Introduction

This advanced topic explains Journal Entries. They are also known as Adjusting Journal Entries or AJE for short. In traditional accounting, a record of a transaction in which the total amount in the Debit column equals the total amount in the Credit column, and each amount is assigned to an account on the chart of accounts.

Form Access

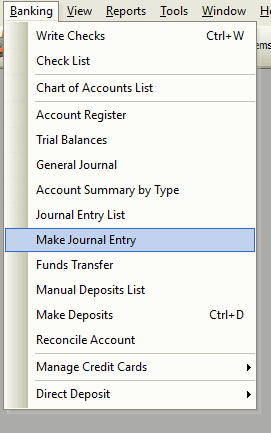

- From the main menu, click Banking | Make Journal Entry, or

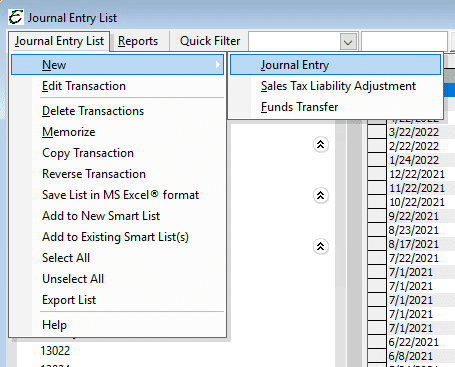

- From the main menu, click Banking | Journal Entry List. Then, select Journal Entry List | New from the menu.

Usage

The recording of a business transaction in a record window is used for accountants or people who prefer the traditional system of accounting by entering transactions in a general journal.

If you are not an accountant, you might use the general journal to transfer amounts from an income or expense account to another, or from one class to another.

Your accountant’s review of your books may require that you make adjustments to various accounts, such as adding the depreciation of a fixed asset. To add these adjustments in Total Office Manager, you can use the General Journal Entry window.

If you are a bookkeeper and are unfamiliar with how a general journal works, you should do some research. This is a very common accounting function.

Additional Details

AJE’s serve these functions:

- They adjust balances. This means that they change the amounts that go to financial statements.

- Reclassifications. These AJE’s move balances from one account to another.

Accountants put some AJE’s to special uses:

- Recurring entries – These entries are the same each month. They always have the same amounts and go to the same accounts.

- Reversing Entries – AJE’s may not be permanent. You may wish to reverse them at the beginning of the next period. These are called “reversing entries”.

Example

Payday is not the same day as the end of the month. So, what about the wages that were earned between the last payday and the end of the month? We debit Wages Expense and credit Accrued Wages Liability. This makes our financial statements correct but throws us off for the next month. What to do? Reverse that monster and just go ahead and make your regular payroll entry. We take care of the problem in the next month’s accrual.

How Debits and Credits Affect Account Totals

Credits do not necessarily mean increase and debit does not necessarily mean decrease. It all depends on what account type we are talking about.

A credit increases income, liability, equity, and accumulated depreciation accounts. Credits decrease expense and assets accounts.

A debit increases expenses and assets accounts. Debits decrease sales, income, liability, equity, and accumulated depreciation accounts.

Example of Adjusting Journal Entries

If you wanted to increase your rent account balance by $12,000.00, you would debit the account by $12,000.00. There must always be an offsetting entry made (because the cash had to come from somewhere), so you would credit a bank account $12,000.00.

Here are some typical adjusting journal entries (or AJE’s for short).

- Depreciation – The amounts come from a schedule as described here. In the General Journal, we enter a debit to Depreciation Expense and a credit to Accumulated Depreciation.

- Amortized Intangible Assets – Treated as depreciation as AJE’s.

- Inventory – The amount of the adjustment as described elsewhere is the difference between the ending inventory amount and the booked amount. Debit or credit Inventory as needed and balance your entry by debiting or crediting the Cost of Goods Sold.

- Payroll Tax Liabilities – These affect the appropriate liability accounts and payroll tax expense accounts. Here’s more info.

- Loan Balances – At least once a year we like to compare the balances on our books to what the bank says are the balances. We adjust the differences to Interest Expense.

- Accruals – These can be a whole lot of different things. Asset and liabilities are adjusted to Revenues and Expenses.

Field Definitions

| Date | The current date will populate this field automatically. |

| Entry # | The next JE Number will populate this field automatically. |

| Account | Enter the account number that the transaction will affect (from drop-down menu). If you are using an A/R or A/P account, the first account in the G/ L transaction should be the accounts A/R or A/P account. |

| Debit | Enter the debit amount for the account you entered. |

| Credit | Enter the credit amount for the account you entered. |

| Memo | Optional: Enter any pertinent information pertaining to the transaction (the amount), which will be helpful for future reference. The memo appears on reports that include the general entry. |

| Name | Enter the name of the vendor, customer, employee, or other name associated with the amount. If the entry is for an A/R or A/P account, you must select a name. The Customer:job name is used in Job Costing as well as makes the item available on a sale or invoice as “reimbursable”. |

| OK | Save and Close |

Step-By-Step

- From the main menu, click Banking | Make Journal Entry.

- If you wish to create a new journal entry, click in the field under Account.

- If you wish to edit a new journal entry, click in the field to edit.

- If you wish to delete a journal entry, click on the red X, just before the Account field.

Or

- From the main menu, click Banking | Journal Entry List.

- If you wish to create a journal entry, select the Journal Entry button (bottom left corner of form) and choose New Journal Entry.

- If you wish to edit an existing journal entry, select the journal entry button (bottom left corner of form) and choose Edit Journal

- If you wish to delete an existing journal entry, select the journal entry button (bottom left corner of form) and choose Delete Journal Entry

Tips for Adjusting Journal Entries

- You can delete multiple journal entries. To highlight multiple journal entries, press and hold your CTRL key and click each journal entry. You may also select a range of journal entries by highlighting the first journal entry in that range, pressing and holding your left Shift Key, and clicking the last journal entry in that range.

- You can select a journal entry and right-click for common tasks.

- Continue to enter distribution lines until the transaction reaches a zero balance (the total in the Debit column equals the total in the Credit column).

- Do NOT use AJE to adjust Payroll Liabilities. General journal entries do not affect payroll liabilities. To adjust your payroll liabilities, from the Employee menu, choose Adjust Payroll Liabilities.

- If an expense account has mistakenly been associated with a payroll item in place of a liability account, you can edit the payroll item: From the Lists menu, choose Payroll Items

- General journal entries appear in the journal for any balance sheet account A record of similar transactions under one title in the ledger. Example: Sales, rent, utilities, labor, cost, insurance, etc. Basically any item found on an income statement or balance sheet is referred to as an account. These accounts were entered into TOM using your Chart of Accounts.involved.

- AJE can be used to adjust job costing reports.

Related Content

https://www.aptora.com/faq-items/will-my-general-journal-details-migrate/