Accumulated Depreciation: Overview + Calculator

Quick Answer: What is Accumulated Depreciation? Accumulated depreciation is the total amount of an asset’s value that has been used up over time. It shows

Accumulated depreciation is the total amount of an asset’s value that has been used up over time. It shows how much wear and tear an asset has gone through since you bought it. This amount builds up year after year and helps reduce the asset’s value on your balance sheet.

If you run an HVAC, plumbing, electrical or similar service business, you’ve likely run into the term “accumulated depreciation” on your financial statements and, like many business owners, thought to yourself “Great, another accounting term I don’t have time for.” I get it. Understanding accounting jargon doesn’t help you install ductwork or land your next service call, so deciding not to care too much is admittedly pretty easy.

But the truth is: accumulated depreciation is a crucial part of your books. It not only tells you when it’s time to replace that aging equipment, but it also affects how your business looks on paper to investors and lenders, and it weighs in on how much you owe come tax season.

In this article, I’ll break down everything you need to know about accumulated depreciation: from what it is and how it works to how to calculate it and why it really matters for field service businesses like yours.

Key Takeaways

Depreciation itself is simply the spreading of an asset’s cost over its useful life. While accumulated depreciation is the sum of all those annual (or monthly) depreciation expenses added together, year after year.

So, at its core, accumulated depreciation is the total amount of depreciation expense recorded for an asset since it was purchased. You can think of it as a running tally of how much of your truck, computer, or rooftop unit has been “used up” over time.

For example:

On your balance sheet, you’ll still see the van’s original cost of $40,000, but right below it, you’ll see an accumulated depreciation of $24,000. The difference between the two is what accountants call “net book value.”

Because accumulated depreciation appears alongside your assets on your balance sheet, it’s easy to assume it’s an asset too. But, it’s important to note, accumulated depreciation IS NOT an asset. It’s what’s known as a “contra asset account”, which means it offsets the value of an asset to reflect its true worth over time.

Looking at the way accumulated depreciation is handled in accounting, people commonly ask “Why can’t I just reduce the asset directly? Why complicate it with another account?”

Here’s why: the balance sheet needs to show both the original cost of your asset AND the reduction in value over time. This clarity matters for:

When you pull up your company’s balance sheet, accumulated depreciation works to tell you the cumulative impact of wear and tear on an asset straight away. Seeing this figure listed just below the asset it belongs to without muddying up the record of what you originally paid for it is much more helpful.

Accumulated depreciation doesn’t live in just one spot. It appears in different areas and in different ways depending on which financial statement you’re looking at. Here’s where you can expect to see accumulated depreciation in your books:

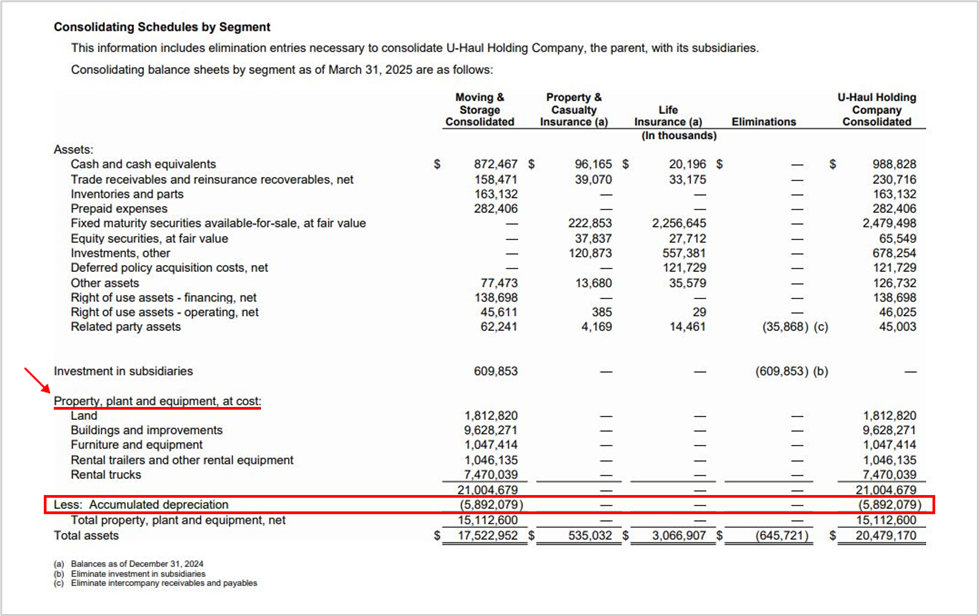

On your balance sheet is where you’ll actually see the accumulated depreciation account itself. Here’s a real-world example of what that looks like:

Again, on your balance sheet, you’ll always see accumulated depreciation paired with the asset it relates to.

