How to Number Your Chart of Accounts (COA)

A standard chart of accounts (or COA) is organized according to a numerical system. The Chart of Accounts numbering convention states that each major category will begin with a certain number, and then the sub-categories within that major category will all begin with the same number.

If assets are classified by numbers starting with the digit 1, then cash accounts might be labeled 101, accounts receivable might be labeled 105, inventory might be labeled 112, and so on. Whereas, if liabilities accounts are classified by numbers starting with the digit 2, then accounts payable might be labeled 201, short-term debt might be labeled 202, and so on.

Chart of Accounts – Numbering Convention Example

| Starting # | Account Type* | Comments |

| 1000 | Bank | Cash held in financial institutions. |

| 1100 | Accounts Receivable | Money for work completed but not yet paid. AKA: A/R |

| 1200 | Other Current Asset | Short-term assets like inventory. This would contain your Inventory account. |

| 1300 | Fixed Asset | Long-term tangible assets used in business operations. |

| 1400 | Other Asset | Non-current assets not classified as fixed assets. |

| 2000 | Accounts Payable | Money owed to suppliers (A/P). |

| 2100 | Credit Card | Balances owed on credit cards. Company credit card accounts. These are like bank accounts but include a vendor selection. |

| 2200 | Other Current Liability | Short-term liabilities other than A/P. |

| 2300 | Long Term Liability | Debts payable over a period longer than one year. |

| 2500 | Equity | Owner’s interest in the company. |

| 4000 | Income | Revenue earned from business activities. |

| 5000 | Cost of Goods Sold | AKA: COGS. These are direct costs attributable to the production of goods sold. Tip: Income less Cost of Goods Sold equals Gross Profit. |

| 6000 | Expense | AKA: Overhead. Contains fixed and variable. |

| 9000 | Other Income | Revenue from non-core business activities. |

| 9500 | Other Expense | Costs incurred from non-core business activities. |

FAQs about COA Numbering Conventions and Best Practices

Q: Where did the name “Chart of Accounts” come from?

A: The term “Chart of Accounts” (COA) has historical roots in accounting practices where “chart” refers to a list or map, and “accounts” represent financial categories used in bookkeeping. The COA is essentially a structured list of all the financial accounts used by an organization, providing a framework for organizing and categorizing financial transactions. This term has been in use for many decades as part of traditional accounting systems to ensure clarity and consistency in financial reporting.

Q: Why is a consistent COA numbering system important?

A: A consistent numbering system ensures clarity, reduces errors, and simplifies financial reporting and analysis.

Q: How can I decide on the initial numbering range for my accounts?

A: Consider the size of your business, future growth, and industry standards to determine a range that allows for expansion and categorization.

Q: What are the benefits of using departmental codes in COA numbering?

A: Departmental codes help track financial performance by department, enabling more detailed financial analysis and better resource allocation.

Q: How often should I review and update my COA?

A: Review and update your COA at least annually or whenever significant changes occur in your business operations or accounting standards.

Q: What common mistakes should I avoid when creating a COA?

A: Avoid overly complex numbering systems, insufficient numerical gaps for future accounts, and inconsistent application of numbering conventions across the organization.

Chart of Account (COA) Numbering Tips

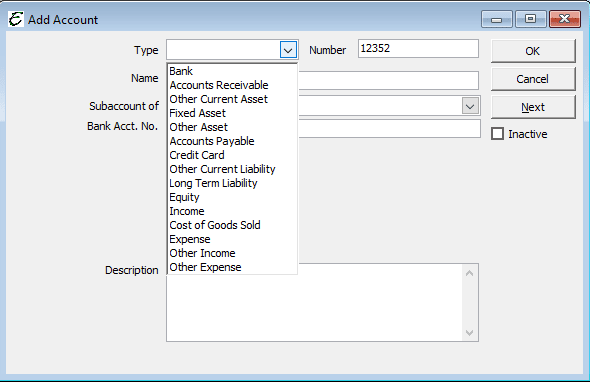

- These are the fifteen different account types found in Total Office Manager. Within each type, you would enter your own specific account. An example would be “Rent” or “Utilities”.

- When entering your accounts, please be sure to separate each account by at least ten numbers (such as 1010, 1020, 1030, etc).

- Consistent Numbering: Ensure that all accounts are numbered consistently to avoid confusion and maintain uniformity across financial statements.

- Sufficient Range: Leave enough numerical gaps between account numbers to allow for future additions without restructuring the entire COA.

- Departmental Codes: Use departmental prefixes or suffixes in account numbers to track expenses and revenues by department or division.

- Regular Review: Periodically review and update the COA to reflect changes in business operations and financial reporting requirements.

Adding a New Chart of Account

The image below shows how you add a new account to your Chart of Accounts (COA) list in Total Office Manager and QuickBooks Enterprise.

Chart of Accounts (COA) Related Content