Understanding Account Types used in the Chart of Accounts

This article explains the use of Chart of Accounts – Account Types. Here, various account types are defined and explained. We will explain what the (Chart of Account) account types are and how to use them to keep your contracting company’s finances organized and accurate.

This topic may be helpful if you are setting up accounting software or want to learn more about the chart of accounts and accounting.

Why Account Types Matter

The chart of accounts is the backbone of Total Office Manager and the foundation of your company’s accounting system. It’s important to set it up correctly, and understanding account types and detail types is a key part of that.

Understanding the Importance and Purpose of COA Account Types

When you’re setting up your chart of accounts, choosing the right account type is crucial because your business’s accounting is built around account types. The account type determines which financial report QuickBooks adds each account’s data to. Choosing the right account type sets you up with accurate reports, such as the balance sheet and profit and loss reports, so you can analyze the financial health of your business.

Accounts that have an opening balance feed into the Balance Sheet report. These include accounts payable and receivable, asset accounts, liability accounts, equity accounts, and credit card and bank accounts. The Profit & Loss report is fed by your business income and expense accounts, including cost of goods sold accounts as well as other income accounts like interest earned or other expense accounts like depreciation expenses.

Accounts Types at a Glance

Balance Sheet Accounts

Accounts Receivable, Accounts Payable, Bank Account, Credit Card, Fixed Assets, Current Assets, Other Assets, Other Current Assets, Current Liabilities, Other Current Liabilities, and Equity.

Income Statement Accounts

Income, Cost of Goods Sold, Expenses, Other Income, and Other Expense.

What is Chart of Accounts

Your company’s chart of accounts is a complete list of all account names that will be used in the General Ledger. Each account is usually associated with a numerical account ID to help locate it when recording data. Accounts are used to classify transaction information for reporting purposes.

Chart of accounts can vary depending on the business type. You should ask a qualified person to help you set up a good chart of accounts for your company. If you use specialized contractor software or a service industry accounting software program, such as Total Office Manager® from Aptora Corporation., the program will have a set of professionally designed chart of accounts for you to select from.

Using the Chart of Accounts List

A chart of accounts list is used every time you enter a new client, inventory item, bill, and more. These are the same accounts that appear on your company’s income statement (profit and loss statement), balance sheet, and other financial reports. These accounts might include Labor Income, Parts and Materials, Technician Wages, Rent, Insurance, Office Wages, and more.

Defining Account Types in Detail

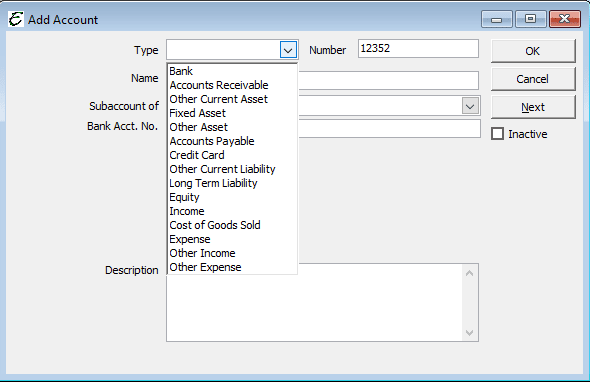

Total Office Manager uses the following account types in its Chart of Accounts List. This information is provided for reference for those researching the various account types that make up a chart of accounts. These accounts are essentially universal and independent of what accounting software system you are on.

Accounts Receivable

A/R is a form of current assets. It is money owed by clients for items or services sold to them or for materials furnished by the company when cash is not received at the time of sale. Typically, accounts receivable balances are recorded on sales invoices that include terms of payment. Accounts receivable is used in accrual-based accounting.

Accounts Payable

A/P is a form of current liabilities. The amount of money owed to vendors for goods, supplies, and services purchased on an open account. Accounts payable balances are used in accrual-based accounting, are generally due in 30 or 60 days, and do not include regular interest. Please do not confuse with Notes Payable.

Bank Account

This is a current asset. Add one bank account for every account your company has at a bank or other financial institution.

Fixed Assets

They represent property, plant, or equipment assets that are acquired for use in a business rather than for resale. They are called fixed assets because they are to be used for long periods of time.

Current Assets

These accounts will be converted into cash within a year. Current assets include the following account types: cash, accounts receivable, inventory, and other current assets.

Other Assets

They represent those assets that are considered nonworking capital and are not due for a relatively long period of time, usually more than one year. Notes receivable with maturity dates at least one year or more beyond the current balance sheet date are considered to be non-current assets.

Other Current Assets

Represent those assets that are considered nonworking capital and are due within a short period of time, usually less than a year. Prepaid expenses, employee advances, and notes receivable with maturity dates of less than one year of the current balance sheet date, are considered current assets.

Current Liabilities

These are obligations (payments) due within one year. Current liabilities include the following account types: accounts payable and total current liabilities.

Other Current Liabilities

Represent those debts that are due within a short period of time, usually less than a year. The payment of these debts usually requires the use of current assets.

Expense (aka: Overhead)

Also known as “Overhead”, money spent on normal administrative activities such as rent, insurance, office wages, utilities, telephone, and more. Please also see Cost of Goods Sold.

Fixed and Variable Overhead

It is very important to separate your overhead into fixed and variable types. Fixed overhead remains essentially unchanged within a certain range of income. Examples include salaries, liability insurance, and rent. I like to refer to variable overhead as “somewhat variable overhead” because it varies slightly with changes in income. Examples include gasoline, small tools, office supplies, and legal fees.

Note: If income exceeds expenses; a net income is produced. If expenses exceed income, the business is said to be operating at a net loss.

Other Expense

Money spent on something other than normal business operations, such as corporate taxes.

Cost of Goods Sold

The cost of goods and materials held in inventory and then sold. Represents the known cost to your business for items or services when sold to clients.

Note: Cost of Goods Sold (also known as Cost of Sales) for inventory items are computed based on the inventory costing method (FIFO, LIFO, or Average Cost).

Income (AKA: Sales or Revenue)

An account used to record revenue. (money coming into your company). These accounts are way of categorizing or separating out your income. They represent the inflow of assets resulting from the sale of products and services to clients. If income exceeds expenses a net income results. If expenses exceed income, the business is said to be operating at a net loss.

Other Income

Money received for something other than normal business operations, such as interest income.

Credit Card (account)

A current liability account, this is used for credit card purchases, bills, and payments.

Long Term Liability

Represent those debts that are not due for a relatively long period of time, usually more than one year. Portions of long-term loans due and notes payable with maturity dates at least one year or more beyond the current balance sheet date, are considered to be long term-liabilities.

Owner’s Equity

The sum of the following account types: equity – doesn’t close, equity retained earnings, equity – gets closed, sales, cost of sales, and expenses.

Equity

Equity, also known as capital, is the original investment in a company, or the claims against assets.

Retained Earnings

The Retained Earnings account is updated at the close of the fiscal year with the ending balance of your income and expenses (net income). The balance in the retained earnings account continues to accrue at the end of each fiscal year.

Designated Accounts

These are accounts automatically created by Total Office Manager. You will find these accounts have already been added to your Chart of Accounts. The software must have these accounts. They cannot be deleted.

Sales Tax Payable

Accounts Payable

Accounts Receivable

Opening Balance Equity

Retained Earnings

Rounding

Uncategorized Expense

Uncategorized Income

Undeposited Funds

Item Reservation