Introduction

This topic will cover setting up and editing your company’s federal and state unemployment tax rates.

Form Access

-

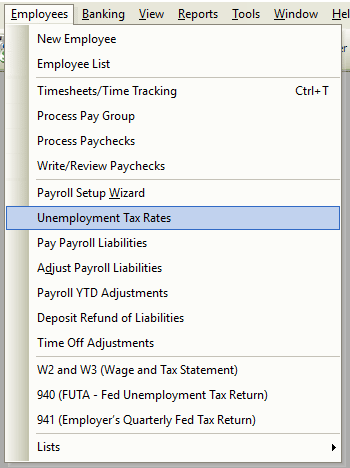

From the main menu, click Employees | Unemployment Tax Rates.

Field Definitions

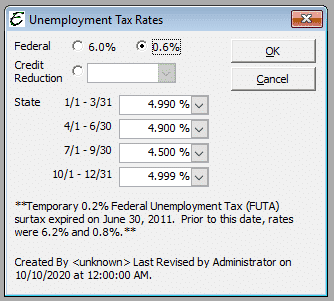

| Federal – | The rate for the United States Federal Government. Check with your accountant to be sure. |

| State – | The rate for the state your company resides in. |

| Date Range – | You may be required to enter a different tax rate depending on the quarter. Please be sure to seek help from your accountant if you have any concerns. |

Usage

Use this form to enter state and federal tax rates for unemployment. This is a tax your company may have to pay to cover federal and/or state unemployment benefits. Note: If you do not use Total Office Manager’s payroll, you do not need to concern yourself with this topic.

Step-By-Step

- Open the form as noted above.

- Enter your state unemployment tax rate.

- Enter your federal unemployment tax rate.

- Click the OK button to save your changes and close the form.

Tips

- Please be sure to seek help from your accountant if you have any concerns about this form.