Understanding the Bank Reconciliation Report

The Bank Reconciliation Report displays a specific reconciliation for a particular account. The report displays beginning balance, cleared checks and payments, cleared deposits and credits, uncleared checks and payment, and uncleared deposits and credits in report form for a period ending date. It is a summary of the monthly bookkeeping task – bank reconciliations.

Form Access

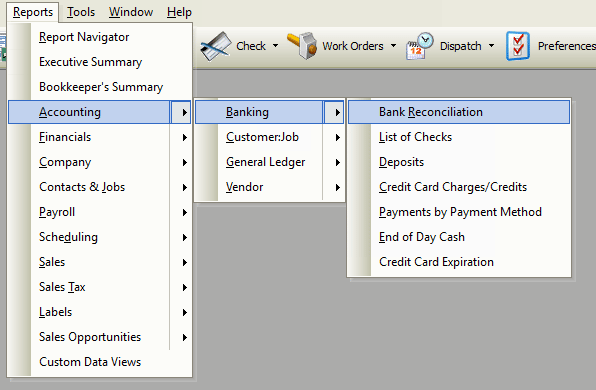

-

From the main menu, click Reports | Accounting | Banking | Bank Reconciliation, or use the Report Navigator.

Report Options

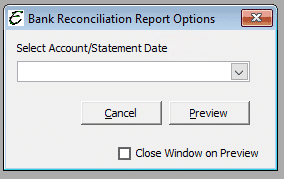

The following options are available.

- Select reconciled account and period – Select from this drop-down list, an available previous bank account reconciliation on which to base the report.

- Cancel – The Cancel button closes the window.

- Preview – The Preview button will show an on-screen display of the report, from which a hard-copy can be printed. The preview screen is also capable exporting the report in a PDF format for email use. A text search function in the preview screen can be used to locate a particular string of text.

- Close Window on Preview – Ticking this checkbox will have the options window automatically close when the Preview button is clicked.

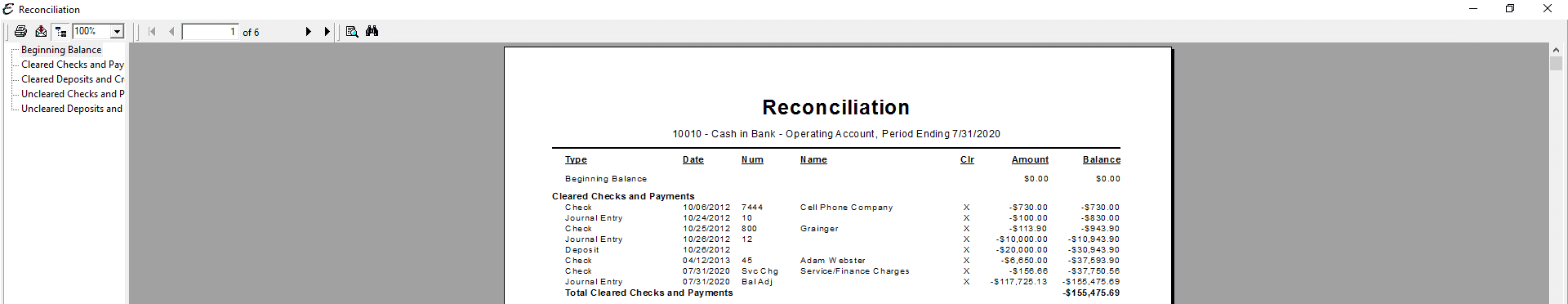

Example

Below is an example report (which may have been cropped and shrunk to conserve space).

Bank Reconciliation Reports Are Not Static

The Bank Reconciliation Report name includes the date that was selected in the Statement Date field when the Bank Rec was performed. It adds that name to the report name. Example: “Cash in Bank – Savings Account (12/31/2023).” When the report is saved, it accurately represents everything that a user selected, didn’t select, entered, etc., during that bank rec. If changes are made to records contained on that bank rec report, the report will be different. If records are deleted, amounts are changed, etc., the report will no longer be correct.

Saved bank and credit card reconciliation reports are not static, any more than your income statement and balance sheet reports are static. They are all subject to change depending on whether any of the related transactions are modified after the reconciliation. If you run the reports at a later time, they will contain any changes made to related transactions or records (if any).

We recommend that you print PDF versions of your bank and credit card reconciliation reports. That way, you will have a static report as to exactly what was reconciled.

Set a new Cutoff Date after you reconcile and “close the books” for that period. This will prevent others from changing transactions that were cleared. Go to Preferences > Cutoff Date > Company Preferences.

Related Content

https://www.aptora.com/uncategorized/the-importance-of-bank-reconciliations/