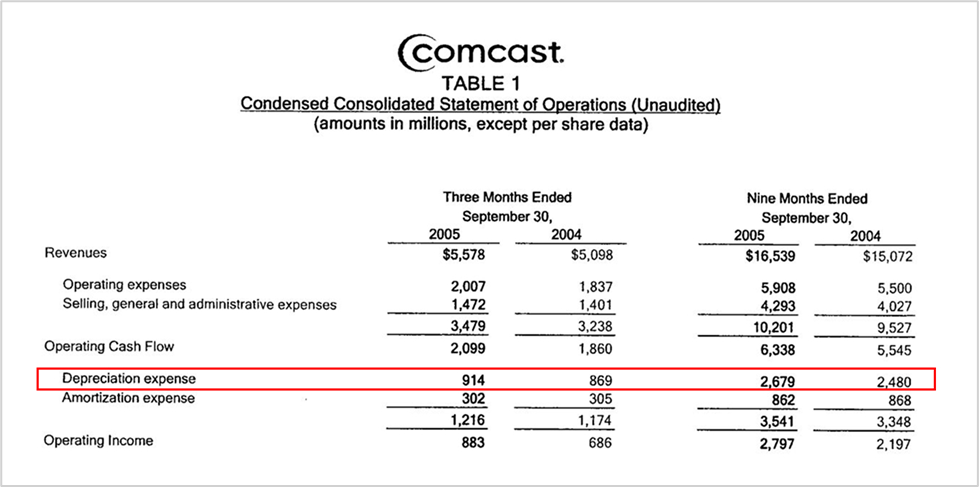

On your income statement, you won’t see the term “accumulated depreciation”, but you will instead see a “depreciation expense.” This is the amount of depreciation recorded for the current period. That will look something like this:

While it is a non-cash expense (you’re not cutting a check for it), it still reduces your net income. Over time, these individual depreciation expenses add up to the accumulated depreciation you see on your balance sheet.

⚠️ Warning: Depreciation expenses lower your taxable income, which is a plus. But, if you’re operating on thin margins, be aware that depreciation expenses can easily swing your business from profit to loss on paper (i.e., your income statement).

For more on how depreciation affects cash flow, check out this helpful article from Indeed.com.

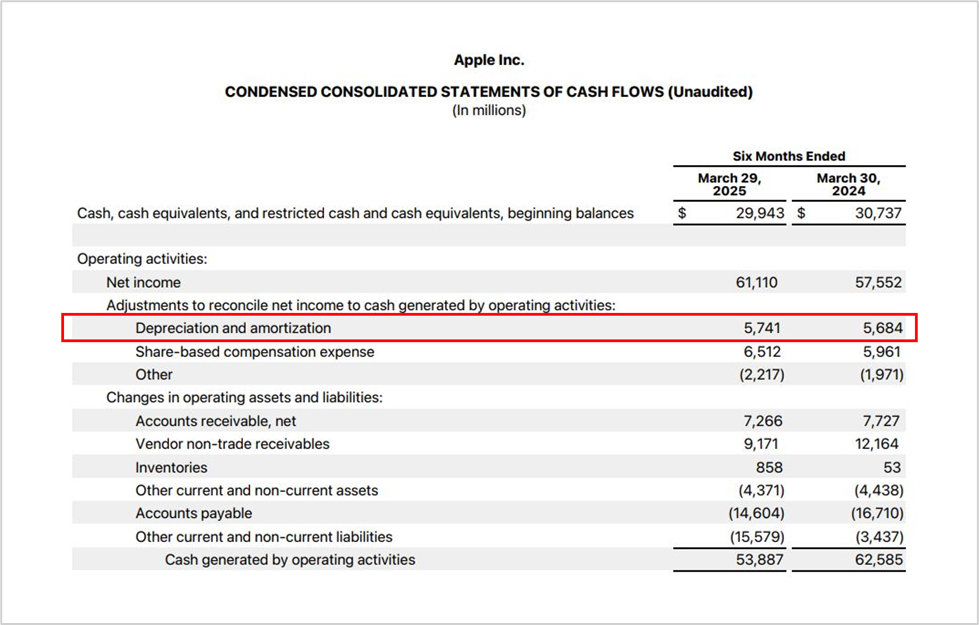

The cash flow statement works a bit differently. Because depreciation is a non-cash expense as you just learned, it gets added back to net income in the “operating activities” section. Why? To reconcile the fact that depreciation reduced your net income on the income statement, even though no cash actually left the business. That looks like this:

This adjustment is crucial for showing your real operating cash flow (i.e., the money you actually have available to pay bills, reinvest, save for that new service van, etc.).

