Understanding Certified Payroll for Contracting

To be awarded government jobs, or to be hired for your expertise in your field as a Sub-Contractor by a General Contractor working on a job requiring payment of a prevailing wage for each of the skills employed in completing that job – you will likely be required to provide a certified payroll report. The actual wage your employees must be paid for their work on the project will be determined by asking the General Contractor (project manager) what the experience level and type of wage rate is that you must pay. (Apprentice, Journeyman, Master, etc.)

Once the rate and experience level are known, your employees that will be working on the project must have an earnings category set up and a wage rate set up to conform to these requirements. (The company level payroll items must be set up before the individual employee’s earning item is added.) The set up will include regular hours at the rate and overtime hours. (Over time hours for a trade may not always be calculated at the usual “time and a half” rate…checking this with the project manager would also be wise.).

Quick Take

Certified Payroll is a report that is required for government jobs or sub-contracting work that requires payment of a prevailing wage for each of the skills employed in completing that job.

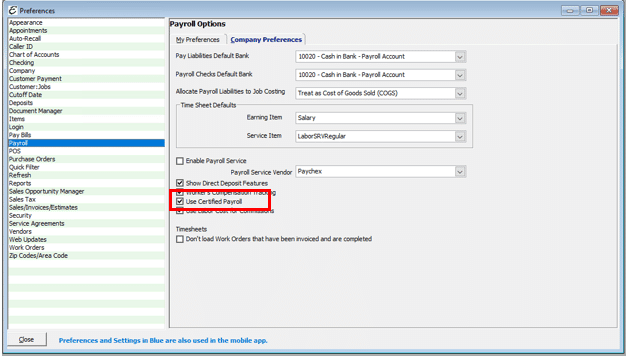

To prepare Certified Payroll, you must enable this feature in Total Office Manager by going to Edit > Preferences > Payroll > Company Preferences tab and check Use Certified Payroll.

The wage your employees must be paid for their work on the project will be determined by asking the General Contractor or project manager what the experience level and type of wage rate is that you must pay. Once the rate and experience level are known, your employee that will be working on the project must have an earnings category set up and a wage rate set up to conform to these requirements.

General Usage

Total Office Manager can generate the necessary reports to verify that employees on the project are being paid the correct rate for their level of experience, and that all of the regular and over-time hours they work at the site are being reported correctly.

Step-By-Step Certified Payroll Setup

Set the Preference

To enable certified payroll to be reported, you must first go into “Preferences”, and choose the “Payroll” tab. On the Company Preferences tab, at the bottom is a box that says “Use Certified Payroll”. Make sure the box is checked.

Create or Edit Payroll Earning Items

Be sure your employee’s earning items meet the requirements of the job. You will need earning items that cover regular time, overtime, and (possible) double time for the prevailing wage.

Set Default Information

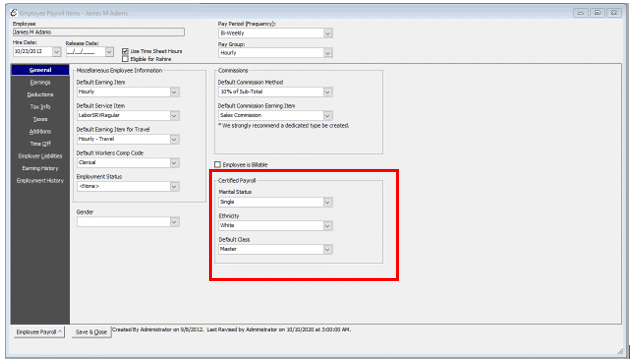

Employees who work on a project where certified payroll reports must be submitted, are required to have the following information set up in their individual employee payroll items record:

- To access this form, click Employees | Employee List.

- Open an employee’s record. Click Menu | Payroll Items.

- Select the default values as needed.

- Click Save & Close.

Certified Payroll Field Definitions

- Marital Status – Either Single or Married as defined by the Internal Revenue Service.

