How did people do bookkeeping before there was software? Well, they filled out a lot of forms, double and triple entered information, wore out adding machines, spent a huge amount of time preparing reports, and thought carbon paper was awesome.

First a Little History

Accounting’s history can be traced back thousands of years to the cradle of civilization in Mesopotamia and is said to have developed alongside writing, counting and money. The early Egyptians and Babylonians created auditing systems, while the Romans collated detailed financial information.

The Father of Accounting

The father of modern accounting is an Italian man named Luca Pacioli. In 1494, he first described the system of double-entry bookkeeping used by Venetian merchants. While he was not the inventor of accounting, Pacioli was the first to describe the system of debits and credits in journals and ledgers that is still the basis of today’s accounting systems.

The Bookkeeping System

Let us take a look at the basic forms of a bookkeeping system for a contracting type of business. Other types of businesses will have other forms specific to their own requirements. This list applies to almost any Business-to-Customer (B2C) operation.

Forms and Documents

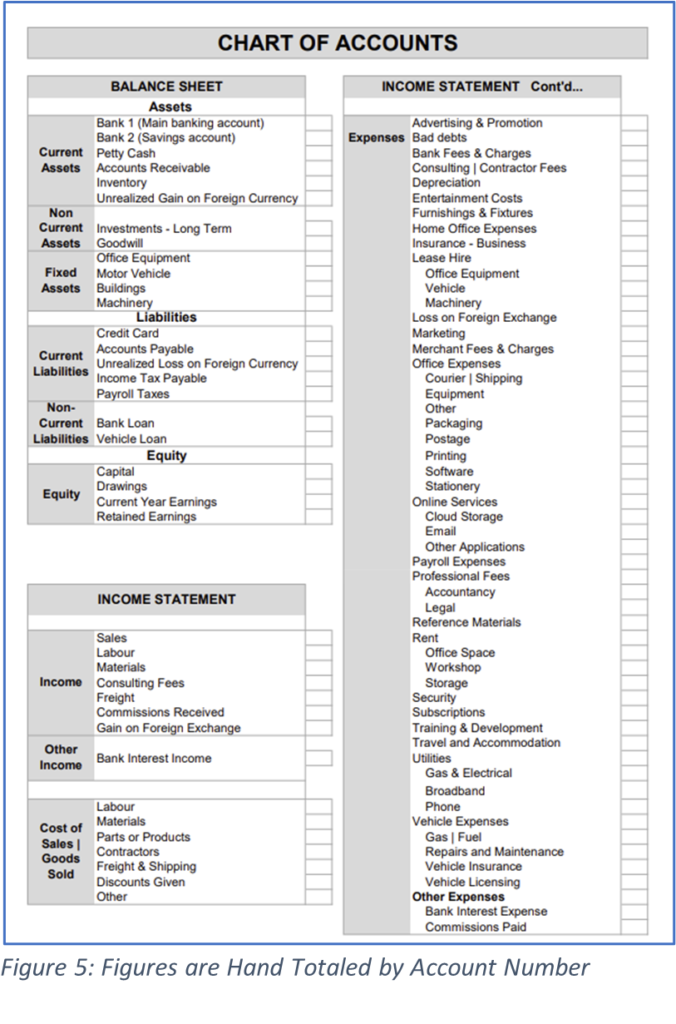

- Chart of Accounts List

- SKU List (part numbers of items you stock)

- Sales Proposals and Estimates

- Sales Slips

- Invoices

- Credits (refund)

- Customer Statements

- Petty Cash Slip

- Time Sheets and Time Cards

- Work Orders

- Service Agreements

- Statement of Warranty Coverage

- Purchase Orders

- Approval Sheet

- Bill of Materials

- Pull Sheet and Pick Ticket

- Change Order

- AIA Payment Application Form G701-G703

- Check Book and Checks

- Payroll Checks and Stubs

- Payroll 940, 941, W2, and W3 Forms

- Vendor 1099 Forms

- Inventory Journal

- Inventory On-Hand Sheet

- Inventory Reorder Sheet

- Packing Slips

- Receipts

- Bills

- Vendor Credits

- Bank Deposit Slips

- Bank Statements

- Credit Card Slips

- Credit Card Statements

- Calendars

- Appointment Books

- Phone Message Slips

- Notebooks and Logs

Wow. That is a lot of forms. Bookkeepers must have thought that carbon paper was a fantastic invention.

Manual Bookkeeping Hardware

The manual bookkeeping system included a lot of machines. Here are just a few of the common ones.

File Cabinets

Let us not forget about all the space wasting file cabinets that are required to store these documents for at least five years or more. Service records might be kept for fifteen years or longer.

These cabinets had a large cost that went far beyond the actual cost of the item. They took up valuable space and consumed large amounts of labor to file documents and search for information.

