Reading and Understanding the AR Aging Report Summary

The AR Aging Summary Report shows, in a condensed way, the amount of money owed to you by your customers along with the timeframe in which the amount has been owed (age of the receivable).

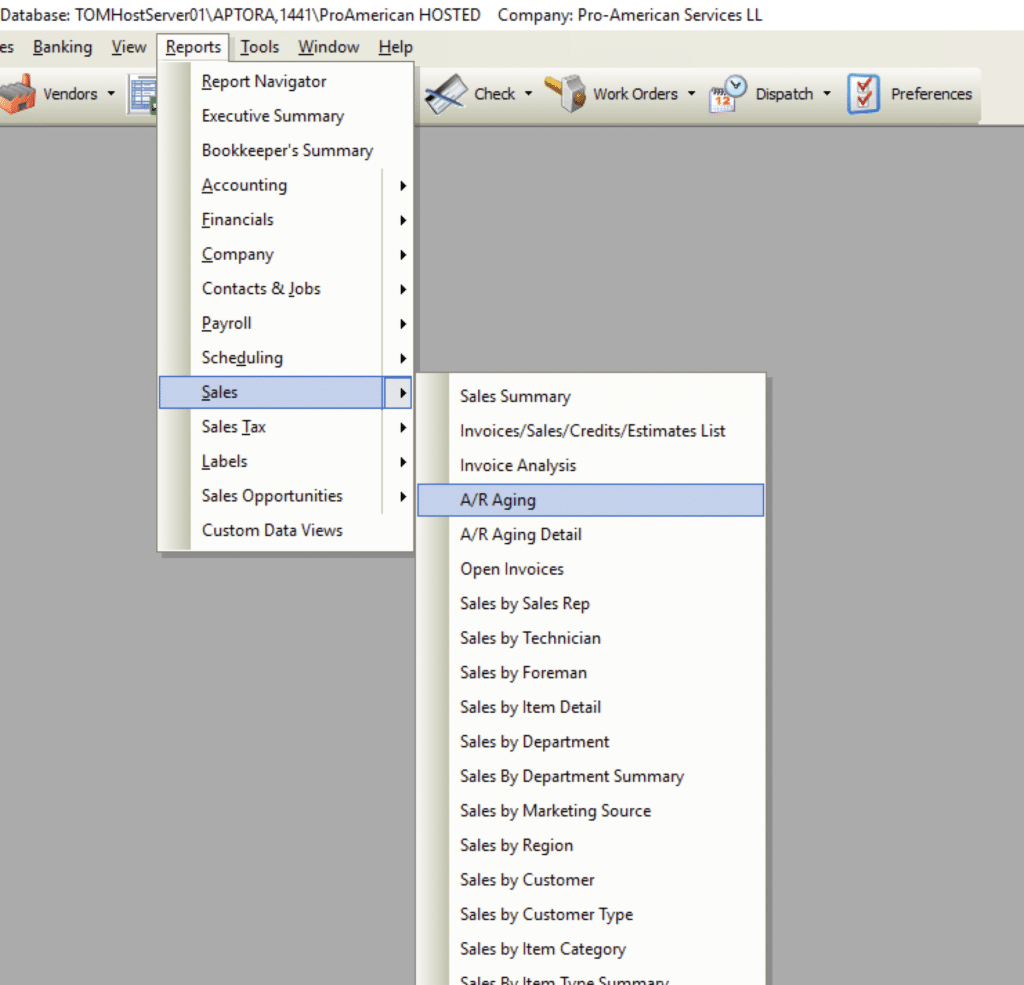

AR Aging Report Access

-

From the main menu, click Reports | Sales | A/R Aging, or use the Report Navigator.

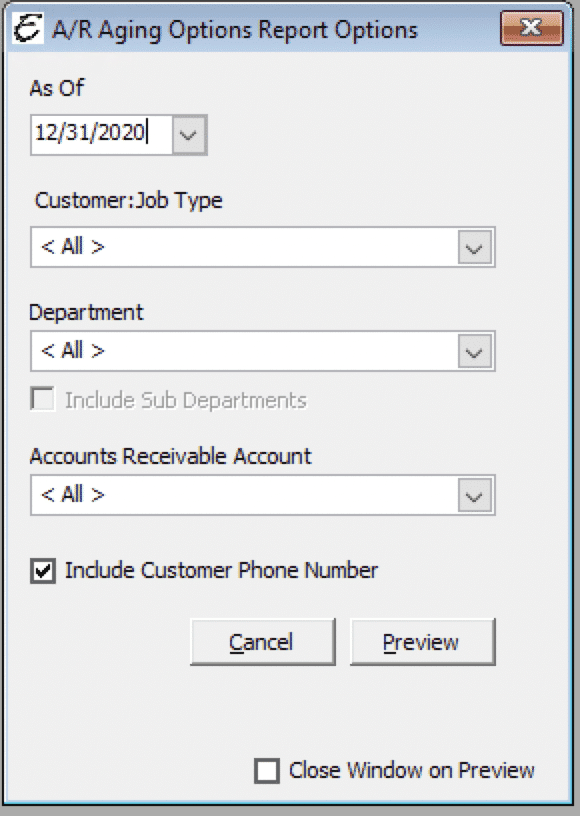

AR Aging Report Options

The following options are available in the AR Aging Summary Report.

