Core Charges Defined

A “core” is a used and non-functioning part that can be recycled and sold as a remanufactured part. Some of the recyclable parts that manufacturers consider core parts are water pumps, motors, circuit boards, certain air conditioning compressors, and more. The return of core parts to the manufacturers lowers the cost of the parts and related repairs. A core item may also be an item that will not be manufactured but contains valuable materials such as copper and aluminum.

A core charge (or fee) is a customer deposit, usually limited in time where the customer can return the item and get a refund. If the core item is not returned, the core charge becomes income. Some cores have no value because of their condition.

In some cases, the technician collects the item at the time of the repair. In that case, the customer receives their credit at the time of the service call.

Core Expenses

It is also possible that the service company may not charge a core fee but they are willing to pay for core items. For example, a company might be willing to pay for certain items that have scrap value. Items that contain copper and aluminum might be purchased and resold for a profit. In this case, there is no “core charge” but there will be a core expense and eventually core income.

Example Scenarios

- You remove a water pump from a car and take it to an auto parts store for a replacement. They will sell you a water pump and charge you for the core. They will immediately credit you the same amount for the core since you brought it with you. The auto parts store sends the water pump to a company that will recondition it and they get paid for those cores.

- You go to the auto parts store for a water pump. They will sell you a water pump and charge you for the core. They will credit you back the same amount once you come back with the old water pump (the core). The auto parts store sends the water pump to a company that will recondition it and they get paid for those cores.

- You might purchase a radiator from a parts store. They do not charge you a core fee. You might sell that radiator back to the store or any other company that buys scrap metal.

- You run a service call and replace a circuit board. That board has a value of $30.00 if it is returned to the manufacturer for reconditioning. You replace the board and optionally charge the customer for the core. You immediately give them credit for the core since you are onsite and will take the circuit board with you. The office collects the cores from each truck and sends them back for credit.

Total Office Manager Setup

Management Decisions

Before you setup Total Office Manager to manage your core items, you must make some management decisions. Pretend as if you did not have software and the entire policy and policy and procedure was going to be handled with paper and pen. You have to work out the entire manual process first before applying that process to software.

One decision you must make is how detailed you want your financial reporting for core item activity. Most companies will have a single income account and a single cost of goods sold account for all core items. Do you wish to offset the core charge (income from the customer) with the core expense (money paid to the customer) for each specific item? That method will give you more detailed information but it will require far more work to set up, manage, and audit for accuracy. Our example below considers a simplified approach that offers a good combination of financial reporting and daily simplicity.

- Create an “Other Charge” item called Core Charge. The Item Number might be “CoreCharge”. It is up to you whether you have an item for each specific to the part. This item will create income so you will need to select an existing income account such as “Parts and Materials” or “Other Income”. You may also create a new one specific to Core Charge income.