Accumulated depreciation isn’t just an accounting formality. It influences how much equity you really have, whether or not lenders can trust your financials, and how confidently you can plan your next big equipment purchase. So, this single figure ties your books to real-world business decisions. Here’s more on why accumulated depreciation deserves your attention:

Without accumulated depreciation, your balance sheet would show assets at their original purchase price, even if they’ve been in use for years. That creates an inflated picture of your company’s worth.

Accurate depreciation ensures your financial statements reflect reality, which again is essential for lenders, investors, and decision-makers.

Accumulated depreciation tells you how much value an asset has lost and how much useful life remains. This insight helps you budget for replacements before a piece of equipment fails, schedule upgrades strategically, and avoid unexpected downtime.

For businesses with heavy capital investments, this is a game-changer for long-term planning.

Depreciation may be a non-cash expense, but it still impacts your profit and loss statement. Higher depreciation reduces net income and, in turn, lowers your taxable income.

For businesses with tight margins, this can mean significant tax savings, making depreciation a powerful tool in your financial strategy.

The IRS allows businesses to recover the cost of long-term assets through depreciation deductions.

Accumulated depreciation is how you track these deductions year by year, ensuring you claim every dollar you’re entitled to (without overstepping compliance rules).

Generally Accepted Accounting Principles (GAAP) require accurate reporting of both depreciation and accumulated depreciation. The IRS is even stricter when it comes to depreciation schedules and calculations.

Mistakes here can lead to penalties, audits, and letters you don’t want to see in your mailbox.

Now we get to the math of it all… Don’t worry, it’s simpler than you think.

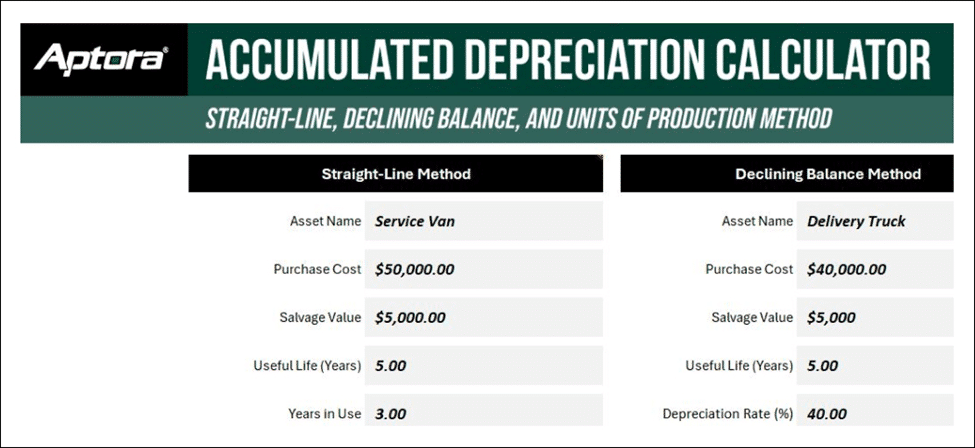

The three most common accumulated depreciation methods are the straight-line, declining, and units of production methods. The formula you use will depend on what kind of asset you’re depreciating or the method your business chooses as standard.

Let’s walk through each method and examine their applications.

This method spreads the cost of the asset evenly over its useful life. So, same expense each year.

🗝️ The straight-line method is best for assets that wear out evenly over time and have consistent benefit to your business year after year (e.g., buildings, office furniture, patents/long-term intangibles, etc.).

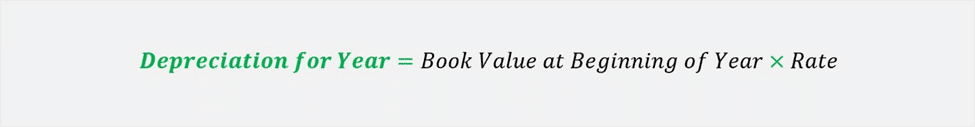

This method accelerates depreciation. So, larger expense in the early years, smaller expense later.

🗝️ The declining balance method is best for assets that lose value or become obsolete quickly, or when an asset’s economic usefulness is highest in the early years (e.g., vehicles, machinery, tech equipment, etc.).

