Report Summary

This report reflects a summary of the wages, deductions, taxes, additions, and employer contributions which are generated through payroll processing. The following transactions are summarized in this report:

- Paychecks

- Payroll YTD Adjustments for the employee

- Liability Adjustments for the employee

Report Access

This report may be accessed from the following locations:

- From the Employees Tab of the Work Flow Navigator

- Navigating the main menu to Reports | Payroll | Payroll Summary

- Using the Report Navigator

Report Options

When running this report, the following filters options are available:

- Date Range = This field allows you to choose from a list of predefined date ranges. These ranges are specific to the calendar year (01/01/20XX to 12/31/20XX).

- From = The report start date

- To = The report end date

- Union = The Union option available for filtering within the employee record.

- Employee = The list of employees, which includes active and inactive records. This list can be sorted to help isolate a particular employee type, for example. By default, the < All > option is selected. When selecting individual or multiple employees, < All > will become unselected. To remove any employee selections, reselecting < All > will unselect employee options. To sort a particular column, click the column header together for easier selection.

- Show Non-Posted Amounts = Selecting this option will show non-posted paycheck information. Use this option to review a pending payroll processing in report format. Leave it unchecked to report taxable activity.

- Show SSN & DOB = Selecting this option will display the employee social security number and date of birth on the report.

- Exclude Inactive Employees = Selecting this option will remove any inactive employees from reporting. Do not select this option when reporting for taxable activity.

- Exclude Zero Amounts = Selecting this option will remove any line entries with zero dollar reporting values. Select this option to exclude employees with no taxable activity for the reporting period.

Report Data

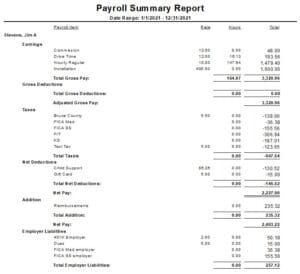

This report summaries the data by employee with a summary total on the last page for all employees. Within each employee report, the details are totaled into six sections.

- Earnings = Total earnings for the reporting period. These earnings are pulled from paycheck and payroll YTD adjustments.

- Gross Deductions = Total Gross Pay deductions for the reporting period. These deductions are pulled from paychecks, employee liability adjustments, and payroll YTD adjustments.

- Taxes = Total taxes for the reporting period. These taxes are pulled from paychecks, employee liability adjustments, and payroll YTD adjustments.

- Net Deductions = Total Net Pay deductions for the reporting period. These deductions are pulled from paychecks, employee liability adjustments, and payroll YTD adjustments.

- Addition = Total additions for the reporting period. These additions are pulled from paycheck and payroll YTD adjustments.

- Employer Liabilities = Total employer liabilities for the reporting period. These employer liabilities are pulled from paychecks, employee liability adjustments, and payroll YTD adjustments.