Introduction

Are you having trouble with your financial reports not displaying the correct information? Are the accounting numbers wrong, and getting worse and not better? Please read on. We just may have the answers you have been looking for.

Honestly we get angry communication once in a while from Total Office Manager users who are convinced that Total Office Manager cannot perform basic arithmetic and that’s why their reports are wrong. We never wish to assume that there are no bugs in Total Office Manager. Bugs are a part of software life. So we research these issues carefully. We almost always find that users have been entering data incorrectly or not using certain features properly. When users wait months or years to report their concerns, fixing the problems can become a huge ordeal. Since it is not the role of technical support to perform bookkeeping services, which is often required to fix the problem, hard feelings can result.

Below are some of the most common setup mistakes made by Total Office Manager users. Our hope is that some of you will be able to identify problems with your data and perhaps fix it with a little help from us, or your accounting people.

Situation #1

Problem

When creating a new account for their chart of accounts, users use the wrong “type” of account. Example: Users create an account called Service Materials and select an account type of Accounts Receivable. This causes related reports to be more incorrect every time they buy or sell an item using this account.

Solution

Print your Chart of Accounts. Look at each description and be sure that description matches the account type selected. If the description reads “Rent”, it should to be an “expense” account.

Situation #2

Problem

When creating new items, user selects the wrong Income, COGS, or Asset Account. Example: User creates a new item and selects a sales account even though they meant to select a COGS account. This is easy to do and very common. This causes related reports to be more and more inaccurate each time these items are used.

Solution

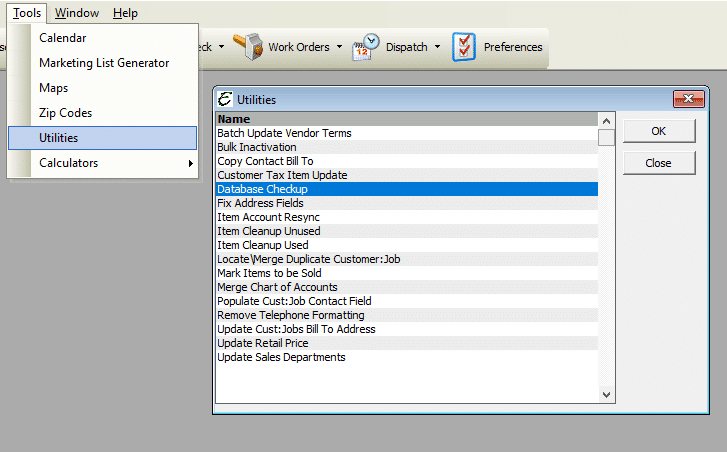

Check each of your inventory items to make sure that you have selected proper accounts. You may also click Tools | Utilities | Database Checkup and select Items. Total Office Manager will scan your database looking for items that have setup incorrectly.

Situation #3

Problem

Users setup payroll incorrectly. The most common problem again, is incorrect account selection (selecting the wrong account from your chart of accounts).

Solution

Click Reports | Payroll Setup. Print your Payroll Setup report. Look at it very carefully making sure that the account selections are correct. If you have any doubts, have your accountant look it over. You may schedule an accounting review with Aptora for a second opinion.

Situation #4

Problem

Users have not properly setup the Sales Tax feature. You must setup your sales tax agencies as vendors and create the appropriate sales tax items. You must use these items appropriately when processing invoices. Many users are not correctly applying tax and they are not ultimately paying the correct amount, to the appropriate agencies, in a timely manner.

Solution

A full charge bookkeeper should be qualified to setup sales tax properly with a small amount of help. Check with your local sales tax authorities to be sure you understand your obligations. Carefully review your sales tax settings.

Situation #5

Problem

Users are not using Total Office Manager’s Pay Sales Tax and Pay Payroll Liabilities features. These features were specifically designed to make sure these important liabilities are paid, adjusted, and tracked. If you do not use these forms to pay these liabilities or make adjustments, your payroll and sales tax liabilities will be a mess. The same thing is true for the Pay Bills feature. We have seen users create bills and never pay them. These bills are left “hanging”. Instead, they make the mistake of writing a check to cover the bill. The result is your A/P reports are messed up as well as many other Liabilities on your balance sheet.

Related Issues

-

Do not use the Make Journal Entry (adjusting journal entry) to increase or decrease sales tax and payroll liabilities. Please use the Sales Tax Liability Adjustment or Adjust Payroll Liabilities forms to make adjustments to sales tax or payroll taxes.

-

If you receive a payroll tax refund, use the Deposit Refund of Liabilities feature. Do not use the regular Make Deposit feature.

Solution

This is a tough one to fix. You will probably need to void all of the checks that paid these bills, sales taxes, and payroll taxes. You will then have to recreate these transactions and pay them correctly using the correct features in Total Office Manager. Contact technical support if you suspect you have this problem. We cannot do the work for you but we can offer some general advice.

It may be beneficial to read our help topic on Troubleshooting Sales Tax Problems.

Situation #6

Problem

Bookkeeping is treated like an unimportant job that requires little skill, training, or equipment. Owners spend lots of money training and equipping technicians. Trucks, meters, and other tools cost thousands of dollars. Technicians go to classes, take tests, and get certified. Bookkeepers are rarely trained. Bookkeepers rarely follow written company protocol. Yet owners are dismayed when they cannot get the reports they need to run their businesses.

Solution

Real bookkeepers (what the industry calls a “Full Charge Bookkeeper”) are highly skilled professionals. Bookkeeping is not the same thing as answering the phones and filing papers. Don’t hire just anyone to be the bookkeeper. Create a bookkeeping budget so that you can invest properly in equipment and training.

Summary

You may have noticed most problems stem from a poorly constructed chart of accounts and incorrect COA account selection throughout Total Office Manager.

When setting up items, payroll, sales tax, etc., please pay particular attention to the type of accounts you are picking, not the name of the account.

Other problems are created when the user does not pay liabilities (like sales tax, payroll tax, and vendor bills) using the proper procedures. It is crucial that you enter bills and other liabilities and pay these liabilities using the correct forms.

Related Content

https://www.aptora.com/help/database-checkup/