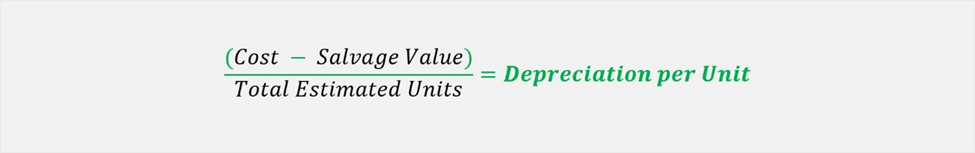

This method is best when the depreciation of an asset is tied to its actual usage (e.g., hours of operation, units produced, miles driven) or when its expense varies depending on how much the asset was used in that period.

🗝️ The unit of production method is best for assets where wear and tear depends on usage, not just time, or when usage fluctuates significantly year to year (e.g., manufacturing equipment that depreciates based on the number of items it produces, vehicles that depreciate based on the number of miles driven, mining or drilling equipment that depreciates based on the number of tons extracted or barrels pumped, etc.).

As you can see, the method you choose will affect how quickly accumulated depreciation builds. Many field service businesses often prefer straight-line for simplicity, but accelerated methods can help reduce your taxable income faster. So, don’t be afraid to venture out and explore other methods to gain smarter tax advantages.

For more on how calculating accumulated depreciation works, check out: How to Calculate Accumulated Depreciation: Formula + Calculator.

Ready to get started calculating your accumulated depreciation? Download our easy-to-use Accumulated Depreciation Excel Calculator! With three calculation methods built in, you can quickly determine depreciation for any asset, accurately and with confidence.

💡 Pro Tip: Combine Depreciation with Fleet Utilization Metrics

For vehicles or equipment that vary in usage, track actual operational hours or miles (as opposed to a generic schedule or estimate) alongside units-of-production depreciation. This dual approach gives a more realistic picture of wear and tear and helps justify accelerated depreciation methods.

Now that you understand how accumulated depreciation works and why it matters, it’s time to see how it actually flows through your books. Journal entries may sound intimidating, but they’re really just the bookkeeping way of tracking what you already know: your assets are being used, their value is declining, and your financial statements need to reflect that.

Here’s how it typically works:

Every month, quarter, or year (depending on your accounting schedule), you record the depreciation for your assets:

This entry reduces your net income on the income statement while steadily building up the accumulated depreciation account on the balance sheet. It’s a non-cash adjustment, but it’s what keeps your books accurate and compliant.

Here’s an example of that:

Scenario: Your service van depreciates $8,000 per year using straight-line depreciation.

Journal Entry (annual):

Account | Debit ($) | Credit ($)

----------------------------|-----------|------------

Depreciation Expense | $8,000 |

Accumulated Depreciation | | $8,000

Explanation:

If you sell, retire, or scrap an asset, you need to remove both the asset’s original cost and its accumulated depreciation from your books:

This ensures the balance sheet no longer shows an asset you no longer own, while keeping the historical record intact.

Here’s an example of that:

Scenario: After 3 years, the van has accumulated $24,000 in depreciation and is retired (scrapped).

Journal Entry:

Account | Debit ($) | Credit ($)

----------------------------|-----------|------------

Accumulated Depreciation | $24,000 |

Asset – Van | | $40,000

Loss on Disposal of Asset | $16,000 |

Explanation:

(If the van were sold for $18,000 instead of scrapped, the entries would adjust for a gain/loss — see next scenario.)

Sometimes you sell an asset for more or less than its book value (original cost minus accumulated depreciation). In that case, you also record a gain or loss:

This step reflects the real-world outcome of using and disposing of the asset, keeping your financial statements accurate and meaningful for decision-making.

Here’s an example of that:

Scenario: After 3 years, the van’s book value is $16,000 ($40,000 – $24,000). You sell it for $18,000.

Journal Entry:

Account | Debit ($) | Credit ($)

----------------------------|-----------|------------

Cash | $18,000 |

Accumulated Depreciation | $24,000 |

Asset - Van | | $40,000

Gain on Sale of Asset | | $2,000

Explanation:

A client of mine in Denver, running a growing field service company, is a shining example of how understanding accumulated depreciation can drive smarter business decisions.

A few years back, my client bought a fleet of vans, five of them at about $45,000 each. Using the standard straight-line depreciation, his books showed an expense of roughly $9,000 per van each year. Fast forward to year 4: each van had racked up $36,000 in accumulated depreciation. On paper, that left just $9,000 of book value per van.