The Adding Machine

If we are going to talk about bookkeeping, then we must mention the “Ten Key Adding Machine”. A ten key refers to a type of adding machine or calculator with the numbers 1 through 9 in three rows of three. The term can also refer to the number pad on the right side of many computer keyboards, which features a similar set-up. In jobs that require data entry or accounting skills, knowing how to use this type of keyboard can be very important. While learning the basics of ten key may take only a few minutes, it can take months of practice to master.

Manual bookkeepers needed to be experts with this machine. Data entry workers were required to be able to work at a speed of 8,000 KPH (Keystrokes Per Hour). That was considered to be average.

Charge Card Imprinters

Can you imagine going back to these? You might have had one or two in the office and one in each truck. Employees would have to call a phone number to get an authorization number.

Bookkeeping Processes

Bookkeepers have a lot of work to do. Many companies would quickly discover that they needed to hire additional bookkeepers and file clerks to help out.

Basically, the bookkeepers must deal with all the forms and documents listed above. There are too many processes to list here. We will cover some of the major processes.

Processing Payroll

The bookkeeper walks around and collects all the timesheets and time cards. If anyone forgot to punch in or out, that matter must be resolved. If the company wants to know what their labor costs are by job, such as installation and service calls, the technicians must include job numbers on their payroll sheets. Many companies add that information to the work order. The bookkeeper must obtain copies of those work orders from the various departments.

Payroll is calculated with careful attention to time off, vacation, holidays, and overtime. Sales commissions are calculated and doublechecked against other reports. Payroll taxes are removed from the employee’s compensation and the employee’s portion is also calculated. The bookkeeper calculates state withholding tax, FICA, Medicare, social security, and unemployment tax. There may be other deductions such as health insurance, dental insurance, vision insurance, wage garnishments, employee loan payments, and more.

Paychecks are written by hand or type written. Pay stubs are also completed. Payroll tax forms are completed, and the various tax entities are paid. Checks were then prepared to be mailed and or handed out. There was no direct deposit.

Other Bookkeeping Tasks

- Purchasing general supplies

- Inventory control and restocking

- Entering and paying bills

- Paying taxes of all types

- Filing state and federal forms

- Mailing invoices and collecting money

- Typing and mailing statements

- Bank deposits

- Filing and record keeping

Keeping the Books

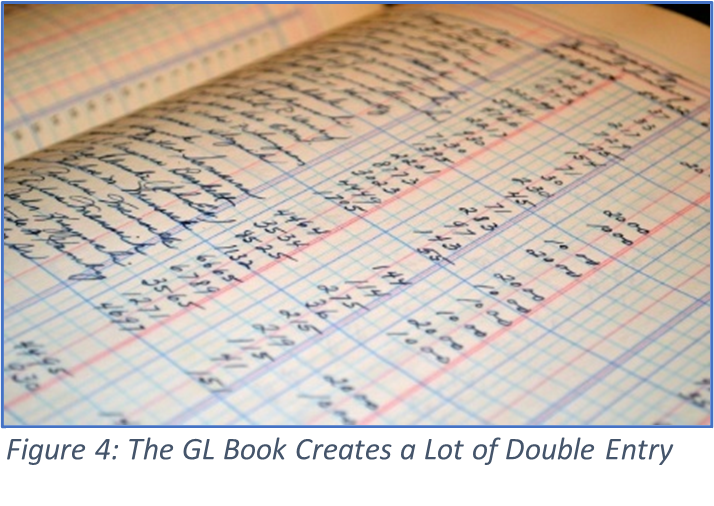

The next step in manual bookkeeping is to gather up all the source documents and painstakingly reenter all information into various journals and ledgers. These things are actually bound books. That is where the term “keeping the books” come from.

General Ledgers

General Ledgers were most often books, with blank lines pages. They are used to record the details of each transaction. Bookkeepers collect all the forms and documents mentioned above and manually reenter the information into the ledgers. The more information they enter, the more useful the reports can be. Hours are wasted dealing with incorrect information, missing entries, typos, bad handwriting, and incorrect math.

- General Ledger

- Accounts Receivable Ledger

- Accounts Payable Ledger

- Bank Ledger

- Sales Ledger

- Sales Tax Ledger

- Cash Receipts Ledger

- Purchases Ledger

- Petty Cash Ledger

- Fixed Assets Ledger

- Depreciation Ledger

- Payroll Ledger

- Payroll Tax Ledger

- Stockholders’ (or Owner’s) Equity Ledger

There can be other subsidiary ledgers used by a company, but we will stop here.

General Journal

This journal is most often a bound book and is used to record the debits and credits of each transaction. The bookkeeper reenters information from the ledgers in the General Journal. A debit amount and a credit amount are entered for each transaction. There must be at least one debit and one credit and the two must total up to be the same number.