- Ethnicity – This field is setup depending on the types your governmental body dictates.

- Default Class – The experience level of the employee (Apprentice, Journeyman, Master, etc.). This will be selected when entering timesheets.

Add Work Classifications

List classifications are descriptions of work actually performed by each laborer or mechanic. Consult classification and minimum wage schedule set forth in contract specifications.

- Click Employees > Lists > Class List

- Add “Work Classifications” as needed. These go in column 3 of for WH-347.

Add Employee Ethnicities

Form WH-347 currently does not ask for this information. You may add this information for state reporting requirements or other employee related reporting requirements.

Click Employees > Lists > Ethnicity List

Entering Timesheets

- When entering timesheets, be sure to select a value in the “Class” column. You have the option to set a default value (covered above).

- Be careful to specify the “customer” (job) carefully. When you create timesheets from work orders, this will be properly selected.

- Any hours over 40 for the week – regardless of job site/customer must be reported and calculated as overtime.

Completing Form WH-347

Total Office Manager does not print form WH-347. The required information to complete these forms is easily available. Here is how to get the information you need:

Generating Certified Payroll Reports

Two reports should have all the information you need.

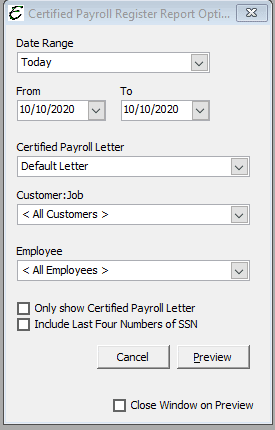

Certified Payroll Register Report: The Certified Payroll Register Report shows the necessary employee payroll information needed to complete the first page of form WH-347. From the main menu, click Reports | Payroll | Certified Payroll Register, or use the Report Navigator. Note: This report will only be visible if the Preference for Certified Payroll is turned on.

Certified Payroll Letter: The Certified Letter print out allows you to produce the backside of form WH-347. This may not be necessary for you to complete the back side on form WH-347.

Total Office Manager does not print form WH-347. The Certified Payroll Register Report and the Certified Payroll Letter will include the necessary information so that you may complete the form manually.

- To create a certified payroll letter (essentially, the backside of the federal certified payroll reporting form WH-347), go to your “Report” command in the main screen of Total Office Manager.

- Scroll to “Report Navigator” and then click on the button for “Options”.

- In the options section, choose a date range for the last pay period. At “Certified Payroll Letter”, leave at “Default Letter”.

- At Customer/Job, scroll to the pertinent job, and at “Employee” make sure “All” is checked. (You will not forget someone in your report who may have worked a few hours on this job, if “All” is checked.)

- Click “Preview” (above Options button.)

