What Are Undeposited Funds?

What are Undeposited Funds and why are they on my balance sheet? Here is a quick answer to that question and a far more detailed answer if needed.

- You will find Undeposited Funds on your Balance Sheet under Other Current Assets.

- Basically, this is money that your company has received from customers but has not yet deposited into your bank account. When you use the Make Deposits form, the Undeposited Funds will be moved to your bank account(s).

- Undeposited Funds will be seen when you select the Deposit To > Group with Other Undeposited Funds option. When you do that, the money is “grouped up” with other money and is waiting to be deposited into your bank account, using the Make Deposits form. Until it is deposited, the money sits on your Balance Sheet as a Current Asset or Other Current Asset called Undeposited Funds.

The Undeposited Funds account in Total Office Manager serves a special function – it’s a special temporary account that Total Office Manager uses to hold payments received from invoices before you deposit them into in the bank. It’s not an actual bank accounts which is why there’s no option to reconcile it in Total Office Manager.

Undeposited Funds in QuickBooks

QuickBooks from Intuit and Total Office Manager from Aptora use the concept of Undeposited Funds. Other accounting and ERP software programs do the same thing. In these software systems, Undeposited Funds is a special temporary account that Total Office Manager uses to hold payments received from invoices before you deposit them into in the bank.

Watch a Video about Undeposited Funds

We offer a short video on YouTube that helps explain the concepts around Undeposited Funds.

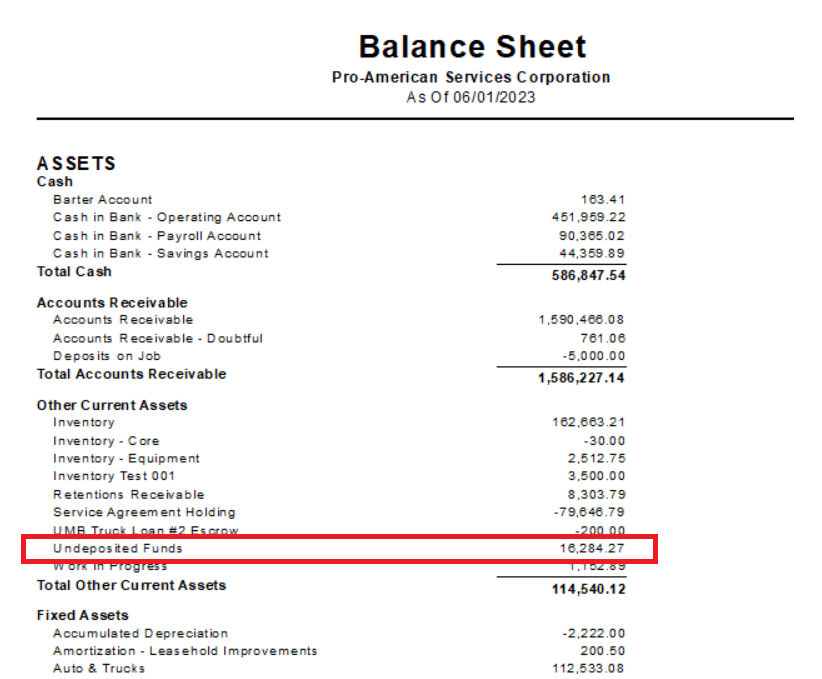

Undeposited Funds on a Balance Sheet

What are Undeposited Funds on a Balance Sheet? This image shows how Undeposited Funds will look on your balance sheet. It will be listed as an Other Current Asset.

Why Use The Undeposited Funds or Group With Other Undeposited Funds Feature?

Use the Undeposited Funds account to hold invoice payments and sales receipts you want to combine. It’s like the lockbox (or drawer) you keep payments in before taking them to the bank. This two-step process ensures Total Office Manager always matches your bank records. It also makes your reconciliations much easier.

Example Situation

When you put money in the bank, you often deposit several payments at once. For example, let’s say you deposit five $100 checks from different customers into your real-life checking account. Your bank records all five checks as one $500 deposit. So, you need to combine your five separate $100 records in Total Office Manager to match what your bank shows as one $500 deposit.

How Do We Turn Undeposited Funds Feature On or Off?

When you use the Group With Other Undeposited Funds option, you are using this feature. The Group With Other Undeposited Funds option is found in the Deposit To selection list.

Additional Details about Undeposited Funds

The following applies to those of you who are using the Group with Other Undeposited Funds feature. We highly recommend the use of this feature. This is a “safety” feature in accounting, used to track the process of making a physical deposit.

- Undeposited Funds are payments that have been received but have not been physically deposited with the bank. This can happen when you enter a customer payment using the Receive Payments form and using the Group with Other Undeposited Funds option.

- This amount is displayed on the Balance Sheet, as an Other Current Asset, called Undeposited Funds. Once deposited, this amount is moved to the actual bank account.

- Go to Banking | Make Deposits to “tell” the software you have made the deposit. The physical bank deposit is later verified to have occurred and recognized by the bank through the Bank Reconciliation feature. Tip: Banks Recs should be performed by an outside accounting firm or other individual of high trust.

Reports Related to Deposits and Undeposited Funds

If you want to see what makes up this amount, there are several reports.

- Click Reports | Banking | Deposits.

- Click Reports | Financial | Balance Sheet. Double click on the Deposited Funds amount. This will list each payment in detail. You will see the date, amount, customer name, and more.

- You may also open the Deposits form. It will tell you that you have undeposited funds. You can click the Payment s button and all of them will be listed with all the details.

How to Fix Undeposited Funds

Getting rid of them depends on how they were entered. Basically, you are changing the Deposit To selection from “Group with Other Undeposited Funds” to a bank account. That wipes out (zeros) the Undeposited Funds and increases your bank account balance.

It also depends on how the mistake was made. Hopefully, the money was deposited and your bank account is low by the same amount as the value of the Undeposited Funds. If that is the case, these steps should fix it.

If they were created from a Customer Payment:

- In the Customer > Receive Payment form, go to the Deposit To drop-down list.

- Change the selection from “Group with Other Undeposited Funds” to any bank account.

- Click Save and close.

When you go back to the Make Deposit form, you will no longer see the payments. They should also be cleared from the Balance Sheet.

If Created From Another Transaction Type

You might have added a Payment Item to a Sales Receipt or Invoice. If that Payment Item had “Group with Other Undeposited Funds” selected: You will need to change each of the Sales Receipt or each of the Payment Items and resave each Sales Receipt.

You may have selected “Group with Other Undeposited Funds” on a Sales Receipt. You will need to change these to a bank account.

Accounting Impact and Taxes

Be careful. Fixing this could change your financials. If you have paid taxes on this period, you must do some additional work with the help of an accountant.

Questions and Answers

Question: Are Undeposited Funds Considered Cash?

Answer: Yes. Cash is a Current Asset and so undeposited funds. Undeposited funds are cash, checks, coins, and equivalents that you have not yet deposited into your bank account.

Question: When I receive money from a client (checks and especially cash), how do I keep track of if the money has been deposited into our bank account yet to keep track of if the tech gave me the cash yet or not? Is there a undeposited funds list I can view?

Answer: Undeposited Funds may be found on your Balance Sheet. You can double click on the number to get a complete and detailed list.

- You can also run the Transactions by Account report.

- When you make a deposit, they are listed on that form.

- There is a report at Accounting > End of Day Cash that shows all money the techs received.