software, you are not alone. I know most service business owners didn’t get into this industry because they love bookkeeping. Unfortunately, that mindset is exactly what dishonest employees rely on.

Embezzlement is one of the most common criminal reasons small service businesses fail, and it almost never looks obvious at first. I’ve spent decades consulting with contractors, and I’ve heard hundreds of painful stories involving trusted bookkeepers, long-time employees, business partners, and even close friends. There is no “type” of person who steals. The common denominator is opportunity.

The good news is this: most theft is preventable. You don’t need to become an accountant, but you do need to understand the basics, stay involved, and set up your systems correctly. In this article, I’ll walk you through the most common embezzlement schemes and the practical controls that stop them cold.

💡 Pro Tip: Take One Week a Year and Personally Do the Bookkeeper’s Job

Once per year, take a full week to personally review bank statements, deposits, invoices, payroll reports, and audit trails as if you were the bookkeeper. You do not need to process transactions, just follow the money. Knowing that the owner periodically steps into the process is one of the strongest deterrents against theft and often reveals weak spots that normal routines hide.

Most embezzlement isn’t sophisticated or dramatic; it’s repetitive, quiet, and designed to blend in with normal daily activity. These schemes work because they exploit routine, trust, and a lack of oversight. Understanding how theft actually happens in real service businesses is the first step toward preventing it. Keep a look out for the following things.

A dishonest bookkeeper creates a vendor name that looks almost identical to a real one; think “Carrier Inc.” instead of “Carrier.” Payments are made to this fake vendor, which is actually a bank account controlled by the thief. Subtle name differences are easy to miss if you’re not reviewing checks and bills carefully.

This scheme involves setting up a non-existent employee in payroll and issuing paychecks, bonuses, or reimbursements. It’s more common in larger companies, but it can happen anywhere payroll oversight is weak.

In older (and still surprisingly common) setups, checks are typed and signed. The criminal later alters the “Pay To” field after the signature. While modern accounting systems reduce this risk, it still happens when controls are lax.

This is one of the most damaging scenarios. A technician collects payment, a bookkeeper deletes or alters the invoice, and the money never makes it into your system. Cash payments make this dramatically easier which is another reason to discourage cash whenever possible.

A bookkeeper deposits company checks but withdraws cash at the same time, pocketing the difference. This should never be allowed. Checks endorsed “For Deposit Only” must go directly into the company account with no cash back, no exceptions.

💡 Pro Tip: Look for Lifestyle Changes Amongst Your Associates, Not Just Bad Math

One of the earliest warning signs of embezzlement has nothing to do with your books. Pay attention to sudden lifestyle changes, such as expensive purchases, frequent vacations, or unexplained cash spending that do not align with an employee’s pay. This does not mean you accuse anyone, but it does mean you increase oversight, review audit trails more frequently, and tighten permissions. Fraud is often uncovered by noticing patterns, not errors.

Strong financial controls aren’t about mistrusting employees; they’re about protecting the business you worked hard to build. The policies below create clear accountability, limit access to money, and make dishonest behavior easier to detect and harder to hide without slowing down your operation.

These controls limit who can touch your money, create clear checks and balances, and make financial manipulation far more difficult to conceal.

Treat the checkbook like the crown jewels.

Your accounting and credit card processing software are critical control points.

📝 Note: If you use Aptora 360, the audit trail cannot be turned off, permissions are granular, and deletion controls are built in for this exact reason.

📥 Don’t rely on memory. Download our Embezzlement Prevention Checklist for small business owners to quickly identify gaps in your financial controls and protect your company before problems start!

The right hiring practices and clear consequences send a strong message that honesty is expected, monitored, and enforced. For that reason, you should always:

Your company data is just as valuable as your cash, which is why securing your servers, backups, and company files is essential for protecting against theft, sabotage, and data loss while ensuring that one bad actor or one bad day does not cripple your business. To protect it, you should:

Failure to protect customer and employee data can expose you to serious legal liability, not just financial loss.

For a real explanation of the legal consequences tied to data breaches, this Illinois Law Review analysis is worth your time: https://illinoislawrev.web.illinois.edu/wp-content/uploads/2019/03/Kesan.pdf

Employees quickly learn which owners are paying attention and which ones aren’t and in tough economic times, internal theft increases.

Running a service business is hard enough without discovering that someone you trusted has been quietly draining your bank account. So, stay involved in your financial systems. Doing so doesn’t make you paranoid or distrusting, it makes you professional.

You don’t need to be an accountant, and you don’t need to do the bookkeeping yourself. But you do need to understand how your money flows, how your accounting software works, and where the risks live. Owners who stay involved, even at a high level, are far less likely to be victims of theft.

At minimum, monthly. Weekly is even better. Focus on bank reconciliations, audit trails, and exception reports.

No. Crime insurance may cover some losses, but it won’t protect your cash flow, reputation, or relationships.

Absolutely not. Controls protect honest employees as much as they protect you.

Resistance to oversight. If someone doesn’t want you reviewing reports or audit trails, pay attention.

They can’t afford not to. Most controls cost nothing but attention and consistency.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.