The Chart of Accounts is referenced to make sure that all money is associated with an account number. Other details may be added to the GL such as the name of the department the transaction belongs to. The level of detail in the GL is referred to as GL Granularity and is the basis of more detailed financial reports.

Journalizing and Posting

The process of recording transactions in a journal is called journalizing while the process of transferring the entries from the journal to the ledger is known as posting.

Trial Balance Worksheet

This is used to make sure the credits and debits balance (are the same). Often, they are not. That means the bookkeeper must spend considerable time figuring out what went wrong. Sometimes they give up and simply “fix” the issue by entering an Adjusting Journal Entry.

Working with journals and trial balances is often performed by a full-charge bookkeeper or a junior accountant.

Completing the Accounting Cycle

The accounting cycle is complete after Adjusting Entries and Closing Entries are made.

Under the matching principle, revenues must be assigned to the period in which they were earned, and expenses must be assigned to the accounting period in which they were used to create revenue.

To apply the matching rule, Adjusting Journal Entries are required at the end of each accounting period. These entries are used to assign income and expenses between two or more accounting periods, to record expenses incurred but not paid for during the period, and to record revenues earned but not yet received. After the accounts have been adjusted, closing entries transfer revenue, expenses, and owner withdrawal balances from their respective accounts to the owner’s capital account. Adjustments are made for depreciation using depreciation schedules that have been prepared by the accountant. Adjustments are made to inventory accounts.

Closing the Books

At this point, the books are now closed, and they will never be reopened to change any of the figures from this accounting period. That is where the “close the books” term came from.

The Preparation of Reports

Numerous reports need to be prepared. The adjusted trial balance is used to generate financial reports.

There are also plenty of forms that need to be completed and filed with various private and government entities. If income tax, payroll withholding, and sales tax are not accurately accounted for, and paid on time, there can be very serious consequences.

Financial Reports

Now that we have collected all the documents, reentered information into numerous ledger books, and reentered all that information into the General Ledger, we are now ready to create reports for management. This work is performed by an accountant.

These reports are crucial to the success of the business. They allow mangers to make important decisions such as hiring, giving raises, setting retail pricing, borrowing money, expansion, and much more. Without these reports, management is trying to operate a business without sufficient information to make business decisions.

These are the seven (7) basic “must have” financial reports to adequately operate a business.

- Balance Sheet

- Income Statement

- Statement of Cashflows

- Financial Ratios

- Operating Budget

- Accounts Receivables with Aging

- Accounts Payable with Aging

Income Statement Prep

We need some perspective on how much work this is. So, let us take a look at how the income statement is prepared. The accountant opens the General Ledger (GL) and totals up all the figures using an adding machine.

These figures are laboriously totaled by account number, starting with income accounts. The cost of goods sold, and expense accounts are then carefully totaled up. The income statement should be departmentalized. In other words, there should be an income statement for each department. For that reason, the information is further divided into departments.

This information is then entered into an Income Statement Template or hand typed with a typewriter. Other financial periods need to be entered alongside the current month. Periods are compared and the differences are shown as dollar amounts and or percentages. These numbers are calculated by hand. Mistakes were easy to make and must be found and fixed.

The balance sheet is next and the process if very similar to the income statement. Once that report is finished, there are at least five more that need to be completed. Keep in mind, these are considered to be the bare minimum required.

Other Reports

There are many other reports that the accountant may be required to prepare. It depends on the type of business and the requirements of the business managers. These might include job costing reports, sales and marketing reports, payroll reports, sales tax reports, and many others.

As with all reports, they would be created using an adding machine, aper, pencil, and plenty of erasers.

Software Changed Everything

The real problem with manual bookkeeping is reentering information that you or someone else has already entered at another time or in a different place. This is a huge waste of time. Once customer contact information is written down, it would be efficient to somehow have that information show up where we need it to. The same goes with journals and ledgers. That information was entered on the various forms and document used every day.

Software also virtually eliminated the need for time killing triple data entry. Errors due to manual calculations were practically eliminated and so was the time needed to fix them.

That Easy Button is Not Real

Bookkeeping and accounting software does not include an Easy Button. Those things are not real. Software should not take shortcuts. It should include all the forms, journals, ledgers, and reports mentioned in this article. Your business likely needs every one of them.

Software will make data entry more efficient. It will reduce computational errors, make searching for information easier, and generate reports with no extra effort. However, you still must do the work. You can only report on information that someone has entered.

Shopping for Software

You want specialized bookkeeping and accounting software built for the contracting industry. It takes one to know one, so you want to select a company with deep roots in the contracting industry.

The software should be a single unified program with all major systems built-in. Avoid band-aid programs for QuickBooks(s). You will end up with a hodgepodge of software sold by a variety of disconnected companies.

Your single software program should connect to a single non-proprietary database that you control. Make certain that if you leave, you can take your entire relational database with you. Do not settle for a data dump. For a complete solution to manage every aspect of your business, try Total Office Manager®