So, the vans were still starting every morning… But, just barely. They were in the shop more often than not, repairs began eating into profits, and his crew grew increasingly frustrated with the constant breakdowns.

It was evident that there was a problem, but my client was having trouble pinpointing the “smoking gun” within his books. After I investigated the problem and presented to him his accumulated depreciation numbers, that was the wake-up call he needed.

It made him realize those vans were nearly “used up” financially, even if they did technically still run. Understanding this, pushed him to trade in those old vans and finance a whole new fleet. That move cut downtime, reduced repair costs, and gave his team a serious morale boost with everyone being proud to drive newer, more reliable vehicles.

Accumulated depreciation isn’t just an accounting entry. It can shine a light on when an asset has outlived its economic usefulness and help you make smarter, real-world business decisions.

💡 Pro Tip: Optimize Replacement Timing

Use accumulated depreciation alongside maintenance logs to schedule your asset replacements proactively rather than reactively. Pairing the financial “used-up” value with actual repair costs can prevent downtime and unexpected expenses, helping you get the most life out of your trucks and equipment without hurting your profitability.

As you can see, even seasoned business owners can get tripped up on depreciation. Here are a few pitfalls I see all the time, and how to steer clear of them:

Think ahead: when that truck, machine, or laptop has reached the end of its useful life, will you sell it or scrap it? If it’s worth something, don’t depreciate it all the way to zero. That “leftover value” (salvage value) needs to stay on the books.

It’s tempting to just pick a number, but useful life isn’t a shot in the dark. The IRS has tables (see: How to Depreciate Properly on the IRS website), and your industry usually has norms. Follow them. Doing so keeps your numbers defensible if anyone ever asks questions.

Drop $20,000 on a new engine for your service van? That’s not just a repair; it extends the van’s useful life. If you don’t update your depreciation schedule, you’re leaving your books out of sync with reality.

When an asset leaves your business, both its original cost and its accumulated depreciation need to come off the books. Miss that step, and your balance sheet will keep showing ghosts of assets you no longer own.

Here’s a big one: tax rules (IRS) and book rules (GAAP) don’t always match, which is fine. In fact, it’s actually normal. Just keep them separate, so your tax return and your financial statements both tell the right story.

Your fixed asset schedule should always tie back to your general ledger. If it doesn’t, something got missed (usually a disposal or adjustment). Reconciling regularly keeps small errors from turning into big headaches.

💡 Pro Tip: Automate Reconciliation Checks

Set up automated alerts in your accounting system to flag discrepancies between your fixed asset ledger and general ledger. Early detection of misaligned accumulated depreciation prevents errors from snowballing and reduces the likelihood of trouble during audits or tax season.

Accumulated depreciation might not grab headlines, but it keeps your financial house in order. It helps you:

Knowing how to calculate it, track it, and interpret it gives you a clearer picture of your business’s long-term financial health.

Depreciation might be slow and steady, but the financial impact? Fast and significant.

So, start by reviewing your depreciation schedules, and ask yourself:

If you’re running a field service business with dozens of tools, trucks, and assets on the move, and your answers to the questions above aren’t giving you peace of mind, it may be time to upgrade your accumulated depreciation methods.

Aptora’s accounting and asset tracking tools make it easy! Equipped with automated depreciation calculations, real-time reporting, and clear visibility into every asset, you can rest assured your balance sheet reflects your business’s full story.

Join our community of over 5,000 field service businesses that trust Aptora to streamline their operations and drive profitability!

No. Depreciation stops once an asset hits its salvage value (i.e., the amount you expect to get when you sell or scrap it). You can’t go below zero, or your books will start telling a story that isn’t real.

It’s a non-current contra asset, which just means it sits right alongside the long-term asset it’s offsetting. Think of it as a running tally of “how much value has been used up” on trucks, tools, or equipment over time.

Monthly is ideal. This keeps your books in sync and makes year-end reporting smoother. Some smaller operations do it annually, which can work too, as long as you stay consistent.

When an asset leaves your business, you clear both the original cost AND the accumulated depreciation from your books. If you sell it for more or less than its book value, you record the difference as a gain or loss. Simple, but crucial for keeping your balance sheet accurate.

Not directly. You’re not actually paying anything out of pocket. But here’s the kicker: it lowers your taxable income, which can save you cash on your taxes. So, while no money changes hands when you record depreciation, it can still have a real impact on your bottom line.

Subscribe to our newsletter

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.

By submitting this form, I agree to receive marketing communication via phone call, email, or SMS from Aptora.