Understanding the Chart of Accounts (COA)

The Chart of Accounts (COA) displays the account number, name of the account, type (expense, income, asset, payable, etc.) and a description of what the account would be used for.

Accounts are used to indicate and summarize the increases or decreases to the balances of each asset, liability, and owner’s equity-type items. These can include capital, withdrawals, revenues, and expenses. An example of an account may be credit card fees, rent, gasoline, cost of goods sold, etc.

This topic explains how to add, edit, inactivate, or delete an account from your Chart of Accounts list.

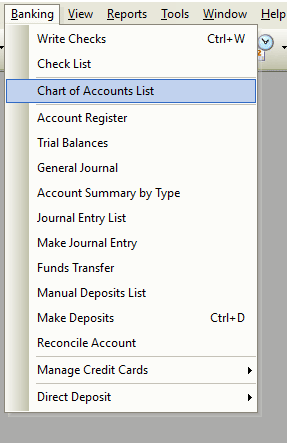

Opening the Chart of Accounts Add Edit Form

- From the main menu, click Banking | Chart of Accounts List. The “New COA” form is accessed from the COA list.

How to use the Chart of Accounts Form

Financial accounts track your business transactions. The Chart of Accounts classifies the nature of an accounting transaction. Use this List to create a new account or select an account to edit, delete, and inactivate. You have the ability to filter and sort these records in many different ways.

You will probably want to add new accounts as your business grows and changes. Example: If you never accepted credit cards, but you do now, you would want to set up an account for credit card transactions.

The account numbering system in Total Office Manager has approximately 10 numbers in between each account number that can be used for new accounts.

Example Chart of Account 1:

10010 Cash in Bank- Operating Account

10020 Cash in Bank- Payroll Account

If you needed to set up a new Cash Account, you could assign 10015 Cash in Bank- Petty Cash Account.

If you want to make this account a sub-account of another account, select the account from the drop-down menu and select the account that would be the higher-level account for this sub-account.

If a particular account in COAs seems to cover too much, you can divide the account into one or more sub-accounts. Sub-accounts let you track several related types of income or expenses independently yet keep them all under the all-inclusive of a single parent account.

Example Chart of Account 2:

In the parent account “Phone” you might want to set up sub-accounts for cell phones, local phone service, long-distance service, toll-free phone service, and pagers. You could then track how much your company spends on long distance, cell phones, etc. individually, but still have the ability to know exactly how much you pay out in the utility ‘Phone”.

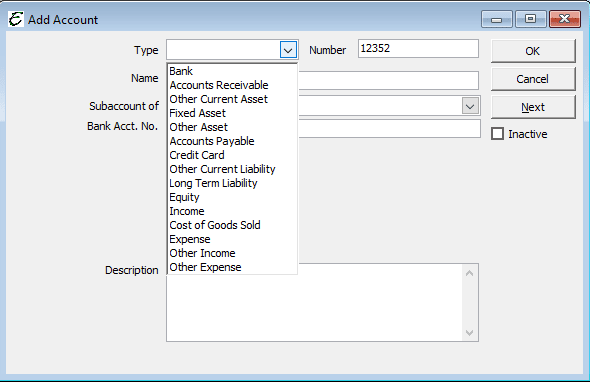

Chart of Account Types

The following are Chart of Accounts Types used in Total Office Manager: Accounts Payable, Accounts Receivable, Bank, Cost of Goods Sold, Credit Card, Equity, Expense, Fixed Asset, Income, Long Term, Liability, Other Asset, Other Current Asset, Other Current Liability, and Other Expense.

Field Definitions

| Number |

The numbering system used to track accounts. |

| Name |

The name given to the account: Payables, Receivables, Asset, Labor, MESO. |

| Type |

Type of account: Income, Liability, COGS, Expense, Income, Equity, etc. |

| Fixed or Variable |

With an Expense type, you will see a Fixed or Variable overhead option. It is very important to separate your overhead into fixed and variable types. Fixed overhead remains essentially unchanged within a certain range of income. Examples include salaries, liability insurance, and rent. I like to refer to variable overhead as “somewhat variable overhead” because it varies slightly with changes in income. Examples include gasoline, small tools, office supplies, and legal fees. |

| What Best Describes |

This selection box allows you to further describe the COA using a standardized process created by Aptora. This information is used by the software for certain reports, KPIs, dashboards, etc. |

| Overhead Allocation Method |

This setting will be shown for Expense types of accounts. If you don’t see this setting, you may need to turn it on in Preferences | Company | Chart of Accounts. The default value is Labor. That setting is correct the vast majority of the time. |

| Balance |

The balance of each account. |

| Total Balance |

The balance of each account as a parent-child relationship. Parents will include their balance plus the balance of their children. |

| Description |

An explanation of what the account would be used for. This takes the guesswork out of which account should I use for this transaction”. |

| OK |

To Save (when in the New Account form or the Edit Account form). |

| Next |

Saves then opens a blank New Account form (when in the New Account form or the Edit Account form). |

Step-By-Step Chart of Account

- To edit an existing account, highlight the account then select Chart of Accounts List | Edit Account.

- To create a new account, highlight the account then select Chart of Accounts List | New Account.

- To delete a new account, highlight the account then select Chart of Accounts List | Delete Account.

- To inactivate an account, highlight the account then select Chart of Accounts List | Make Account Inactive.

Designated Chart of Account Types

These are accounts automatically created by Total Office Manager. You will find these accounts have already been added to your Chart of Accounts. The software must have these accounts. They cannot be deleted.

- Sales Tax Payable

- Accounts Payable

- Accounts Receivable

- Opening Balance Equity

- Retained Earnings

- Rounding

- Uncategorized Expense

- Uncategorized Income

- Undeposited Funds

- Item Reservation

Tips

- Parent account (top level) should not be selected when entering numbers. In other words, you should not select a parent account when entering a bill. Example: Let’s say you have an account called “Employee Related” with a sub (aka: Child or Children) accounts under it. You should never select Employee Related. You should select the lowest tier/level possible.

- You can delete or inactivate multiple accounts. To highlight multiple records, press and hold your Ctrl key and click each account. You may also select a range of accounts by highlighting the first record in that range, press and hold your left Shift Key, and click the last record in that range.

- You can select an account and right-click for common tasks.

- We generally recommend that you avoid deleting accounts. You should use the Inactivate or Void option instead.

- Accounts are systematically arranged according to assets, liabilities, equities, income, and expenses.

- There are two main types of accounts in Total Office Manager’s chart of accounts used for tracking:

- Balance Sheet Accounts

- Income and Expense Accounts

- Use expense accounts to track reimbursed expenses as income.

- For a recommended Chart of Accounts list, you may download it here: https://bit.ly/3I1SQFQ