How to Correct Deposits or Customer Payments

Have you ever recorded a customer payment or deposit in Total Office Manager and later found you’ve made a mistake? Often, you will not catch a payment or deposit error in Total Office Manager until you are reconciling your monthly bank statement. This help topic covers ways to fix incorrect customer payments and bank deposits.

General Advice

They key to correcting information is to start with the last step in the bookkeeping process. To fix a an invoice that has been paid, you must delete the customer payment (if any). However, to delete the customer payment, you must first delete the deposit. Records often become locked when other records are created “on top” of them.

Correcting a Deposit

If a customer payment (Receive Payments form) has been deposited, most of the fields on the payment will be disabled (locked). This is required for referential integrity.

If a deposit has been recorded incorrectly because a customer payment was entered for the incorrect amount, here are the steps to correct your deposit:

Fixing Deposits Step-By-Step

- You need to delete the deposit first (if any), correct the customer payment, and recreate the deposit.

- Please follow the instructions below for “Correcting a Customer Payment”. The process is the same.

Correcting a Customer Payment

If you entered a customer payment (Receive Payments) and need to correct it, please follow these steps:

Fixing Payment Step-By- Step

-

In order to correct a customer’s payment that has been grouped in a deposit with several other customers’ payments, first, you need to delete the incorrect deposit.

-

Go to Banking > Manual Deposit List. Locate the deposit that contains the customer’s payment. Double-click to open the deposit.

-

With the Edit Deposit form open, click the “Print Deposit Summary” button to print a copy of the deposit (so that you can remember which customer payments were in the deposit).

-

From the Edit Deposit form, delete the deposit line item. You do this by clicking the red X on that row. If this deposit is the only line item, you must delete the entire deposit. You do that from the Manual Deposits List. Right-click and select Delete.

-

Once the deposit is deleted, the Receive Payments form will allow for editing. Go back to the correct Receive Payment form and edit it.

-

The payment will show up in the “Undeposited Funds” window again. Create a deposit as usual for the corrected payment. Go to “Make Deposits” and select the corrected payment. Be sure the deposit is dated correctly. Use the Deposit Summary that you printed for refence.

Now your deposit is correct and your customer’s balance should also be correct.

Other Related Scenarios

Incorrect Customer on a Deposit with a Credit Card

Let’s say that you took a deposit from a customer. In the Receive Payments form, you processed a correct credit card but selected the wrong customer. The customer cannot be changed because there has been a credit card charge processed.

- You can’t Void an ETransaction once it has settled.

- You can’t Delete the Payment since it is tied to an ETransaction.

- The payment will always show the incorrect customer, so they need to make a note of the correct customer on the Memo field on the payment.

- The incorrect customer has a credit that doesn’t belong to them, and the correct customer has an open invoice.

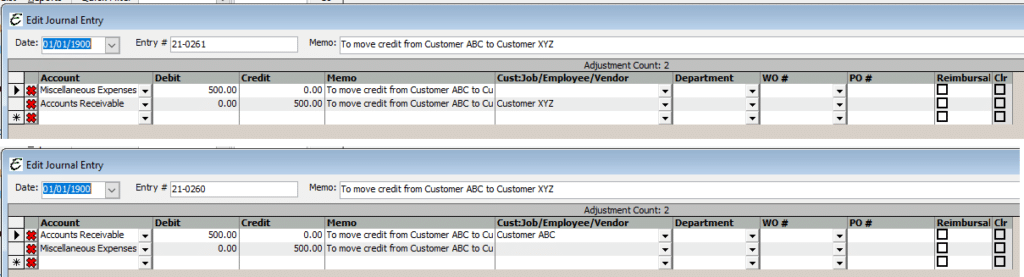

To fix this, you will need to create two Journal Entries. One will move the credit balance from the incorrect customer to a “wash” account and the other will move the funds from the “wash account” to the correct customer to close the open balance. The reason for two journal entries is because Total Office Manager will allow you to use Accounts Receivable more than once on a JE.

The JEs should look like this:

Your Parent Company Received the Your Customer’s Payment

Let’s say you have a parent company (a company that owns your company) that uses another software program for their accounting. They received a payment for one of your customers. Your customer has paid their invoice but you have not received any money. Basically, your parent company needs to pay you the money. The can give you a check or credit card. You will use their form of payment in the Receive Payments form for that customer. Enter a god memo as well as a note in the customer’s Contact Log. Your parent company should select whatever account they selected when they received the payment. We can’t offer them any specific advice though. Your parent company will need to deal with their own bookkeeping issue.

Other Tips

Important Note: Avoid receiving a payment for a parent account and applying that payment to a child of that parent. It is best to select the exact Customer:Job and not the parent (if any). In other words, don’t select a parent (top level) and apply payments to children (sub-accounts).