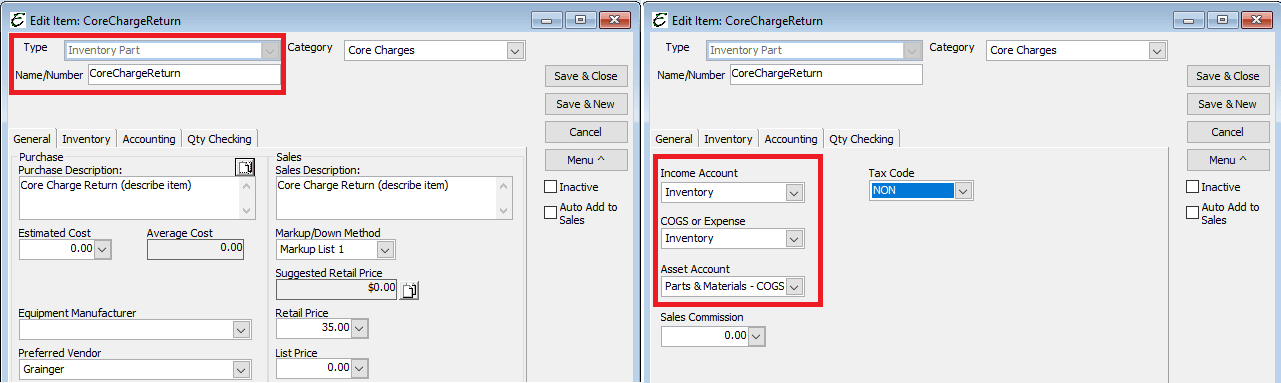

- Create an “Inventory Part”. The Item Number might be “CoreChargeReturn”. It is up to you whether you have an item for each specific to the part. This item will increase your inventory balance when you receive the “Core” from your customer and it will reduce inventory when you return it to the vendor. The following account selections may look odd but it is very important that this step be followed closely.

- In the Income selection, select the “Inventory” asset account.

- In the COGS selector, select the same asset account as above.

- In the Asset account selection, select a COGS account (ex: Parts and Materials).

Tips

- Items have a Copy feature located under the Item Menu button. You may use this to speed up the process of creating similar items.

- When the “CoreChargeReturn” item is added to an invoice with a negative quantity, it will increase your inventory balance. You will do this when you receive the “Core” from your customer. It will reduce inventory when you return it to the vendor.

- If you have items that will also include a potential core return, consider adding “(core return eligible)” to the end of the item description.

- If you are using a generic Core item description, always, enter a good description of the item you are returning in the item description field.

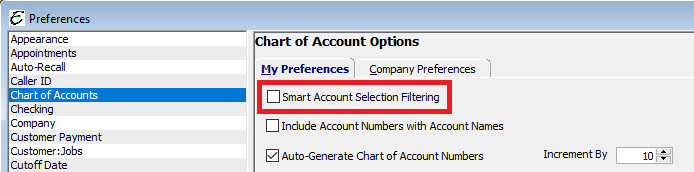

- If you are unable to locate the Chart of Account you are looking for when setting up your items, please be sure to turn off Smart Account Selection Filtering. See the image below.

- If core charges are sometimes a percentage of the item being sold, consider setting up an item using the Other Charge – Percentage item type. When this item is added just below the new item, the core charge will be applied automatically. You can always change the percentage later or add several items for each percentage rate you need.

Usage in Total Office Manager

- Create invoices and sell items as usual.

- When you wish to collect a core fee, add the “CoreCharge” item to your invoice. This will create income. It will not create a Cost of Goods Sold or affect your Inventory Balance. Add a proper description and price (if needed).

- If you are receiving a core, add the “CoreChargeReturn” item to the invoice. Use a negative quantity sold (enter -1). This will reduce your income and add this item to inventory. Add a proper description and price (if needed).

- Create a Vendor Credit using the “CoreChargeReturn” item. This will create a credit for that Vendor that can be applied to a vendor bill at a later time. This action will also relieve inventory for that item. Obviously, this item will need to be physically returned to the Vendor. This action may need to take place first. The paperwork the Vendor gives you will be used to enter the Vendor Credit.

A More Detailed Methodology

If you wish to have more detailed financial reporting, here are some other options to consider. We have provided several easy things that you can do to improve your core related reporting. There are others that will require far more effort. You will decide if that effort is worth the additional details.

- In the above scenario, existing chart of accounts was used to track core fees and expenses. You could very easily add an inventory asset account called “Inventory – Core”. You could also add an income account and a cost of goods sold account just for core item activity. This would be easy to set up and manage.

- Set up a department called “Core Items” or something like that. Select that department on each line item that is related to core item activity. This activity is very easy to do and will offer full departmentalized financial reporting.

- Create multiple core items. You may find that approximately ten core items will do a reasonably good job of covering the various core item categories that you wish to track. For example, you may create a core item called “CoreChargeReturn010” for all $10.00 core charges, and so forth. You would want to create item categories to help further define this activity.

- The most detailed reporting would come from creating a specific core charge item for each related item you sell. Let’s say that you sell a circuit board that has a core charge. If you must relate that circuit board to that core charge, you will create a core charge that matches that item. Use the copy feature and add “C” or something of your choice to the end of the item number.

- You have the preference to sell serialized items without being required to select a serial number. You could use serialized item types when you wish to receive a core item and track the serial number.