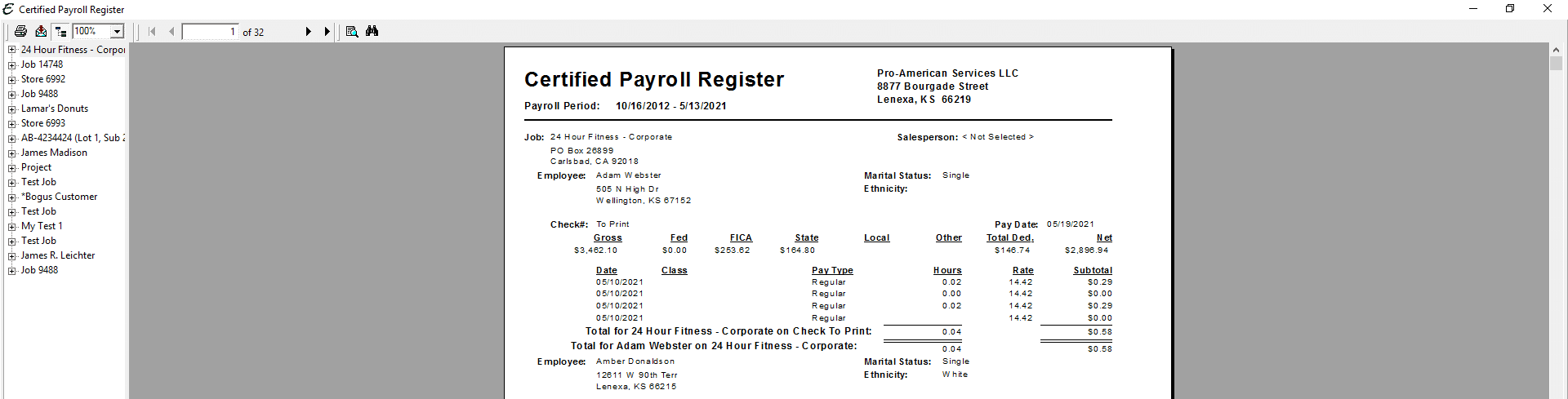

A report will be generated that includes the information needed to complete the front page (Payroll Register) of the form WH-347. Most of the fields that are required to complete the form will be shown in this report. You may need to gather other information, depending on your requirements.

Example of the Certified Payroll Register Report

Below is an example report (which may have been cropped and shrunk to conserve space).

Additional Reports and Information

There are various Custom Data Views that may provide helpful information. Please check these, as needed:

Job Costing Time Sheet Details: Includes details on each timesheet entry by job. This may help users get details on payroll and timesheet entries needed for payroll reporting including Certified Payroll.

Payroll Register: Includes a lot of details about each employee’s payroll. Check this if the first suggestion does not work for you.

Individual State Reporting Requirements

Many states in the U.S. have their own specific prevailing wage and certified payroll reporting requirements, often in addition to the federal standards set by the Davis-Bacon Act. These state-specific regulations are generally in place for state-funded construction projects and can vary significantly from state to state. Here’s a general overview:

- California: Known for having one of the most rigorous sets of requirements, California mandates detailed certified payroll reporting for public works projects. This includes specific forms and electronic submission requirements.

- New York: New York State has its own prevailing wage laws and requires certified payroll reports for public work projects. The state provides specific forms for this purpose.

- Illinois: Illinois also has its own prevailing wage law. Contractors on public works projects must submit certified payroll reports to the Illinois Department of Labor.

- Washington: Washington State requires contractors to submit certified payroll records for public works projects, ensuring compliance with its prevailing wage laws.

- Massachusetts: Known for stringent requirements, Massachusetts requires detailed certified payroll reports for public works projects to ensure compliance with state prevailing wage laws.

- Oregon: Oregon requires certified payroll reporting for public works projects, with specific forms and details that need to be included in the reports.

- Connecticut: In Connecticut, contractors must adhere to state-specific certified payroll requirements on public works projects.

- New Jersey: Similar to other states, New Jersey requires certified payroll reporting for public works projects under its prevailing wage laws.

- Pennsylvania: Pennsylvania has its own prevailing wage act, requiring certified payroll reporting for state-funded construction projects.

It’s important to note that this list is not exhaustive, and many other states may have their own specific requirements. Additionally, these requirements can change, so it’s always a good idea to check the current regulations for a specific state. For businesses operating in multiple states, understanding and complying with these diverse requirements can be challenging, and specialized software that can adapt to different state requirements can be very useful.

Certified Payroll Tips

- Payroll must be run for a payroll letter to be created in the Certified Payroll Report.

- The Certified Payroll Feature supports the US Department of Labor “Employment Standards Administration- Wage and Hour Division form WH-347″, which is used by most states. To be sure you are in compliance by utilizing this very valuable Total Office Manager report, consult the project manager for the job you are being hired to do.

- States may have other reporting requirements.

- Contractors usually need to submit these reports weekly. Contractors who process payroll bi-weekly may have to process payroll each week.

Content Related to Certified Payroll