Using the Customer:Job Tax Info Tab

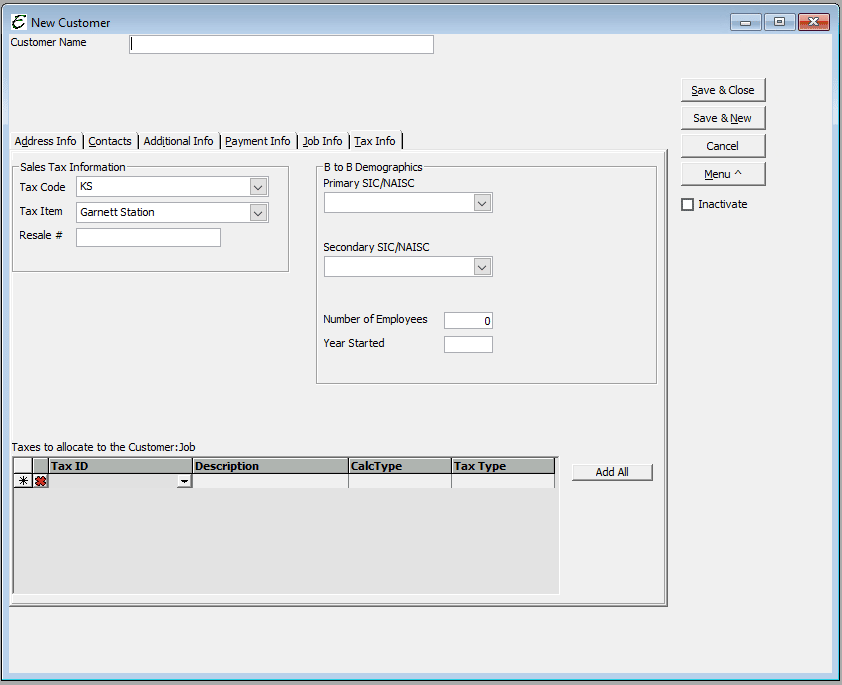

The Customer:Job Form – Tax Info Tab is used to store a variety of tax information regarding the customer.

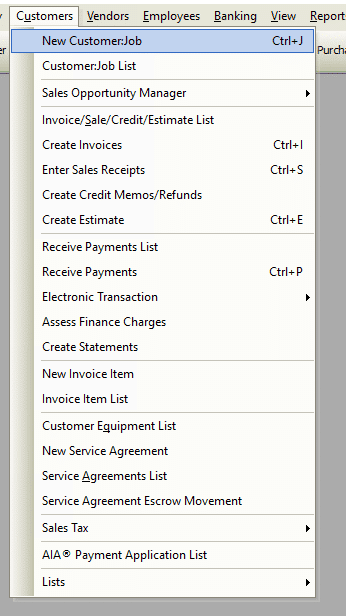

Accessing the Tax Info Tab

- From the main menu, click Customers | New Customer:Job, or

- From the toolbar, click the New Customer:Job button.

Customer:Job Form – Tax Info Tab – Field & Button Definitions

- Sales Tax Information –

- Tax Code – Select from the drop-down menu the sales tax code that applies to the customer. You may also create a new tax code, if the tax code you need is not in the list. Click on the hand icon to the right of the Tax Code field and Add a Tax Code. Is the customer taxable or non-taxable?

- Tax Item – Select from the drop down menu the tax item that applies to the customer. You may also create a new tax item, if the tax item you need is not in the list. Click on the hand icon to the right of the Tax Item field and Add a Tax Item).

- Resale # – Enter the customer’s resale number, if you do not charge the customer sales tax. When a person gives you a resale number, they are asking not to pay sales tax because they plan to resell the item, collect tax, and forward that collected sales tax to the proper authorities. This is the number issued by their local sales tax authority. You don’t have to use this field.

- B to B Demographics –

- Primary SIC/NAISC – Select from Industry Code is provided. Or add a new one and select if it is SIC or NAISC.

- Secondary SIC/NAISC – Select from Industry Code is provided. Or add a new one and select if it is SIC or NAISC.

- Number of Employees – Enter the number of employees.

- Year Started – Enter the year started.

- Taxes to allocate to the Customer:Job