- As Of – Select a date in which to run the report through.

- Filter by Customer:Job Type – To filter the report by a Customer Type, choose one from this drop-down list.

- Filter by Accounts Receivable Account – To filter the report by a specific A/R account, choose one from this drop-down list.

- Include Customer Phone Number – To have the customer phone number included on the report, tick this checkbox. This functionality is helpful during collection efforts.

- Cancel – The Cancel button closes the window.

- Preview – The Preview button will show an on-screen display of the report, from which a hard-copy can be printed. The preview screen is also capable exporting the report in a PDF format for email use. A text search function in the preview screen can be used to locate a particular string of text.

- Close Window on Preview – Ticking this checkbox will have the options window automatically close when the Preview button is clicked.

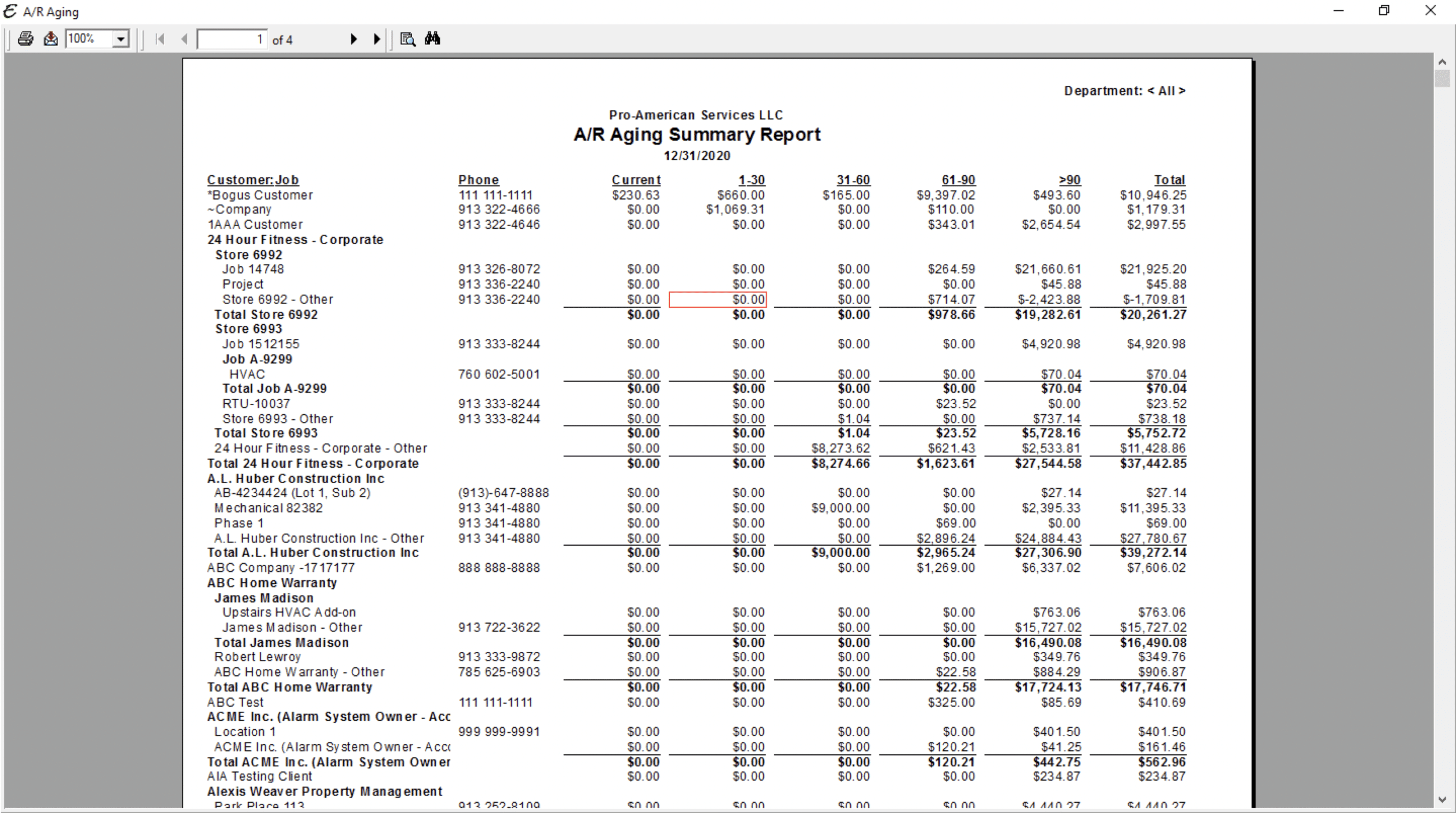

Example of an AR Aging Report

Below is an example report (which may have been cropped and shrunk to conserve space).

This report is Drill Down Capable. This meaning that by double clicking on a specific Invoice takes you to the specific transaction in Total Office Manager.

The summary of your Accounts Receivable can also be viewed in more detail by accessing the A/R Aging Details Report. To view aging over a period of time, please refer to the A/R Aging Detail Report below.

FAQ for AR Aging Report

- Q: What do negative values mean in the A/R Aging Summary Report?

- A: Negative values in the A/R Aging Summary Report indicate that you owe the customer money. This typically occurs when customers have been issued a credit memo, but a refund check has not yet been written.